2024-7-19 09:51 |

Coinbase (NASDAQ: COIN) stock price has been ugly in the past three months as concerns about the crypto industry continued. After peaking at $283 in March, it has dropped by almost 18% and is nearing a technical bear market.

Despite the retreat, the Coinbase share price has done well since December 2022 when it bottomed at $32. It has soared by over 630%, beating most fintech companies like Block and PayPal. The company faces numerous tailwinds ahead.

Coinbase stock chart

Bitcoin has formed a bullish patternThe first tailwind that Coinbase has is that Bitcoin has formed four important patterns that could push it higher in the future.

First, as shown above, Bitcoin has formed a falling broadening wedge chart pattern. In most cases, this pattern results in a strong bullish breakout.

Second, Bitcoin has formed a three drives pattern, which leads to more upside when it enters the third phase. In this case, such a bullish breakout will be confirmed if Bitcoin rises above the key resistance point at $72,000.

Third, Bitcoin price has formed what looks like a bullish flag chart pattern since the wedge formed after it moved to it stage a strong comeback.

Finally, Bitcoin has remained above the 50-day and 100-day Exponential Moving Averages (EMA), which is a sign that bulls are still in control. Also, the Relative Strength Index (RSI) has crossed the descending trendline that connects the highest point since February 29th.

Therefore, these technical arrangements mean that Bitcoin has more upside in the coming months. If this happens, Michael Novogratz believes that it could jump to over $100,000 by the end of the year. Other analysts believe that the coin could have more gains in the next few years.

Historically, the end of Miner Capitulation periods following Bitcoin Halvings has led to significant price increases for Bitcoin in the subsequent months and year.

The Hash Ribbon metric suggests that Bitcoin bottoms out when miners capitulate due to high mining costs and/or… pic.twitter.com/6CiDVyKM7i

Coinbase has a close correlation with Bitcoin. In most cases, its stock rises when Bitcoin is soaring and vice versa. For example, it surged to a multi-level high in March as Bitcoin rose to a record high.

Bitcoin rally leads to more demand for other altcoins like Ethereum and Solana as well. It also leads to more activity in the crypto market.

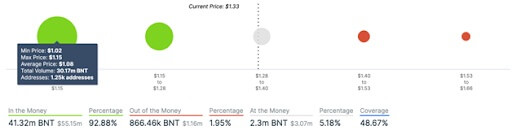

ETF inflows are risingThe other potential catalyst for the Coinbase stock is that ETF inflows are rising. Data shows that spot Bitcoin ETFs have accumulated coins worth over $50 billion. Inflows have jumped to over $16 billion this year.

Coinbase benefits from high inflows for two main reasons. First, Coinbase has become the biggest Bitcoin custodian in the industry. It is the main provider of these solutions to companies like Blackrock and Ark Invest.

Second, Coinbase will be the main custodian of the upcoming spot Ethereum ETFs. This is important because the companies pay Coinbase a fee for these services. They also pay transaction fees and it also offers reporting and compliance solutions. While these fees are not much, they are consistent and easy to predict.

Further, more ETF transactions and inflows will help boost crypto prices in the long term as institutions buy. Some of the top institutions that have bought Bitcoin ETFs are Millenium, Apollo Global, and Susquehanna.

Trump presidential hopesThe other tailwind for the Coinbase stock price is Donald Trump’s presidential hopes. Recent polling data shows that he has a clear chance of winning the presidency, especially after the shooting.

A Trump victory is seen as a good outcome for Bitcoin and other cryptocurrencies. Besides, Trump has expressed support for the industry and is expected to speak at an important Bitcoin event later this month.

A Trump presidency means that the Securities and Exchange Commission (SEC) will have a new leader who will replace Gary Gensler, who is disliked by the community. In a note, analysts at Wolfe Research identified Coinbase as one of the companies to benefit from this trend.

Still, there is a caveat about this. First, it is still too early to determine whether Trump will win the election, especially if Biden drops out.

Second, in most cases, stock picks meant to do well after an election tend to underperform. For example, solar stocks have crashed during Joe Biden’s presidency. In contrast, prison stocks that were expected to plunge like Geo Group and CoreCivic have jumped sharply.

Coinbase stock risksDespite these hopes, Coinbase stock price faces numerous risks ahead. First, recent data shows that the CEX and DEX volume has crashed in the past few months. The same has happened in decentralized exchanges in the same period. That is a sign that Coinbase’s revenues will miss analysts estimates.

DEX volume chart

Second, there are valuation concerns since the company trades at a premium. It has a price-to-earnings ratio of 48, higher than the S&P 500 index figure of 21.

Also, there is a risk that Coinbase is losing market share in the crypto industry. It is losing share to DEX companies like Uniswap, Raydium, Orca, and Jupiter and CEX companies like OKX and Bybit.

The post Coinbase stock price faces key tailwinds and potential risks appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|