2019-5-7 23:00 |

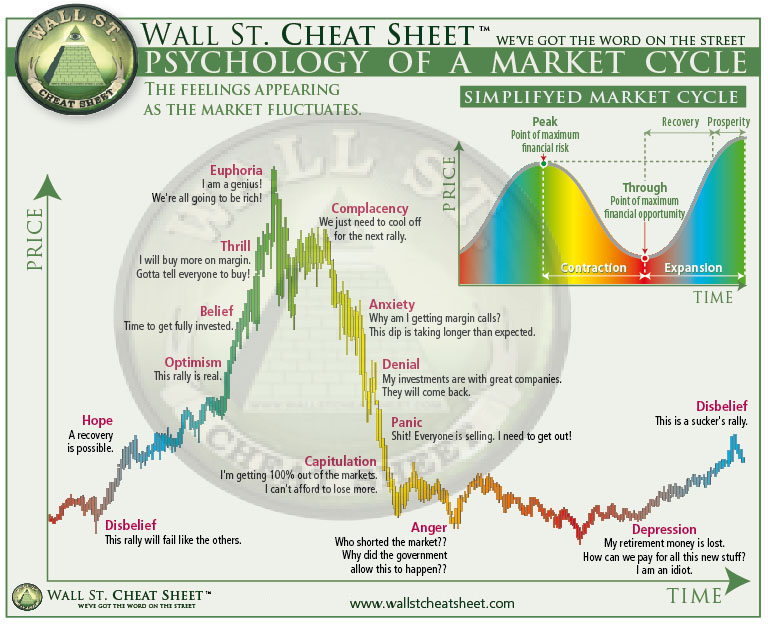

The first ever cryptocurrency has struggled to recapture the enthusiasm and exuberance prior to the 2017 hype bubble pop. Since then Bitcoin price has declined over 85% to its eventual bottom, and a brutal and hard-fought bear market has caused investors to question the long-term validity of BTC and its altcoin cousins.

But on long-term price charts, signs that the momentum has turned are evident. On the 1-week RSI, the important momentum indicator has broken into bull market territory for the first time since the start of 2018 when the crypto market first began to collapse.

RSI: Bitcoin Bull Market is BackLong-term chartist and crypto analyst, Dave the Wave, known for his analysis of the MACD indicator and moving averages for Bitcoin price prediction, has shared a new chart with the message “self explanatory.”

Self-explanatory~ pic.twitter.com/OxlozdqgGr

— dave the wave (@davthewave) May 6, 2019

The chart shows the MACD – the Moving Average Convergence Divergence – and RSI – the Relative Strength Index – stacked upon one another, with the RSI demonstrating clear resistance that Bitcoin has now broken through on the one week timeframe.

Related Reading | Sell in May and Go Away? A Look At Historic Bitcoin Price Performance in May

The resistance is drawn all the way back to the 2014-2015 bear market finale, when Bitcoin finally flipped bullish – a bull run that took the price of the leading cryptocurrency by market cap from $1,000 to $20,000 and made Bitcoin a household name in just a couple short years.

Once the resistance level was broken on the RSI following the last bear market close, the price stayed above the resistance turned support all the way through until the end of 2017 when the crypto bubble popped and the market crashed.

The RSI isn’t the only indicator to suggest the initial stages of a Bitcoin bull run have begun. The SuperGuppy, an indicator based on a variety of moving averages, has turned bullish for the first time in over a year, suggesting that a new uptrend has been confirmed.

Related Reading | Bullish Bitcoin Price Formation Hints At Short Term Move Above $6K

According to analysts, Bitcoin formed a “text book” bump-and-run-reversal bottom which caused the price of the leading crypto by market cap to rally over $1,000 over the course of an hour, setting off a full-blown April rally and a green monthly candle close that had bulls everywhere rejoicing.

Bitcoin is struggling with resistance above $5,800 – a zone that played important support during the first stages of the bear market. Bitcoin will have layers of strong resistance above it ranging from $5,800 to $6,400. But once those levels are taken out by buyers, the price of Bitcoin – given its scarcity – could skyrocket as new investors consider the emerging asset class and billions of sidelined money re-enters the market.

Featured image from ShutterstockThe post Crypto Analyst: Bitcoin Price (BTC) RSI Breaks Into Bull Market Territory appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|