2023-7-3 08:59 |

America’s central bank wants people to believe that the banking crisis is over. But that couldn’t be further from the truth as one of the country’s largest banks, Bank of America, is facing its own issues.

On July 2, industry-leading commentary on global capital markets, the Kobeissi Letter, posted an update on the Bank of America situation.

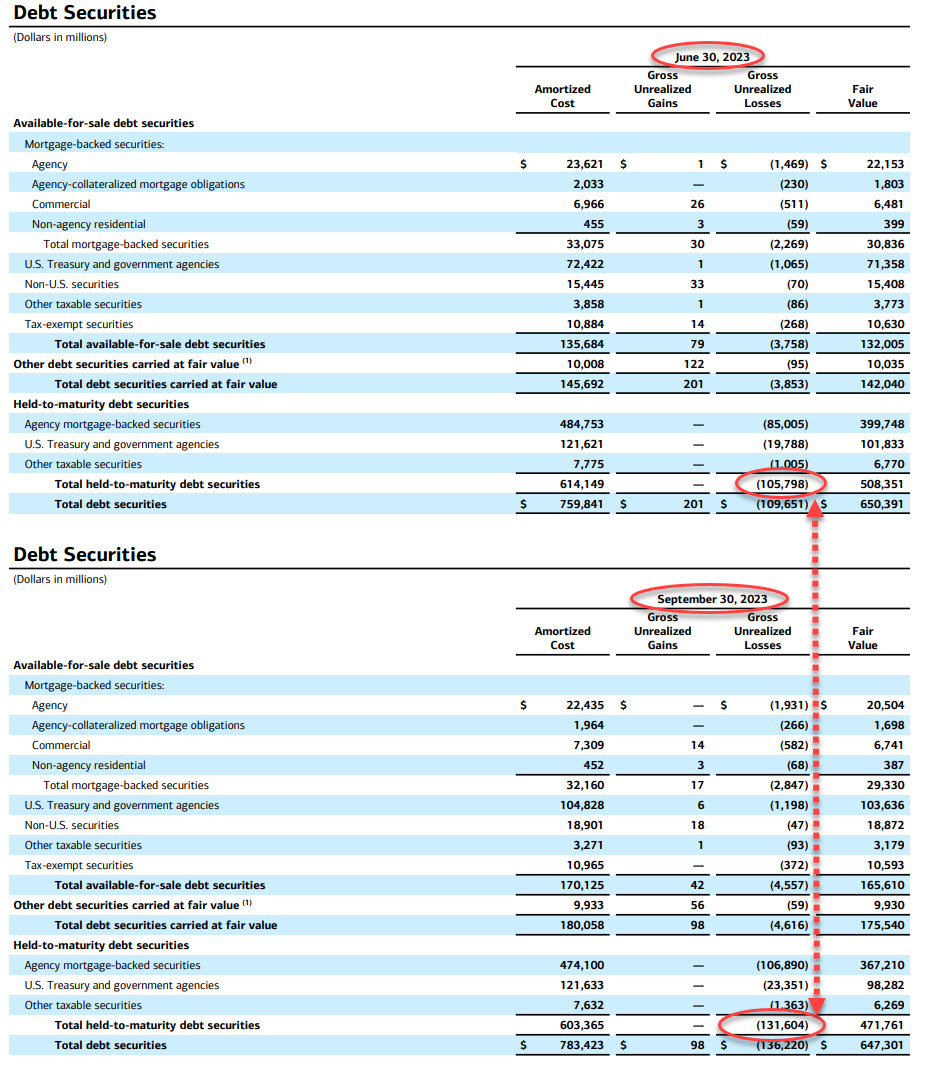

Banking Crisis ContinuesAccording to new data from the Federal Deposit Insurance Corporation (FDIC), Bank of America faces $100 billion in bond market paper losses.

Furthermore, the outlet pointed out that this could be a potential problem for the bank:

“Bank of America claims it’s not an issue as they don’t plan to sell. Sound familiar? That’s because it is. Both Silicon Valley Bank and First Republic collapsed for this reason.”

Last week, the Financial Times reported that the Bank of America made a decision to invest the majority of $670 billion in pandemic-era deposit inflows into debt markets. This was done at a time when bonds traded at historically high prices and low yields.

Therefore, America’s second-largest bank, with $2.5 trillion in total assets, could be forced to sell these bonds at a loss if depositors want their money.

This is what happened to SVB and First Republic Bank.

The Kobeissi Letter added, “It’s also worth noting that unrealized bond market losses are an industry-wide issue.”

Total unrealized losses are at a record $620 billion at U.S. banks. This is well beyond the peak of around $75 billion in 2008.

Unrealized bond market losses. Source: Twitter/@KobeissiLetterIt also noted that Bank of America’s paper losses are larger than their competitors:

“Comparing Bank of America to other large banks, their ~$109 billion in paper losses are far larger.”

JPMorgan has $37 billion in paper losses, Wells Fargo has $42 billion, and Citi and Morgan Stanley combined are at $34 billion.

Get the lowdown on the 2023 U.S. banking crisis: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

It added that BofA losses do not account for credit. The bank only made around $931 million of provisions in the last quarter, which amounts to a total of roughly $14 billion of Credit Loss Provisions for the quarter.

The hope is that BofA will never have to realize these paper losses, it concluded before warning that:

“None of the recent bank collapses “expected” to face the problems that they did. A system built on a contingency so severe is dangerous.”

Fed Bailout Fund Hits New HighThe Federal Reserve has been actively bailing out America’s smaller lenders this year. The Fed’s emergency lending program is called the Bank Term Funding Program (BTFP). It has hit an all-time high of over $103 billion since its creation in March.

Data from the St. Louis Fed confirms that central bank spending on propping up embattled banks has skyrocketed.

With trillions of dollars printed over the past few turbulent years, banks are now drowning in debt as interest rates rise. The banking crisis could also be driving America’s war on crypto. Bankers clearly view crypto as a real threat to traditional finance.

The post Could Bank of America Be Next on the U.S. Banking Crisis List? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) íà Currencies.ru

|

|