2026-1-12 14:13 |

Crypto funds experienced a sharp reversal last week, with $454 million in outflows, nearly erasing early-year inflows of $1.5 billion.

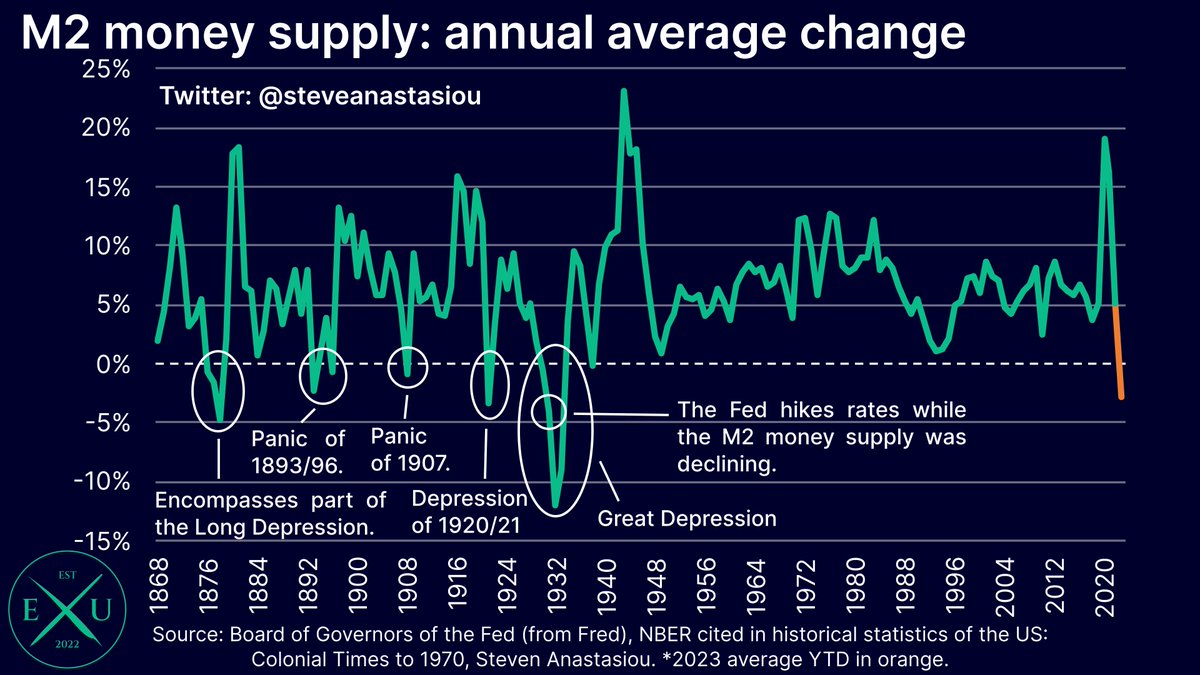

The sell-off appears linked to dwindling expectations of a Federal Reserve interest rate cut in March, following recent macroeconomic data that suggests the Fed may maintain its current policy stance.

Crypto Funds Lose $454 Million as Fed Rate-Cut Hopes FadeAccording to the latest CoinShares data, last week’s crypto outflows came after a four-day streak totaling $1.3 billion.

It almost completely reversed the optimism seen during the first two trading days of 2026. Friday, January 2, had started the year strongly, with $671 million flowing into crypto funds, highlighting the abrupt swing in investor sentiment.

Regionally, the US led the outflows, recording $569 million in withdrawals. By contrast, several other countries bucked the trend, reflecting the widening adoption of crypto investment products outside the US. It also highlights the impact of macroeconomic factors on investor sentiment.

“This turnaround in sentiment appears to stem mainly from investor worries over the diminishing prospects of a Federal Reserve interest rate cut in March following recent macro data releases,” read an excerpt in the report.

Indeed, Fed rate cut probabilities have shrunk significantly, with the CME FedWatch Tool showing only a 5% chance of a rate cut.

The CME Group's FedWatch Tool indicates only a 5% chance of a rate cut in January. pic.twitter.com/C3khuPcfQW

— Grey BTC (@greybtc) January 12, 2026The implication on investor sentiment was evident, with Bitcoin bearing the brunt of the negative sentiment. Investment exits linked to the pioneer crypto reached $405 million last week.

Even short-Bitcoin products saw modest outflows of $9.2 million, sending mixed signals about market expectations. Ethereum also recorded significant withdrawals, totaling $116 million, alongside $21 million in outflows from multi-asset products.

Crypto Fund Flows Last Week. Source: CoinShares ReportSmaller outflows were noted in Binance and Aave products, at $3.7 million and $1.7 million, respectively.

Altcoins See Selective GainsDespite the broad retreat, selective altcoins saw renewed interest. XRP, Solana, and Sui attracted fresh inflows of $45.8 million, $32.8 million, and $7.6 million, respectively. This reflects a growing trend among investors to rotate into high-performing alternatives rather than broadly allocating across the cryptocurrency market.

This rotation aligns with patterns observed in the early days of 2026. The week prior, investors had already demonstrated a preference for Ethereum, XRP, and Solana, while Bitcoin allocations lagged, signaling a shift from traditional market leaders to selective altcoins.

Looking back at 2025, global crypto fund inflows reached $47.2 billion, just shy of the record set in 2024 at $48.7 billion. Ethereum led with $12.7 billion in inflows, representing a 138% year-over-year increase.

XRP surged 500% to $3.7 billion, and Solana skyrocketed 1,000% to US$3.6 billion. By contrast, inflows into the broader altcoin market declined 30% YoY, highlighting the concentration of investor interest in top-performing tokens.

The recent $454 million crypto outflows, therefore, represent not a collapse of the market but a momentary recalibration. Investors are adjusting their positions in response to macroeconomic signals while continuing to favor high-conviction altcoins over Bitcoin.

The post Crypto Funds Lost $454 Million as Fed Rate-Cut Hopes Dim appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|