2022-6-24 07:00 |

The recent crypto crash presents an opportunity for companies in the decentralized finance space to rethink how the whole system works. And it gives us a chance to rebuild it, says Kieran Mesquita, Chief Scientist at RAILGUN.

There are steps that crypto companies and projects can take right now to create a more secure and stable future for decentralized finance (DeFi). Because crypto projects cannot exist without their investors, they must diversify their target audience, take responsibility for educating them, and look beyond moonshots. If cryptocurrencies want to be considered true currencies, they have to start acting like them.

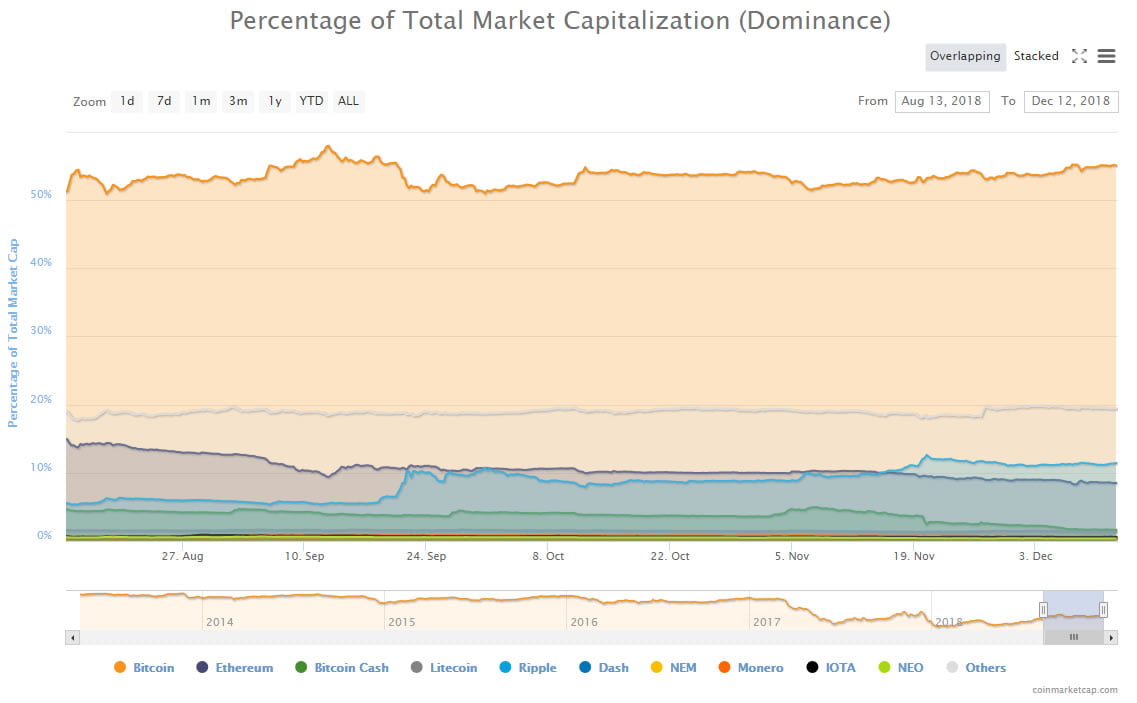

A broad variety of investors is paramountCryptocurrency, like any currency, is most successful when it is owned by a variety of holders in varied situations. Think about it. Everyone, everywhere, has some kind of fiat bill or coin in their possession. No matter what socio-economic background they come from. This is what crypto needs to strive toward.

The best way to inject reliability into crypto is to spread it out as much as possible. Corporations with DeFi investments are incentivized to play it safe, in order to protect shareholder interests. Hedge funds are able to take big chances because they have the financial wiggle room to make daring bets on different coins and tokens. Day traders add a layer of depth to the distribution that can keep currencies from tipping too fast. When will we reach the stage where casual investors can be found anywhere?

To get there, industry leaders need to build technology that is clear, easy to use, and – most importantly – easy to access. The current heavily centralized distribution of cryptocurrency betrays both its premise and its promise.

Crypto investorsHow can business leaders address this issue? By identifying target investors – and users – the way that well-run businesses do. Instead of courting whales, blockchain projects should prioritize attracting and retaining a broad array of investors. Companies like E*TRADE and Charles Schwab know how popular crypto is and offer guidelines for their investors. There is a growing potential for crypto projects to court the same investors that trust their long-term investments to these companies.

No one in fiat invests their entire pension in one stock, so why do many crypto projects assume investors will do the same? Recent weeks have revealed that presenting crypto as a get-rich-quick scheme is a fool’s errand.

Industry leaders need to present their ideas as steady, long-term projects. Now is the time to move on from crypto looking like a modern form of gambling and actually instead demonstrate its uses as a decentralized currency built for the long game.

To do so, blockchain projects need to be explicit about who they are, their long-term goals, and what they hope to accomplish with their project. At RAILGUN, we prioritized transparency on our website by listing our core team members, their individual credentials, and links to professional pages. When potential investors are looking at our project, they know exactly who we are and what qualifications we have.

Let potential investors get to know your business modelThe most significant discrepancy between cryptocurrency and fiat is the swift change in value that cryptocurrency can experience. This can be extraordinary for early investors, but the singular drive to find a coin or token that will go “to the moon” ends up ruining the opportunity for those currencies to have functional value outside of being a security.

If DeFi leaders truly want to see the widespread adoption and successful use of cryptocurrency, they need to do what any large movement does: invest in educating people at every level of the game.

Crypto projects should take their best asset – grassroots communication – and use it to be as transparent as possible. Publicly traded companies are required to host a shareholder meeting once a year; crypto projects should do it monthly, if not weekly, and actively invite community members to ask questions to our development team in real-time.

Crypto is built on the mantra of do your own research (DYOR), but successful and trustworthy projects should be upfront and forthcoming about the risks associated with using the protocol, and about the future of our developments. Industry leaders in crypto must aid people’s individual research by giving them as much information and access as possible, as frequently as possible. The era of a blockchain project gaining traction with sweeping plans and vague roadmaps must end.

At RAILGUN, we focus a great deal of time and energy explaining our technology to our community and answering all of the questions from the community. By prioritizing access, we are able to foster a culture of constant knowledge sharing. This doesn’t have to be radical; it just has to be consistent. We’ve created this consistency in the form of weekly DAO-wide Discord calls and bi-weekly Medium blog posts.

Take advantage of opportunities in higher edAnother way blockchain projects can educate an array of potential investors is by fostering the formalized study of blockchain technology, cryptography, and decentralized finance at the university level. It is a given that students can study the economics of fiat at college. Now that cryptocurrency is a force to be reckoned with, our industry leaders need to pivot attention to cultivating foundations for and professors of blockchain technology.

CoinDesk has already begun to annually rank the top universities for blockchain studies. There is currently a push to foster deep tech’s future in European universities, like the University College of London or Oxford, and the community is contributing to this trend. For example, IOTA recently made a donation to Imperial College to study distributed ledger technology, and other top projects are participating in similar initiatives. These students could just as easily be future cryptologists, data scientists, and blockchain developers. Why shouldn’t the cryptocurrency space nab these new talents?

Don’t be afraid to look like a traditional finance companyThe main issue crypto faces is that many potential investors remain suspicious – specifically those outside the tech scene – and after this crash, who can blame them? The crypto industry currently operates like a dysfunctional religious sect, with privileged information shared in gated channels where supporters are kept entertained through flashy distractions.

YouTube personalities operate like pastors, growing a following that is monetized through the cult of celebrity. The real work of educating the public about crypto has been left in the hands of reporters and periodicals that create an endless stream of “Intro to Crypto” listicles and blockchain deep dives.

The future of crypto has currently been set squarely on the shoulders of journalists, who are tasked with multitudes of “what is X” articles when everyone is better served by journalists who have the time and space to explore the “why” around the technologies.

Crypto brosUltimately, it is against the best interests of crypto companies and blockchain projects to narrowly educate tech-savvy crypto bros who are already in-the-know via Discord channels and tech-heavy, esoteric platforms. If decentralized finance is to become mainstream finance and replace fiat, there must be a full-scale pivot to education with the same ubiquity and veracity that traditional fiat demands. The industry should look to more traditional finance for the multitude of ways education and access are offered to the general population.

For example, crypto and blockchain projects can conduct public and easy-to-access workshops similar to how banks and fund managers do them. Newsletters and magazines from major fiat institutions exist that cater to young investors, older investors, or investors with families. The Financial Industry Regulatory Authority (FINRA), a US-based non-profit, offers a program to learn to invest. In the UK, Hargreaves Lansdown offers plenty of free resources to help beginners understand building a portfolio. These targeted educational outreach methods are tailored to specific demographics with the goal of offering financial literacy. In our case, we’ve found that the best way to educate our community is to host weekly calls outlining everything about our tech, smart contracts, and cryptography.

Crypto industry can make changes nowThe crypto industry has suffered crashes before and will again. However, future crashes can be minimized if companies take this opportunity to reevaluate their modus operandi. This may mean abandoning the “go big or go home” mentality to make more space for projects that pursue slow and steady growth.

As soon as the market begins to rise again, this window for change will close, and everyone in DeFi will return to crossing their fingers and praying that the blockchain looks favorably upon their investments. Crypto doesn’t need to operate like this, and now is the time to enact positive changes based on what has successfully served traditional currencies.

About the AuthorKieran Mesquita is Chief Scientist at RAILGUN, the first decentralized smart contract project that brings privacy to cryptocurrencies operating seamlessly with DeFi. He has an extensive background in developing technologies for blockchain and DeFi projects. He was an early adopter of BTC and one of the first people to develop its GPU mining software.

Got something to say about crypto crashing or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

The post <strong>Crypto Crashed. Here’s How Industry Leaders Can Make It Better.</strong> appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|