2024-12-28 00:58 |

Crypto exchange Coinbase recorded the highest outflow last week, with 10,756 Bitcoin (BTC) withdrawn in one hour. The total volume was worth approximately $1.1 billion, sparking slight bull signals in the market. Crypto whales and institutional investors have picked up huge assets, buying the dip and setting sights on another rally.

CryptoQuant analysts highlighted a set of massive outflows from centralized exchanges. Coinbase saw the largest volume following the Fed’s cutting interest rates. The first block contained 8,093 BTC, while the second 2,557 BTC before the hour.

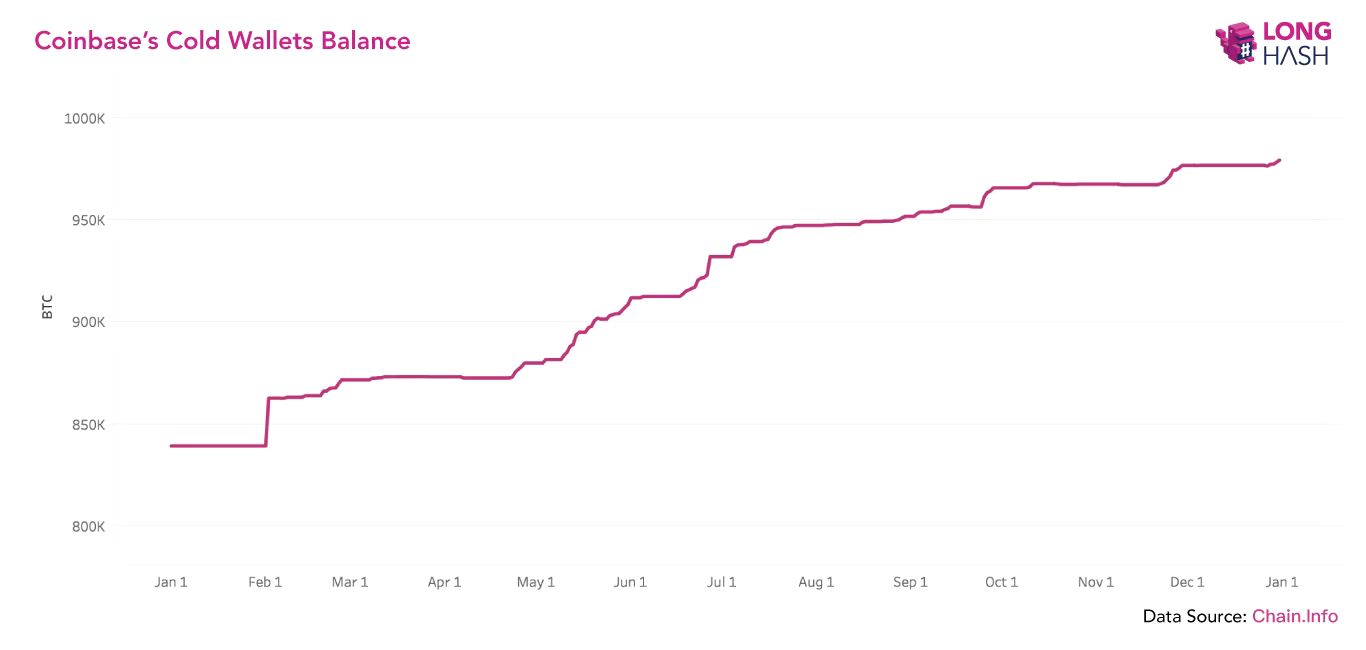

Outflows from centralized exchanges point to improved market sentiments as users seek long-term holdings. Meanwhile, flows to these exchanges often result in offloads due to ease of transaction. As a result, the market faces high sell pressure on mounting inflows to Binance and Coinbase.

Institutional Players Lead BuysRecent Bitcoin buys amid the market dip have come from institutional investors. Retail holders have sold assets to notch gains in the last seven days after the crypto leader touched all-time highs. However, most traditional and bigger players are holding on a long-term basis ahead of positive macro factors in the United States.

Recent outflows from exchanges occurred after the U.S. Federal Reserve announced interest rate cuts. On Dec 18, the US central bank slashed policy rates by 25 basis points, taking figures to lowest levels since February 2023. This follows slowing inflationary trends adding to crypto investments. Rate cuts lead to more inflows as investors pour funds into risky assets.

CryptoQuant analysts explained recent activity was linked to spot Bitcoin ETFs and other institutional activity. This signals a strong rebound for Bitcoin price in 2024, coupled with recent projections by stakeholders.

“The scale of this transaction strongly indicates institutional buying (RIOT and MARA) or intermediary purchases for Spot ETF demand, consistent with similar activity observed over the past year. Such movements highlight the growing influence of institutional players in the Bitcoin market. U.S. investors continue to accumulate Bitcoin relentlessly, undeterred by price fluctuations or market downturns.”

Bitcoin miner Hut 8 purchased 990 Bitcoin worth approximately $100 million, boosting its reserve above $1 billion. The company noted it aligns with its strategy to merge low-cost BTC mining with buying opportunities. Riot Platforms recently splurged $525 million to acquire 5,117 BTC, further boosting bull activity.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|