2018-9-30 18:21 |

CNBC reports that on Friday more than a dozen members from the US Congress called for greater clarity in cryptocurrency regulation from the SEC in a letter written to SEC Chairman Jay Clayton. The letter comes in the wake of a recent four-hour meeting in Washintgon between representitives from Wall Street and the crypto industry, which publicly pushed for similar action to be taken by the SEC.

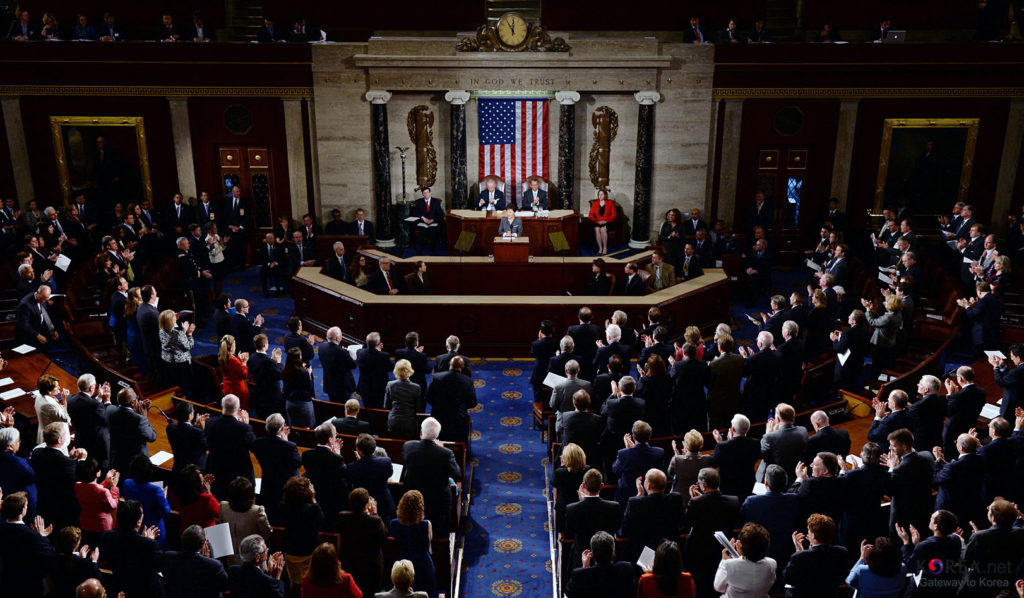

The Congressional LetterOn Friday, more than a dozen members of the US House of Representatives sent a letter to Securities and Exchange Commission Chairman Jay Clayton calling for greater regulatory clarity surrounding cryptocurrencies.

“It is important that all policy makers work toward developing clearer guidelines between those digital tokens that are securities, and those that are not, through better articulation of SEC policy, and, ultimately, through formal guidance or legislation,” reads the letter.

At present, the SEC has labeled the majority of cryptocurrency assets as securities, which are governed under the same regulations as traditional stocks. An exception has been made in the case of Bitcoin and Ether which are regulated as commodities under the CFTC. This designation of cryptocurrencies as securities has been determined using a set of rules known as the “Howey Test”, which is based on a 1946 Supreme Court decision.

According to Chairman Clayton, the SEC has no intention of changing these standards, but the SEC does have the ability to add greater clarity to the existing regulation surrounding cryptocurrencies that the letter from Congress is addressing. One specific concern listed in the letter is that a failure to provide a clear regulatory framework could be damaging to future crypto-innovation within the US.

“Current uncertainty surrounding the treatment of offers and sales of digital tokens is hindering innovation in the United States and will ultimately drive business elsewhere,” the letter reads. “We believe that the SEC could do more to clarify its position.”

As previously mentioned, the letter comes only days after a four-hour meeting in Washington between roughly 50 representatives of cryptocurrency and Wall Street firms concluding similar efforts by the SEC are necessary.

“We all want fair and orderly markets, we want all the same things regulators do,” said Mike Lempres, chief policy officer at San Francisco-based Coinbase said during the meeting. “It doesn’t have to be done in the same way it was done in the past, and we need to be open to that.”

Suggested Reading : Learn more about Coinbase in our review and guide.

Friday’s Congressional letter to the SEC was a bipartisan effort led by representatives ranging across the political spectrum. While the letter does not set a deadline for action, the authors urged the SEC to “be mindful of the speed at which the industry is developing.”

Some of the key requests from the letter are as follows:

“1. The SEC should clarify the criteria used to determine when offers and sales of digital tokens should properly be considered “investment contracts” and therefore offerings of securities”:

“The marketplace for digital tokens is expanding. Other digital tokens in existence today should also be deemed to fall outside the parameters used to define an investment contract under the securities laws. In the current environment it is unclear which other unique characteristics of digital tokens are also considered by the SEC when making this determination.”

“2. Do you agree that a token originally sold in an investment contract can, nonetheless, be a non-security as Mr. Hinman stated? Can the resultant token be analyzed separately from the original purchase agreement, which may clearly be an investment contract? And, if so, could the resultant token, nonetheless be a non-security?”

“3. Please describe the tools available to the SEC to offer more concrete guidance to innovators on these topics.”

The post Congress Calls for Clearer Cryptocurrency Regulation in Letter to the SEC appeared first on UNHASHED.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) íà Currencies.ru

|

|