2020-8-4 12:30 |

Coinspeaker

Could Bitcoin be Safe Haven in Upcoming Market Crash?

The first half of 2020 has seen one of the most turbulent times for stock markets. Many indices started the year off on record highs, before tumbling sharply as spring approached.

For example, the Dow Jones Industrial Average reached a peak of almost 29,000 in January before crashing to just over 19,000 in March, levels not seen since 2016. Similarly, the S&P 500 peaked at just over 3,300 in February, before losing 1,000 points in a month later.

Across the pond, things looked similar. The FTSE 100 in London reached a near-record high of 7,600 in January before losing 2,000 points in March and April, while the German Dax reached 13,264 in early January before falling to 9,772 shortly afterward.

In the U.S. and Germany, both these indices quickly recovered. The Dax has reached almost 12,800 in late July, while the S&P 500 is only 100 points off its high surpassing 26,000 in recent days.

In the UK, things are a little different. The FTSE 100 has been hovering around the 6,100-6,300 mark since May and doesn’t currently show signs of recovering to its record highs any time soon. This is likely due to the impending end to its transition agreement with the European Union which will see its trading terms worsen, at least for a considerable period, from 2021. This is also despite the index being heavily exposed to the USD which has been favorable to traders in recent years.

Many investors and traders are arguing over the likelihood of another market crash. Some argue that we currently find ourselves in a V-shape recovery, while others believe the current market recoveries are due to a dead-cat bounce.

Investors Looking for Safe Havens?Investors often look to move their assets to safe havens during times of extreme volatility. Traditionally, this means assets like gold, government bonds and cash. We can see this happening right now, with the price of gold rising from around $1,500 in January to more than $1,900 in July.

Famous investors like Warren Buffett have also been very reluctant to invest. His company Berkshire Hathaway had $137 billion of cash in May. Others are pointing to high rates of unemployment and downward trends in business performance as signs of an upcoming economic contraction.

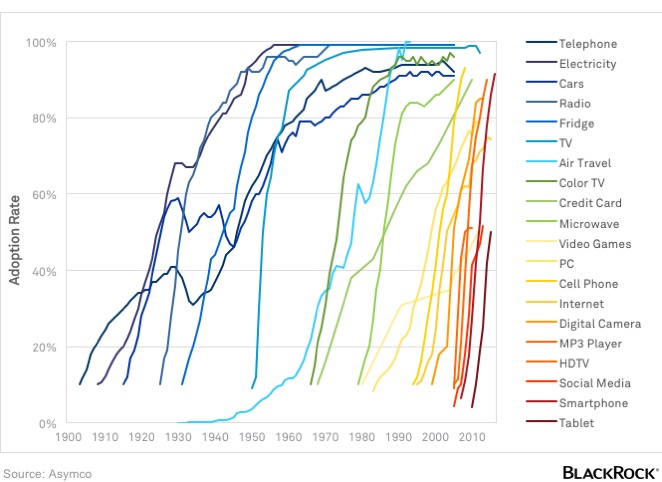

Is Bitcoin Another Safe Haven?Because of its inherent scarcity, Bitcoin has some of the same attributes as gold that could make it attractive to investors looking for a safe haven in times of uncertainty.

The cryptocurrency has been enjoying a gradual increase in the number of retailers that accept it in recent years, with brands like Starbucks and Microsoft letting customers pay for goods. Several blockchain casino sites have also sprung up in recent years.

After the Bitcoin bubble in late 2017, this acceptance helps to legitimize the digital currency and make it more attractive for those looking for a safe haven.

Investors Driving Up the ValueLike with gold, the price of Bitcoin has also increased over the first half of 2020. Having started the year below $7,200, one BTC is currently worth more than $9,500. These are still below the all-time highs of 2017, where a single Bitcoin reached almost $20,000 and the 2019 peak of $11,370, but it shows that the token is in higher demand.

Daily confirmed transactions of Bitcoin are also trending upwards, reaching almost 370,000 per day in July 2020. This is up almost 100,000 daily transactions since January, although still below 2019 and 2018 peaks.

Other CryptocurrenciesIt’s not just Bitcoin that investors have been flocking to. Ethereum is currently worth more than $310, more than double where it started the year. This is still nowhere near it’s January 2018 peak of $1,000 but, unlike Bitcoin, it has surpassed its 2019 highs.

Litecoin appears to be less appealing, with its value remaining flat from the start of the year at around $40-50, despite a spike to more than $70 in February that was followed by an even sharper fall.

ConclusionWhile there is no certainty as to which way the economy will travel, growing negative sentiments are driving more investors to look to safe havens away from the stock market. For some, Bitcoin and other cryptocurrencies look like good places to store their assets during these unpredictable times.

Could Bitcoin be Safe Haven in Upcoming Market Crash?

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|