2022-3-24 16:48 |

A recent report by financial-services consultancy Opimas has shown that the total revenue generated by cryptocurrency exchanges in 2021 outpaced traditional stock exchanges like the New York Stock Exchange and the Nasdaq after recording a 600% growth.

Crypto Exchanges Leading Traditional BoursesFor the first time, global revenue generated by crypto exchanges hit $24.3 Billion in 2021, surpassing the total income generated by stock exchanges. This is a seven times increase compared to the $3.4 billion in sales recorded in 2020 and was 60% higher than the $15.2 billion generated by traditional stock exchanges last year.

“This is quite a shift from only a year earlier when the traditional exchanges had revenues four times greater than exchanges of the crypto world,” Suzannah Balluffi, an Opimas analyst who covers the digital asset industry wrote.

According to estimates based on CoinMarketCap data, the top ten crypto exchanges by volume are generating an estimated $3 million per day in profit or figures north of $1 billion per year. These figures are astoundingly astonishing given that cryptocurrencies are barely thirteen years since their debut, especially when compared to traditional players who have been in the trading space for decades.

“The old, venerable names like the New York Stock Exchange, Nasdaq, Deutsche Borse, and CME have all been left behind in the dust by crypto startups Binance and Coinbase,” Balluffi added.

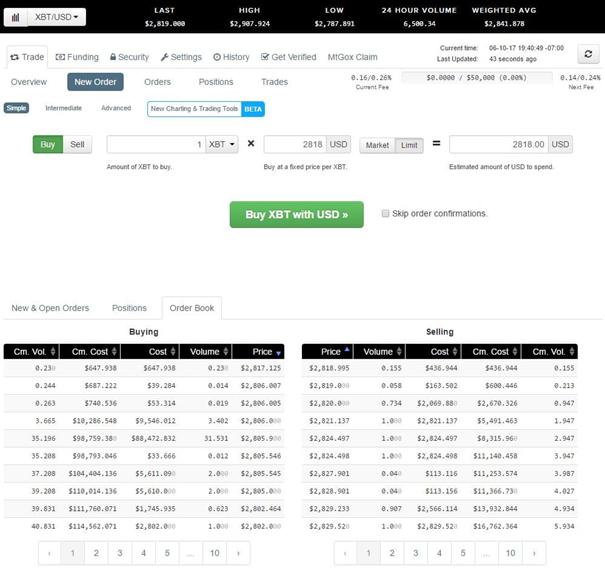

The crypto industry is no doubt the most interesting investment sector in the modern age due to its inclusivity. Its low operational fees to users have played a huge role in the huge revenue figures.

More Growth ExpectedWhile most crypto exchanges and crypto firms relied on charges on trading, deposits, withdrawals by users, they have over the years made inroads into stock exchanges with composites such as Coinbase Global Inc (COIN), Hut 8 Mining Corp (HUT), Asia Broadband Inc (AABB) and Bitfarms Ltd (BITF) already listed into major exchanges, hence generating income in other ways.

Going forward, revenue by exchanges is expected to keep soaring, especially as nations around the world continue to create a thriving regulatory environment for cryptocurrencies spurring adoption. The recent executive order by President Joe Biden could also bolster growth, with the POTUS signaling his administration’s commitment to supporting the nascent sector through sound regulations.

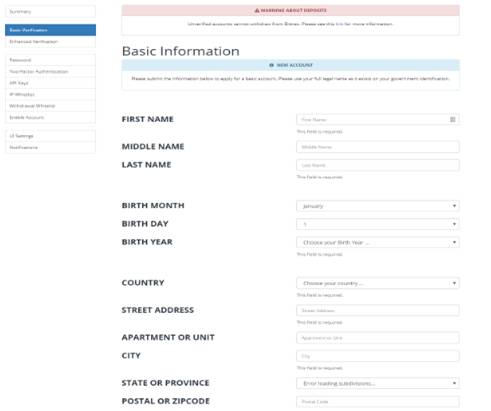

US Securities and Exchange Commission’s (SEC) chair Gary Gensler has also expressed the agency’s intention to push for and enforce sound oversight over centralized exchanges, which on a larger scale, are already complying. In an interview with MarketWatch last month, Gensler stated that the SEC would be focussed on ensuring that “investor protection, market integrity, and anti-manipulation” rules were strongly adhered to in his tenure.

origin »Bitcoin price in Telegram @btc_price_every_hour

Growth DeFi (GRO) на Currencies.ru

|

|