2019-2-9 23:56 |

It seems that the bear market that affected the whole cryptocurrency market could last longer than previously expected. According to a recent report released by Reuters on February 8, companies that issued tokens may have to sell more of these assets to keep operating in the market.

These firms, mostly Initial Coin Offerings (ICOs), will have to sell more of the funds that they gathered during the token sell to keep developing their platforms. Back at the end of 2017, Bitcoin (BTC) and other digital assets reached their all-time highs. At that time, Bitcoin was traded around $20,000. Since that moment, Bitcoin lost more than 80% of its price.

During the bull market in 2017 and the beginning of 2018, several projects started ICOs with the intention of gathering funds to develop their own blockchain-related projects. Nevertheless, the bear market hit the space and affected the whole ecosystem.

The U.S. Securities and Exchange Commission (SEC) has also started to have a more active presence in the market trying to regulate the activities related to ICOs. Some of them were considered illegal securities offerings. During the last few months, the number of ICOs reached new lows in more than a year.

According to data provided by Dead Coins, which tracks tokens that are not operating in the market anymore, there are 1,000 of these companies that have failed in the last year or just have been abandoned. Thus, an incoming supply could also pose a challenge to the business.

Ryan Selkis, the co-founder of Messari, commented about it:

“Many people don’t fully understand the impact of new supply on this market particularly when there’s low liquidity. I don’t think anyone has any idea of how much hidden inflation there is in the form of token reserves that are going to be unwound gradually.”

Messari is a cryptocurrency data platform that is located in New York. The data they provide show that there are 71 coins of more than 400 tokens in their database that issued less than 50 percent of their total supply. In the future, when these companies start releasing the new coins, their value could plummet.

ZCash (ZEC), one of the most popular digital assets in the market, has only issued 28.05 percent of its total supply. Token holders could see the value of their coins fall if the demand does not surpass the new issuance of ZEC tokens.

Bitcoin (BTC) works in a different way. Already 83 percent of its total supply has already been mined. There will only be 21 million BTC.

Fiat currencies are also inflationary currencies. Countries such as Venezuela or Argentina have experienced very high inflation rates in the last years. Individuals in these countries are not able to trust their local currency because they lose their value as time passes.

There are some companies and projects that have taken different measures to reduce their supply over time. This is the case of Binance Coin (BNB), the token issued by the most popular cryptocurrency exchange in the market, Binance. Every single quarter, the company burns 20% of the profits they made during that period.

This allows the coin to increase in price. Binance just ended the 6th token burn and after it, the token was able to enter the top 10. Another project that conducted token burnings is Tron (TRX).

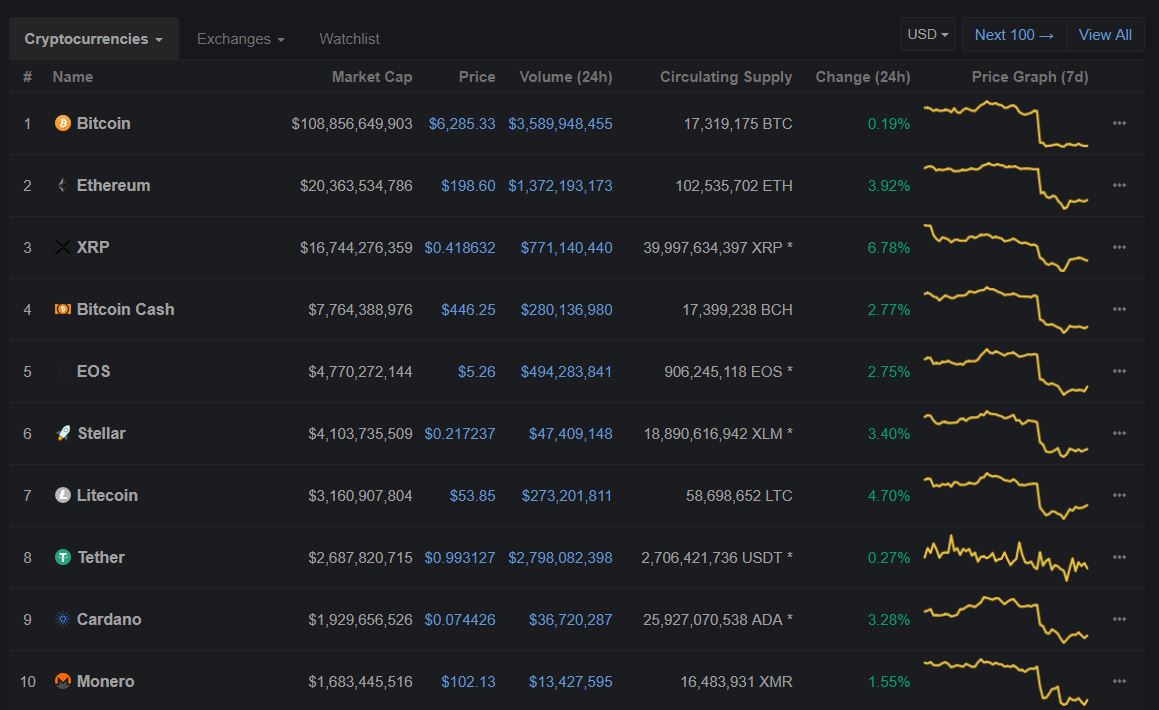

Although this report released by Reuters seems bullish, digital currencies have gained today more than $10 billion. There is no top 100 virtual currency operating negatively in the last 24 hours. Among the top 10, Litecoin (LTC) registered the largest price increase with a 30% growth. EOS has also increased by 16.07% while Ethereum registered a price growth of 14.05%.

Bitcoin, the most popular digital asset grew 8.14% in the last 24 hours. At the time of writing this article, each Bitcoin can be purchased for $3,700 and it has a market cap of $64.57 billion.

Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) Price Analysis Watch (Feb 8th)

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|