2020-4-25 00:10 |

With less than three weeks to go until the next highly-anticipated Bitcoin halving, cryptoasset markets are still in a weakened state leading analysts to suggest it could be a total ‘non-event.’

Bitcoin prices have climbed to another weekly high this week, but markets still remain generally bearish as technicals are still painting a downtrend on longer time frames.

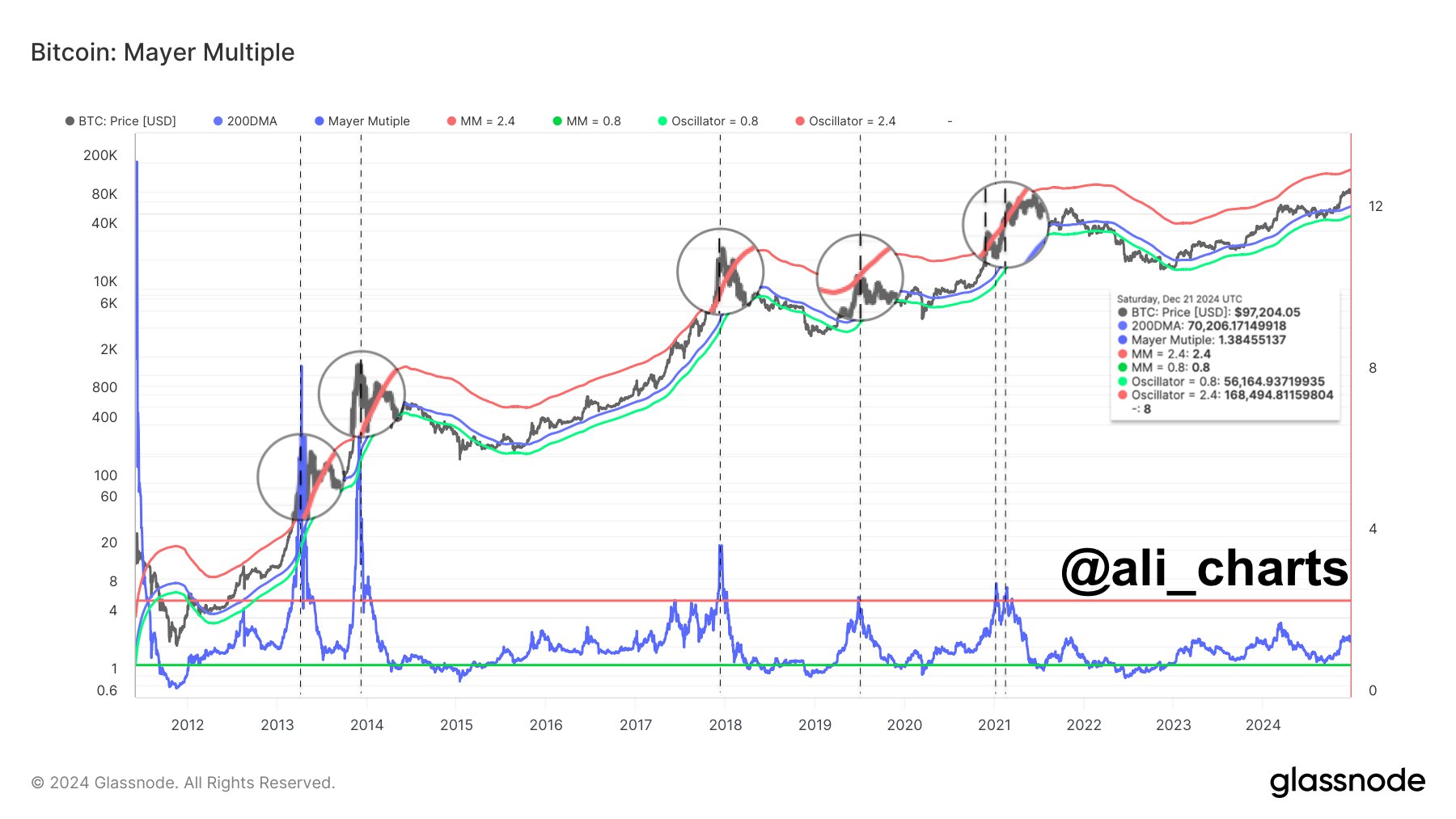

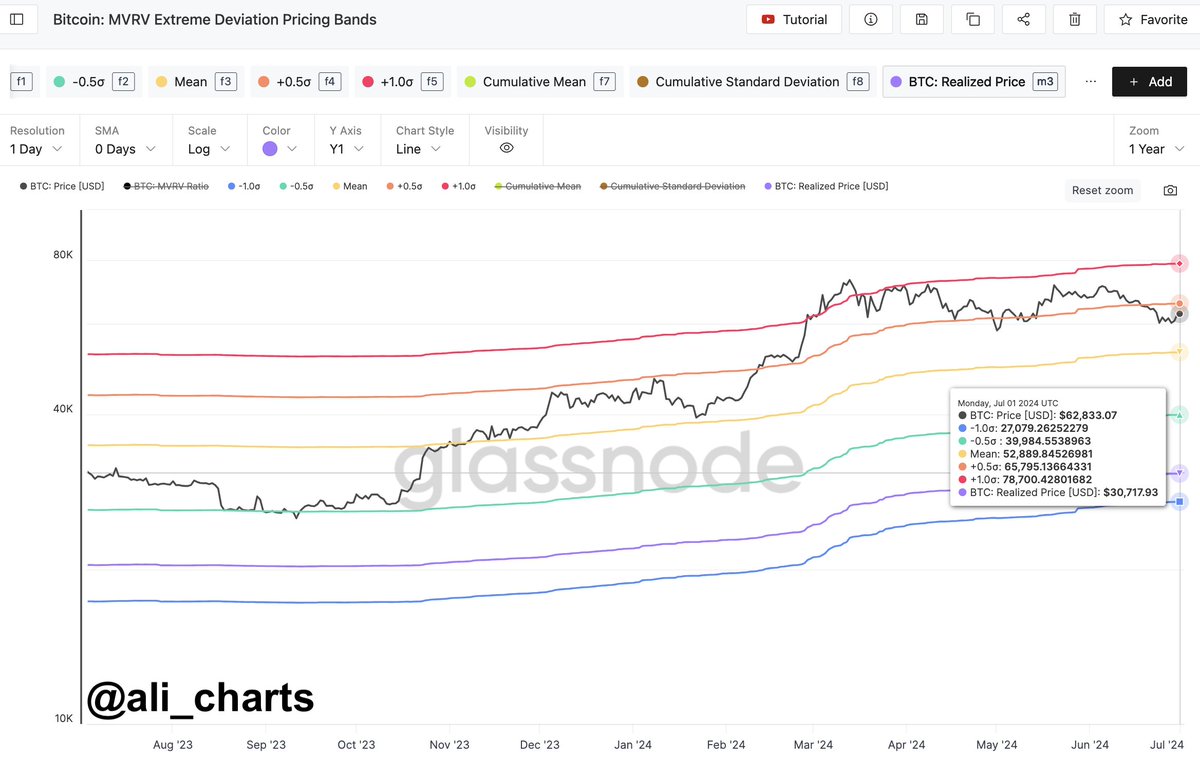

Bitcoin Halving DiscontentPrice prediction models such as stock-to-flow and logarithmic charts all work off previous market behavior to predict future direction. Bitcoin halved previously in 2012 and 2016, and experience huge rallies in the years that followed.

This time around, the global economic outlook is very different, especially with a viral pandemic causing industrial collapse and a financial market nightmare. Cryptoassets have not been spared, and Bitcoin did not prove to be the safe haven asset that many had assumed it was, collapsing 50% last month.

Researchers at Messari have been looking at previous market action to compare with the current state of things — and their conclusions aren’t pretty. Researcher Ryan Watkins tweeted:

“Past performance is not indicative of future results.

We’re in a completely different environment now vs 2016.

But to all counting down the halving, don’t be surprised if it’s a non-event.”

With just 18 days to go, prices are still below the range that Bitcoin was trading in throughout most of 2019. The weekly Relative Strength Index also shows Bitcoin currently hanging out in the middle ground.

Watkins added that the halving momentum last time was assisted by Ethereum and the ICO boom, which helped BTC surge from three figures to five figures in that year alone.

Social Media Searches on the RiseTraders and investors in China have often been the catalyst to drive markets higher, and things may be starting to show promise in this region. Search trends indicate people are looking for information and news on ‘Bitcoin halving’ in record numbers.

According to one analyst Chinese social media is seeing a spike in searches for the halving.

“Bitcoin going viral on ‘Chinese Twitter’. The topic “Bitcoin Halving” was the sixth-most searched in the past 24 hours,”

Crypto social sentiment analysis firm TheTIE has also published figures indicating that Twitter activity regarding the halving has also increased.

“58% of tweets mentioning gold and BTC are positive, 63% on the halving are positive”

Searching and tweeting may be one positive indicator, but there is a strong likelihood that COVID-19 and its economy-ravaging effects have drowned out much of the Bitcoin halving FOMO this year.

The post Could Bitcoin’s Next Halving Be a ‘Non-Event’ Compared to 2016? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|