2020-10-12 14:52 |

Coinspeaker

Crypto Arbitrage Trading: Why Is It Gaining Popularity Today?

Cryptocurrencies differ from the traditional markets in a way that they are completely decentralized. However, when it comes to trading crypto assets, most of the fundamental concepts remain the same, arbitrage trading is an age-old concept that applies to markets all across the globe.

If you are a complete newcomer, it will be better for you to consult with experienced traders who can tell you more about arbitrage trading. Also, you need to remember that before you start trading, you need to find the best crypto wallet to ensure the high level of the security of your assets.

Today we will be looking at the interesting concept of cryptocurrency arbitrage trading. But before we proceed, let’s look at what does “Arbitrage” means in general. As per the Investopedia definition:

“Arbitrage is the purchase and sale of an asset in order to profit from a difference in the asset’s price between markets. It is a trade that profits by exploiting the price differences of identical or similar financial instruments in different markets or in different forms”.

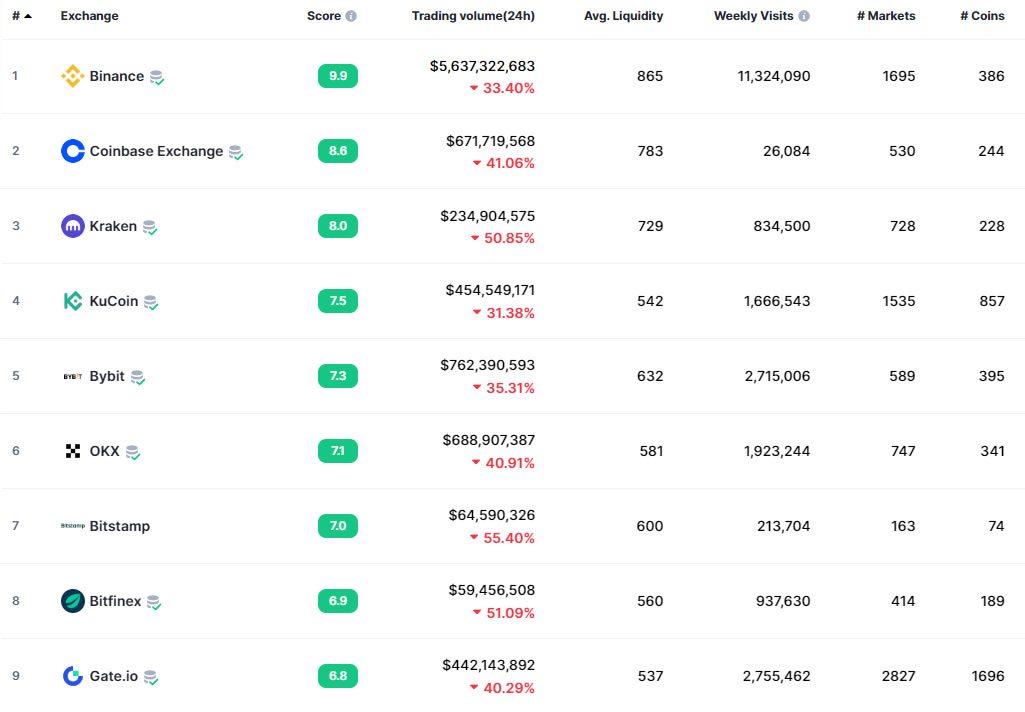

In our case, the asset is a cryptocurrency. Thus, cryptocurrency arbitrage trading refers to the price difference of a crypto asset on different exchanges and making profits. Meaning, you can buy a cryptocurrency at a low price on Coinbase and sell it at the same time on Binance at a higher price listing. Also, the common term referring to these price differences is “arbitrage spreads”. These arbitrage spreads are usually between 0.2-4% in crypto markets.

Suppose that Bitcoin is trading at $10,000 on Coinbase and at the very same time it is trading at $10,005 on Binance. Thus, by speedily buying Bitcoin on Coinbase and selling them on Binance, traders can leverage a $5 arbitrage between the two exchanges. Bulk-buying and bulk-selling can multiple the $5 profit to several hundred/thousand dollars. Needless to say, a crypto arbitrage trader needs to be sharp and blazing fast to leverage the opportunity. It is certainly not a rookie’s game!

So now you might wonder, why do these price differences exist in the first place for the same asset. Let’s understand it.

Anomalies in Crypto PricesIn reality, there is no single reason that explains the price differences across crypto exchanges. Cryptocurrency trading happens across multiple trading platforms across the globe. Also, achieving absolute price synchrony between exchanges is next to impossible. Also, non-synchronous information between buyers and sellers can lead to price arbitrage. This ultimately provides an opportunity for traders to make the most of it.

As said, arbitrage trading is an age-old concept and applicable to several financial instruments. Arbitrage trading opportunities specifically arise in regions where there’s a high demand for a particular asset. “Kimchi Premium” is the famously used term among South Korean traders that highlights the gap in price differences for crypto in Korean exchanges and foreign exchanges.

This term came into existence during the crypto bull run of 2017 when South Korean traders were ready to pay a massive premium on Bitcoin price. Arbitrage opportunities also exist in regions facing economic turmoil. Suppose the local currency of the region collapses due to hyperinflation. In such a case the locals usually move their saving to cryptocurrencies like Bitcoin. Since it happens on a mass scale, people are also willing to pay a higher price.

Now that we are clear on crypto arbitrage, let’s take a look at different methods of crypto arbitrage trading.

Different Methods Used for Crypto Arbitrage TradingSpatial Arbitrage: This process involves literally transferring cryptocurrencies between two exchanges and leverage the price differentiation. Suppose, you buy Bitcoin for $10,000 on Exchange A, later you transfer these Bitcoins to Exchange B and sell it for $10,010.Although it may sound easy, spatial arbitrage (transferring between exchanges) has its own pros and cons. Usually, arbitrage spreads exist only for a couple of seconds and as a trader, you need to make the most of it. Now, the crypto transfers between two crypto exchanges can be slow. Also, there’s a transfer fee attached every time which can be expensive. Possibly after all the process, the crypto price might have fallen on Exchange B, you might have lost the opportunity. Also, the profit you get might not be worth your effort. There another spatial arbitrage trading without any transfers between exchanges. This is much quicker and users can make the most of arbitrage spreads. Consider you are buying BTC on Exchange A and selling on Exchange B. In this case, you move your fiat USD to Exchange A and your BTC to Exchange B. Then, with an eagle-eye, you wait for the perfect arbitrage opportunity to arrive. Soon as the price difference appears, you can buy BTC with USD on Exchange A and simultaneously sell BTC for USD on Exchange B. This way, you can realize profits faster with no transfer fee.Statistical Arbitrage: This is another method and a hi-tech arbitrage strategy involving mathematical modeling. This technique relies on trading algorithms that identify arbitrage opportunities across exchanges. Statistical Arbitrage can be a bit riskier than other conventional methods.Crypto Arbitrage Market and Risks InvolvedThe cryptocurrency arbitrage trading is slowly gaining traction with the growing robust infrastructure of exchanges across the globe. Also, with more traders and institutional players participating in the crypto market, the demand for arbitrage trading is up. As said earlier, the arbitrage trading game is all about speed and you need to have a bulls-eye on price differences. Also, note that cryptocurrencies are very much volatile by their inherent nature. Hence, one must know to smartly sail through it.

Cryptocurrency arbitrage when done cross-border can come with its own set of challenges. These are basically legal hurdles like KYC across exchanges. Another concern can be varying transaction fees and withdrawal fees. If left unattended, they can also impact the trader’s profitability.

Some of the peer-to-peer crypto trading platforms have also unlocked new arbitrage opportunities based on the payment methods. Like the Bitcoin transaction fee can be lower with bank transfers, however, it can cost a premium if paid through other methods like gift cards. It is advisable that the trader maintains due diligence and does the homework at his/her end before jumping in.

If done right, cryptocurrency arbitrage trading can be a good earning opportunity for smart traders.

Crypto Arbitrage Trading: Why Is It Gaining Popularity Today?

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|