2018-12-7 17:19 |

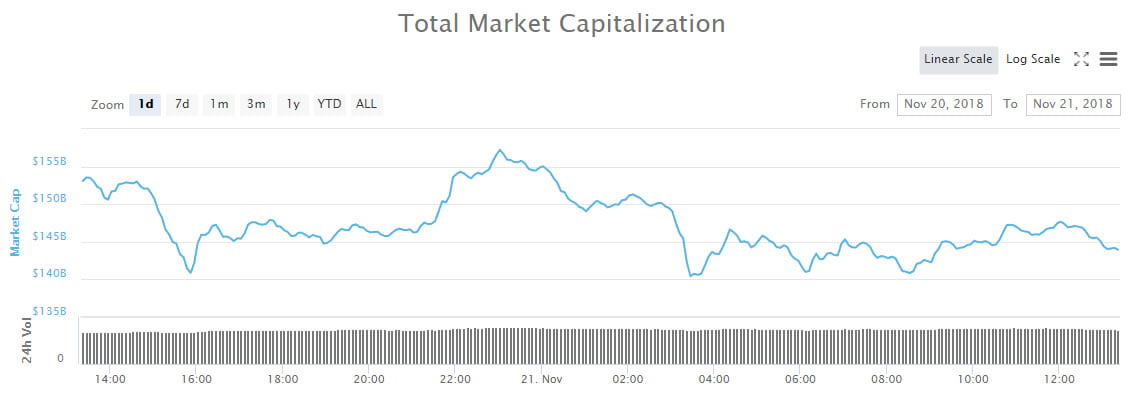

The year 2018 has been a remarkable year for cryptocurrencies with a very volatile situation and a rough market. Cryptocurrencies collectively experienced one of the worst market situations in history during the year and the condition is far from over. The market which started recovering at some point has gone bad again with top cryptocurrencies in red.

This article summarises a review of cryptocurrency exchanges on cryptocompare using major parameters to analyze how their markets have performed so far.

Exchange market segmentation

In the month of November, BitMex (XBT to USD futures) and BitflyerFX (BTC to JPY futures) volumes alone accounted for almost one-quarter of the total cryptocurrency market volumes while the combine bitcoin trading features volume of traditional exchanges like CME and CBOE accounted for an insignificant 0.25% of the entire market volume.

Exchanges such as Bitfinex and BitMEX which charge taker fees accounted for about 89% of daily exchange spot market volume while those with transaction-fee mining such as Fcoin represent a little over 8%. Ironically, those exchanges with no fees accounted for only 2% of the total market volume.

There are more exchanges offering fiat to crypto pairs than those that offer crypto to crypto pairs. However, crypto to crypto total exchange volume averaged $4.45 billion as compared to fiat to crypto volume $2.73 billion. Crypto to crypto represents 57% while fiat to crypto represents only 43% of the total volume for the month.

Transaction volume by Transaction-Fee Mining

Trans-fee mining exchanges on Cryptocompare represent over 8% of the total volume for the month. While the total average 24h-volume produced by the major trans-fee mining exchanges on CryptoCompare added up to 619 million USD, Coinbene and Fcoin experienced a volume surge of 129% and 31% respectively since last month while EXX, CoinEx, and BigONE lost 61%, 44%, and 1% respectively.

Total volume by country

South Korea registered exchanges took the first spot from Malta-based exchanges with a recorded highest total daily volumes of $1.4 billion compared to $1.2 billion from Malta.

Exchange security performance

Up to 11% of the top 130 exchanges by 24h volume have been hacked. Only 86% of these top exchanges have a public privacy policy and a terms & conditions page. Some of the top exchanges such as Coinbase store users’ funds offline which may explain why it ranks among the safest exchanges.

Order Book Analysis

In terms of market stability, Bitfinex, HitBTC, Kraken are some of the most stable by cumulative depth down. On the other hand, Neraex, Exrates, and Cryptagio seem to be significantly less stable showing a relatively low average order book with the thinnest markets.

Web user analysis

Bithumb, ZB, CoinBene, EXX, and FCoin had a lower number of visitors than similar exchanges. Bithumb, Coinbene, and CoinTiger experienced a significant surge in volume but their daily visitors greatly decreased.

Spot vs Futures market volumes

Spot volumes accounted for 75% of total market volume ($7.3 billion between October and November while futures volume accounted for $2.3 billion. Overall, the futures market volume decreased by 28% while the spot market volume gained 5% which, may explain the wide gap in total volume.

The post Crypto Exchanges Performance Review For November 2018 By CryptoCompare appeared first on ZyCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|