2020-3-19 00:30 |

Economists believe the COVID-19 pandemic, which has spread across Europe and America in recent days, could push the global economy to the brink of recession.

JP Morgan analysts have forecasted a coronavirus-driven economic recession to hit America and Europe by July 2020.

The economic recession of 2008 saw the birth of Bitcoin as a potential solution to decentralize the monopoly of central banks. Now, an upcoming economic crisis could cause tokenization to take off as an alternative to many physical assets.

Coronavirus Outbreak Triggers Stock Market CrashTrading on American stock exchanges was partially suspended after the S&P index hit the lower circuit on Monday, marking the third such instance in less than a week. The latest equity rout forced the Federal Reserve to plunge into action and announce an emergency rate cut to provide support to an ailing economy. Equity markets had not witnessed a selloff of this scale since the Lehmann brothers filed for bankruptcy in 2008.

Close scrutiny suggests there is some rationale behind this sharp selloff. Companies will likely not be able to meet their revenue guidelines for the next few foreseeable quarters, sending investors in a panic. According to some estimates by JP Morgan, the American economy is expected to contract by two percent in the first quarter and three percent in the second quarter. [Business Insider]

Europe, which has become the latest epicenter of the recent coronavirus outbreak, is also expected to slide into an economic slowdown later this year. Countries such as Italy, Germany, Spain, and the United Kingdom could witness a sharp decline in economic activity. Estimates suggest a drastic fall of 1.8 and 3.3 percent in the European economy in the first and second quarters, respectively.

According to American think tank CSIS, the COVID-19 outbreak has generated both demand and supply shocks reverberating across the global economy. Due to this depressed activity, the United Nations has projected foreign direct investment flows to fall between five and 15 percent, which would be their lowest levels since the financial crisis of 2008.

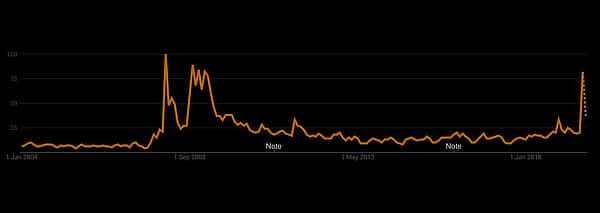

Next Economic Slowdown Could Take Digital Currencies MainstreamThe previous economic meltdown witnessed in 2008 led to the conception of Bitcoin by the pseudonymous developer Satoshi Nakamoto. The Bitcoin genesis block, the first block ever mined on the blockchain, infamously referenced the following headline from The Times: “Chancellor on brink of second bailout for banks.”

For a long time, however, digital currencies were only used by enthusiasts who believed in the vision of a decentralized currency. More recently, the cryptocurrency bull run of 2017 made Bitcoin and other digital currencies more visible in the public eye.

Nevertheless, the sharp drop in cryptocurrency prices did not deter major corporations, entrepreneurs, institutional investors, and academics. Several major mainstream finance companies have successfully completed trials involving blockchain technology. Additionally, a new set of rules in the form of the BaFin license will make it easier for cryptocurrency-related companies to use banking services when it comes into effect later this year.

According to a combination of surveys, including ING (2018), Statista (2018), Bitpanda, and GlobalWebIndex (2019), the share of Europe in the cryptocurrency market is estimated at 30 percent. In a report on the topic of tokenization of assets, Deloitte forecasts that the financial industry could become more accessible, cheaper, faster, and easier due to tokenization. This could, possibly, unlock trillions of euros currently parked in illiquid assets and vastly increasing volumes of trade.

Another recession could see public faith in central banks and governments dwindle and capital flow from equity and bond markets to cryptocurrencies. Emerging economy currencies have especially witnessed a sharp selloff against the U.S. Dollar. Bitcoin may be the preferred choice among investors to hedge this loss.

Furthermore, the European Central Bank and other reserve banks would be forced to simplify laws for the cryptocurrency industry in the unlikely event of an economic slowdown. Central banks will be under severe public pressure to improve the economy and could even turn to the crypto market to ensure a smoother flow of capital.

Businesses May Not Be Prepared for the Era of Remote WorkThe airline industry is already reeling from massive losses, due to various travel bans imposed by governments, and could even be staring at potential bankruptcy by May 2020.

China, famously known as the world’s manufacturing capital, has witnessed an unprecedented disruption in its supply chain network. This has spilled to other countries that have each responded with varying restrictions on the export of essential items.

Social distancing guidelines, meanwhile, have been issued by governments around the globe. This, in turn, has forced companies to allow employees to work from home. While a sound strategy for white-collar jobs, it is virtually impossible for manufacturing companies to adopt this practice.

A study completed in 2018 concluded that one in five businesses in the European Union had an average broadband speed ranging between two and 10Mbps. Another 24 percent of all businesses had an average internet speed between 10 and 30Mbps. Both these categories largely consisted of small businesses that would need significant financial support in the event of a severe economic slowdown. The same report also concluded that only 26 percent of businesses in the European Union used cloud computing services. As a result, most small businesses across Europe would not be able to offer remote work opportunities to their employees.

Small and medium-sized businesses contribute to economic prosperity and also provide jobs to the population. According to Bloomberg economist, Maeva Cousin, having employees work from home could be a possible contingency solution for a number of companies, mostly in the services sector. However, this option was largely unfeasible for most of the 17 percent Europeans working in the manufacturing industry, seven percent in the construction sector, 14 percent in trade and another five percent in hotels and restaurants. She also estimated that the coronavirus pandemic could result in a $2.7 trillion loss for the world economy and have far-reaching social effects.

The post Coronavirus Could Force Central Banks to Change Their Attitudes Towards Digital Currencies appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) íà Currencies.ru

|

|