2023-7-27 14:26 |

“ETH Faces Bearish Indicators but Holds Potential for Support: A Deep Dive into On-Chain Metrics and Technical Analysis”

As the price of Ether (ETH) experienced a decline, various technical and on-chain indicators have raised concerns about potential further downside. On July 24, ETH dipped close to its monthly low, reaching $1,825, amid Bitcoin’s negative price action. Market uncertainty surrounding macroeconomic conditions and the possibility of a whale sell-off added to the pressure.

On-chain analysis reveals several factors pointing towards potential downside for ETH prices. The network value-to-transaction value (NVT) metric, indicating whether the asset is overpriced, has been on the rise since the start of 2023. Historically, the NVT metric fluctuates between 30 and 80, but it surged to three-year highs of 120, suggesting either a price pullback or increased on-chain activity is needed for a reset.

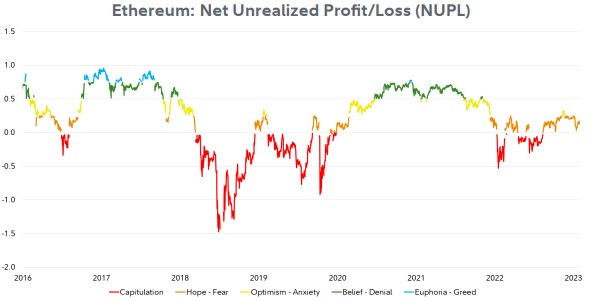

Despite these indicators, there is a silver lining for ETH. The profit levels of short- and long-term holders indicate the downturn could be limited. When the net unrealized profit/loss (NUPL) metric of short-term holders is negative, causing some of them to panic sell, buyers often take the opportunity to purchase coins at a cheaper price. The short-term NUPL ratio is currently close to neutral levels, but history shows room for further downside.

Similarly, the realized profit/loss metric also supports the possibility of a pullback. Although profit-taking is favored at the moment, the NUPL ratio of long-term holders is nearing peak levels seen in 2019 and early 2020, indicating the potential for a downturn.

Another factor contributing to possible limited downside is the decrease in ETH supply on exchanges after the Shapella upgrade in April, alongside an increase in staked ETH for validation in the proof-of-stake network. The locked ETH in staking contracts reduces the liquid supply on exchanges, making it less susceptible to selling.

Technically, the ETH/USD pair shows short-term bearish risks with an impending death cross on the weekly scale. The last death cross in June 2019 resulted in a 60% price drop. On the daily chart, the ETH/USD pair faces the risk of falling toward the 200-day moving average at $1,761, coinciding with lower highs from November 2022.

Derivatives and options data also provide insights into market sentiment. Open interest volume for ETH futures contracts remains relatively stable, suggesting traders are not highly interested in the current price action. The options market indicates a bullish bias, with a concentration of call options between $1,900 and $2,400. As options contracts worth $1.1 billion approach their expiration date on July 28, the price may remain near the maximum pain level for options buyers, around $1,850.

Taking these indicators into account, it appears that ETH could face selling pressure in the short term. However, the presence of strong support levels at $1,700 and $1,500 suggests the potential for a significant influx of buyers at these price points.

Сообщение Critical Support Level Holds the Key: ETH Price Faces Impending Death Cross, Signaling Potential Further Declines появились сначала на Coinstelegram.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|