2025-2-4 01:30 |

In the latest Crypto Asset Fund Flows Weekly Report, CoinShares detailed how digital asset investment products experienced a turbulent week, with an initial $530 million outflow last Monday caused by concerns related to the DeepSeek news.

This sell-off quickly reversed, with the market later recovering more than $1 billion in inflows by week’s end. The report highlighted that despite this volatility, year-to-date (YTD) inflows remain strong at $5.3 billion, contributing to the $44 billion total seen in 2024.

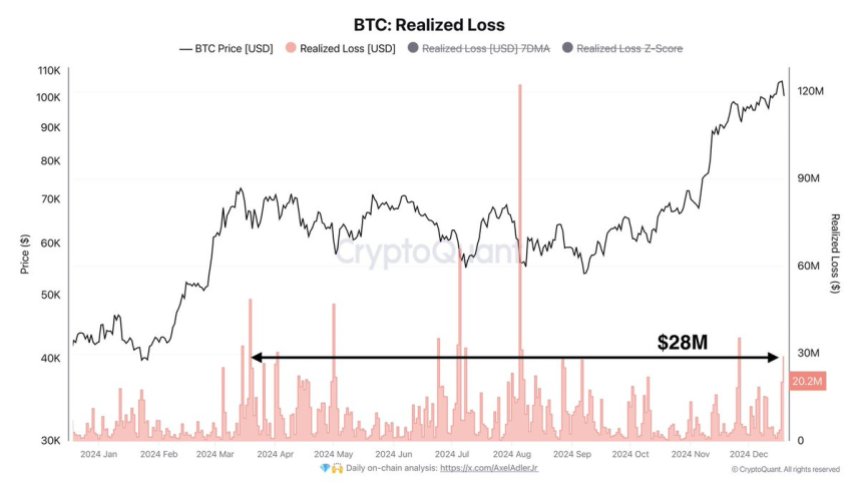

Bitcoin Leads the Pack; Ethereum StrugglesBitcoin emerged as last week’s dominant performer, attracting $486 million in inflows. Even short-Bitcoin products recorded $3.7 million in inflows, signaling continued interest from investors hedging against price movements.

Ethereum, in contrast, saw no net inflows, with earlier losses likely stemming from its ties to the technology sector and global growth concerns, according to James Butterfill, Head of Research at CoinShares

The report also pointed to notable activity in altcoins, with XRP remaining a standout. XRP’s strong performance over the year brought its YTD inflows to $105 million, including $15 million just last week, making it the second-best-performing altcoin in terms of inflows.

Blockchain equities also drew investor attention, recording $160 million YTD as many saw recent price drops as a buying opportunity.

How Regional Fund Flows FaredWhile the U.S. reported $474 million in full-week inflows and $5 billion YTD, Europe saw $78 million last week, bringing its YTD total to $93 million. Canada, however, faced $43 million in outflows, a development possibly tied to US trade tariff concerns.

James Butterfill noted that this back-and-forth in the overall inflows isn’t “unexpected,” given the significant price gains digital assets have achieved this year. He emphasized that regional differences also shaped fund flow dynamics. The CoinShares Head of Research wrote:

Given the $44bn in inflows seen in 2024, US$5.3bn inflows year-to-date (YTD) and significant price gains, the current sell-off is not unexpected.

According to latest data, the crypto market has seen quite an unexpected downturn driven in large part by macroeconomic factors, particularly in the US. So far, the global crypto market has seen a significant plunge dropping by nearly 10% in value in the past day.

Data from CoinGecko shows that the global crypto market valuation now stands at $3.22 trillion, a roughly $500 million drop from $3.7 trillion seen last week. Notably, this plunge in the crypto market has not only been a result of the macroeconomic factors but also the sudden plunge in BTC.

During the weekend, US President Donald trump signed three executive orders placing tariffs of 25% on all goods from Canada and Mexico, and a 10% tariff on both Canadian oil exports and Chinese goods.

Featured image created with DALL-E, Chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Dix Asset (DIX) на Currencies.ru

|

|