2024-4-9 05:00 |

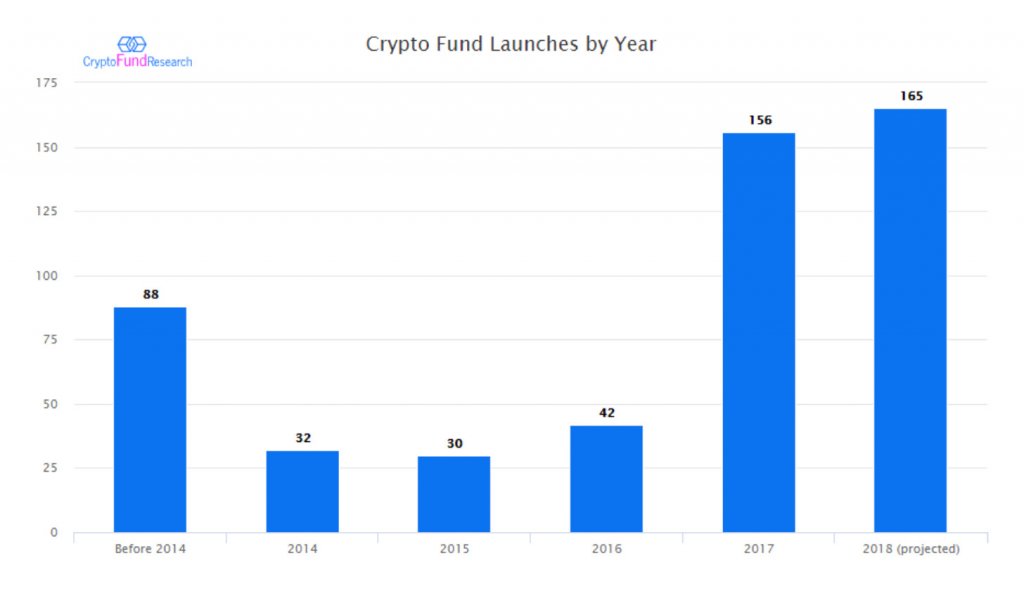

So far, global crypto funds have soared to record annual inflows, reaching roughly $13.8 billion year-to-date as reported by asset manager Coinshares.

This milestone marks a substantial increase in investor participation in the crypto market, highlighting growing confidence and interest in digital assets as a “viable” investment avenue.

Notably, the latest inflow figures also reveal an additional $646 million injected into crypto funds globally over the past week, further fueling the momentum of this trend.

Rising Appetite For Crypto Investment ProductsThe surge in inflows is attributed to heightened investor appetite for crypto investment products offered by prominent asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares.

These investment vehicles have witnessed substantial inflows, with investors allocating significant capital to gain exposure to various cryptocurrencies.

Of particular interest is the growing demand for Bitcoin investment products such as spot Bitcoin exchange-traded funds (ETFs), which remain the focal point for many investors seeking exposure to the leading cryptocurrency.

While CoinShares Head of Research James Butterfill noted a decline in Bitcoin spot ETF flow levels compared to earlier in March, suggesting a possible stabilization in investor appetite, the influx of capital into global Bitcoin investment products has still managed to be quite notable.

Roughly $663 million was added to these vehicles in the past week alone. This underscores the enduring appeal of Bitcoin as a store of value and investment asset, attracting both institutional and retail investors alike.

Additionally, the strong performance of Bitcoin investment products reflects growing confidence in the long-term prospects of the cryptocurrency despite periodic market volatility.

Diversification And Regional TrendsWhile Bitcoin continues dominating the crypto investment landscape, other digital assets have attracted significant investor interest.

Investment products tracking digital currency, such as Litecoin, Solana, and Filecoin, have experienced notable inflows, reflecting a broader trend of diversification within the digital currency investment space.

However, Ethereum-based funds have faced outflows for the fourth consecutive week, indicating a divergence in investor sentiment toward different digital currencies.

Regionally, sentiment remains divided, with US-based funds witnessing substantial inflows alongside products in Brazil, Hong Kong, and Germany.

In contrast, Switzerland and Canada have experienced outflows, highlighting varying levels of investor confidence and market dynamics across different regions.

Despite these regional disparities, the overall trend of record inflows underscores the growing mainstream acceptance and adoption of cryptocurrencies as legitimate investment assets.

In a further sign of institutional adoption, major financial institutions such as BlackRock and Morgan Stanley are expanding their presence in the crypto investment space.

BlackRock, for instance, has recently decided to add five new participants to its iShares Bitcoin Trust (IBIT) ETF, reflecting the growing demand for digital currency investment products among traditional financial institutions.

Similarly, Morgan Stanley plans to approve Bitcoin ETFs on its platform within the coming week, signaling a notable milestone in integrating cryptocurrencies into traditional investment channels.

Featured image from Unsplash, Chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|