2018-12-16 03:09 |

Crypto-Catastrophe As The Market Falls Below The $100 Billion Dollar Mark, Falling A Total Of $15 Billion In Just One Week

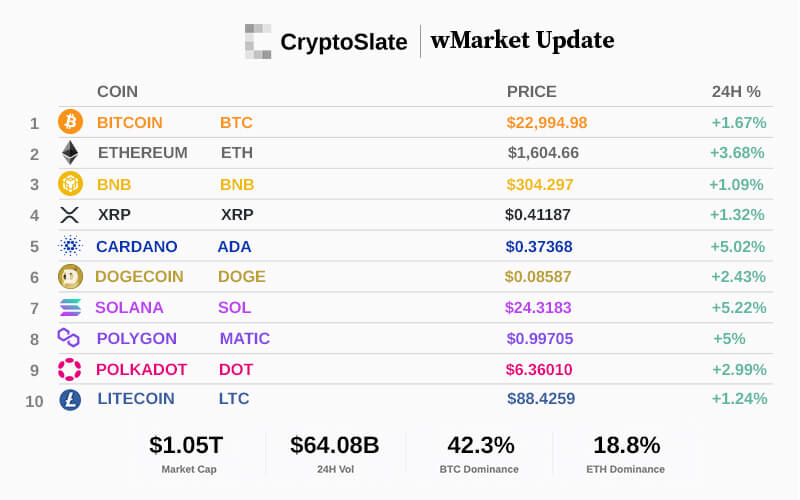

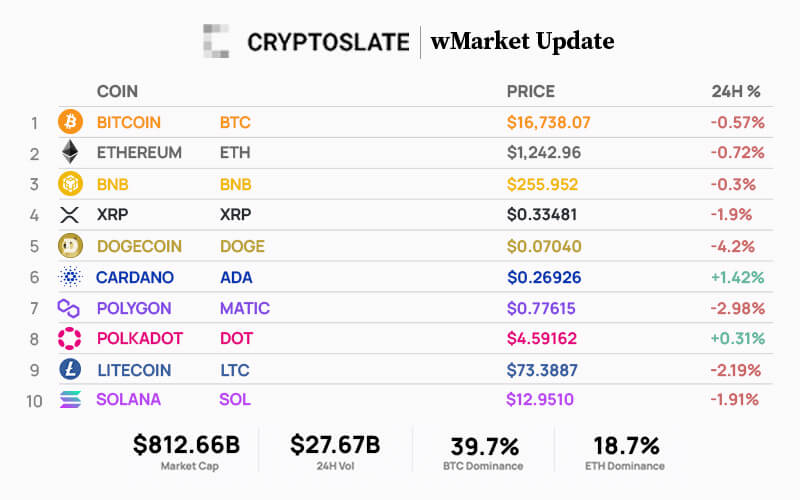

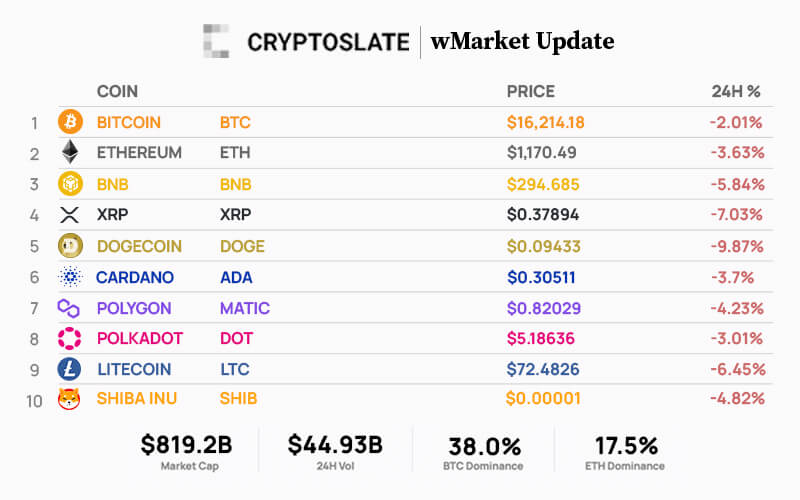

This previous week has not been a prodigious one for the cryptocurrency investment world. Why exactly? Well, the entire market has succumbed to a dramatic fall in the market, making a downwards slide of 15 billion dollars: overall, that's a decline from $117bn to $102bn.

Among those cryptos involved in the downward slid were the major coins such as BTC (Bitcoin), ETH (Ethereum), XRP (Ripple) have performed particularly weakly over the course of the week. The losses have been above the 10 percent marker.

While each of these coins has sustained a negative fall, but out of all of them, Ethereum has suffered the worst out of all of them, dropping down to $84, a total backwards slide of 13 percent compared to others. The overall value of Ethereum has fallen to its worst position in history.

Is Bitcoin Now Under Threat Of Falling Deeper – Is $2,700 The Future Position?Bitcoin, and its value has continued to perform with a modest degree of strength when compared to its distant competitors and smaller market crypto tokens over the course of this past week.

One of the limitations that BTC is facing is the sheer reduction in volume, especially when considering the majority of BTC markets. This has put the entirety of the Bitcoin investing world under threat of falling even further, this includes the broader risk of falling below previously firm support levels, taking it below the $3,000 mark.

One of the more prominent tech analysts and ardent cryptocurrency investors, DonAlt, went into further detail about the current landscape of the Bitcoin market:

“While Bitcoin is running rapidly down the trail that it was previously on back in 2014, there are some that believe the cryptos ideal range would be from $3,000, to $1,000 or possibly even further down. Personally, I still believe that $2,700 is the ideal position for people to begin buying, and progress will go from there. As Mark Twain once said: ‘History doesn't repeat itself, but if does often rhyme.'”

DonAlt himself went on to suggest that any kind of fall below the $3,000 mark is always a possible scenario, any kind of decline for the asset will prove to be an exceptional risk for investors, especially when the market is undergoing a time of fiscal uncertainty and a volatile climate.

“If we were to remove the investment trend which served to cut short the last bear market, we are currently already there. It is with this in mind that it would be understandable, especially considering that while this decline is remarkably familiar to seasoned investors, the current investment market that we see has far more in the way of liquidity, and is in a far more sophisticated position now than compared to before. As a result, this is not the place to see new short positions, personally,” he concluded.

More significant marketplaces such as South Korea and Japan have managed to showcase a more noticeable decline when it comes to market volume and demand for specific crypto asset classes.

One of the more prominent cryptocurrency market data companies, CryptoCompate found that the likes of S.Korea and Japan have been able to outshine the United States, ranking far higher across the bullish market that we see in 2017. But while they are outpacing the US, they only account for roughly 5 percent of the total volume for Bitcoin.

In stark contrast to this, the United States effectively accounts roughly 18 percent of volume in the Bitcoin market in terms of volume, this excludes the likes of stablecoins such as Tether (USDT).

Worked Up Into A Bad StateThe bearish trend in the marketplace has steadily become worse and worse when considering the total market cap in the minds of investors. This is made abundantly clear by the fact that the market is poised for a fall below the $100 billion marker for market cap. This would be the first time since August last year.

This downward trend is primarily made possible by an overly disappointing performance from low volume cryptos.

Some of the worst hit tokens include ones such as VET (VeChain), ICX (ICON), and ZEC (ZCash), all of which have seen horrific declines of roughly 95 percent to 99 percent, these are declines from what were once the all time highs for these respective crypto tokens.

One of the examples out of these three consist of ICON, which was previously at a high watermark of $44 Billion. Officially, according to the last reported market cap from ICX from December, is has since fallen spectacularly, and is currently performing below the $100 million range.

While the cryptocurrency market stagger around in a disoriented, bearish manner through the initial quarter of 2019, the very same virtual tokens and those that carry a low level of liquidity will go on to decline further in terms of value against the likes of the USD and BTC.

As of this date, there is a dramatic level of risk associated with both the short and long positions for Bitcoin, among other big contending cryptos on the market right now. And investors are not blind to this trend, and they are holding out on a number of trades to see where it goes.

origin »Bitcoin price in Telegram @btc_price_every_hour

Miner One token (MIO) на Currencies.ru

|

|