2018-9-6 07:49 |

Bitcoin Gold (BTG), a hard fork from the Bitcoin core (BTC) is set to be delisted from the Bittrex exchange on September 14.

The decision comes after a $18 million USD hack happened on the BTG network in May. If you want to know more about this token and how it is in the eye of the hurricane right now, you have come to the right place.

How Bitcoin Gold Was CreatedBitcoin Gold (BTG), as we have just said, is a hard fork from the Bitcoin that originally happened on October 24, 2017 at the block height of 491,407. The initial project was announced by Jack Liao, the CEO of LightingAsic and BitExchange, in July. He intended to change the BTC proof of work algorithm from the old SHA256 algorithm to Equihash.

The main idea was to create a mining process that would not need such expensive hardware. This way, more people could mine BTC. At the time, 70 percent of the BTC was being mined by Application Specific Integrated Circuits, the well-known ASIC miners. As they can perform SHA256 calculations faster, they became the standard.

With the Equihash protocol, however, GPUs could be used for mining and the whole process would be democratized. The decision was obviously controversial, so the fork happened. Unlike Bitcoin Cash, however, which intends to be the “real Bitcoin”, BTG was not designed to take over, only to give the casual miner a chance in the market.

In the original white paper of Bitcoin Gold, you can see that the project believed that the Satoshi vision of “one CPU, one vote” was supplanted by “one ASIC, one vote” and only some people had power. This way, they intended to democratize Bitcoin.

The First IssuesUnfortunately, it is now clear that BTG would simply not be as successful as its cousin Bitcoin Cash, which is still strong and so popular and divisive that it may have a new hard fork on November.

The new BTG token was launched on October 24 and it experienced a major security breach right from the start. The network suffered a major DDoS attack and experienced about 10 million requests per minute which blocked legitimate traffic.

A few hours later the attack had been already “handled”, according to the Bitcoin Gold Twitter profile, but the system stayed slow for some time. While the site eventually went online, the backlash of the community was clear and the DDoS attacks coincided with many angry posts about flaws of the system.

Another issue was that there were allegations that 100,000 BTG coins were pre-mined, which wa clarified later by the devs when they affirmed that these coins were set aside as bonus for the team.

During all hard forks, to claim the tokens, the users had to hold the original tokens at the time of the fork and they would automatically receive it. The fork was set to be made in November 2017 and the exchanges had the time to state whether they would support the fork or not.

Most major exchanges like Coinbase, Poloniex and Kraken declared that they would not support Bitcoin Gold (although Poloniex changed its mind later). Coinbase alleged security and stability issues and affirmed that they would not allow Bitcoin Gold at the time.

The main reason why this happened was because the BTG protocol was vulnerable to attacks because it had not implemented full replay protection (which does not allow transactions on one chain to be made on the other). The issue was solved on November 1, but you might have guessed that it was too late and the damage was done.

One of the few big exchanges that supported Bitcoin Gold was Bittrex. The company announced support for the token, although it has also affirmed that users should be wary because it still did not have a fully formed consensus code at the moment and lacked protection.

Problems After LaunchThe token was launched on November 13 but it had complications right from the start. Thieves used the Twitter @bitcoingolds address to scam users into handing over their tokens. The launch was already rocky because the network was attacked during the launch and this other problem appeared.

Late in 2017, the BTG site was compromised, people faked a Bitcoin Gold wallet to steal money and about $3.3 million USD were stolen with the fake wallet links.

As if the security of the network was not bad enough, the last straw happened at May 18, 2018. After some more tranquil months, BTG had its largest hack to date. The attackers took more than $18 million USD from the network. Various exchanges, including Bittrex, lost money.

According to the Bitcoin Gold team, the attackers used a combination of a doubling spending and a 51 percent attack. They got enough hash power to perform the attack and attacked the exchanges because they accepted large deposits automatically. This way, they deposited the money at the exchanges and their wallets at the same time.

The hackers had already withdrawn the funds when the exchanges perceived the attack. This was the last straw for Bittrex, which demanded 12,000 BTG (about $255,000 USD) in compensation for the attack and blamed the BTG algorithm for it.

The developers acknowledged the risks and decided to create another hard fork upgrade plan.

Bitcoin Gold’s Unknown FutureFollowing the last attack, Bittrex gave up on BTG and with good reason. It is still not clear whether other exchanges will follow or not, however, the future is definitely not bright for the token, as its image is perpetually stained.

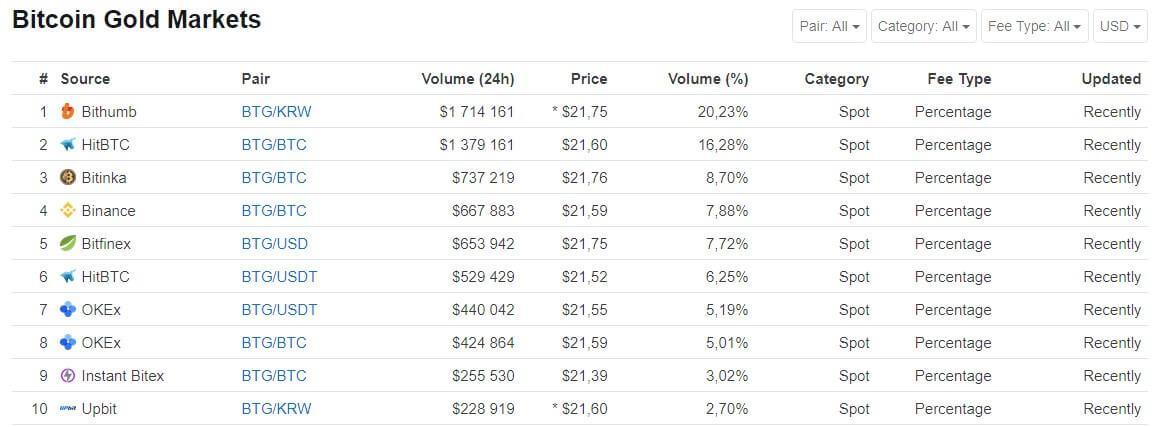

At the time of this report, Bitcoin Gold had a market cap of $368 million USD and each token had the price of $21.39 USD, ranking in 30th by market cap.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|