2022-7-16 16:15 |

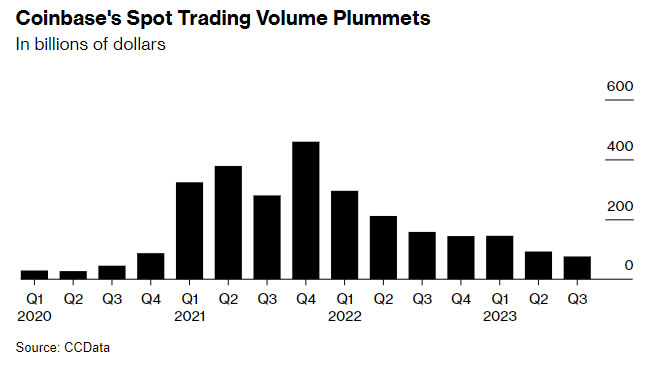

As broader headwinds pull down the crypto market, Coinbase Global is reportedly slipping off the global list of the top 10 digital asset exchanges by volume.

Bloomberg cited data by Mizuho Securities USA, which found that the Nasdaq-listed company has fallen from being the fourth-largest exchange in late 2021 to the 14th-largest exchange this month.

Coinbase market share takes a hitAccording to Mizuho, the largest U.S. exchange now has only a 2.9% market share among the top 30 exchanges worldwide. This is a sharp fall from its 3.6% share in the second quarter of 2022 and the 5.3% share in the first quarter, indicating that Coinbase’s profit trajectory may be unstable.

Source: Coingecko.comThe investment banking company stated in the report: “We worry that the competitive nature of the industry is likely to require further increases in sales and marketing spend over time, and can also weigh on COIN’s take rates,”

“All this, coupled with subdued volume trends, is likely to weigh on profitability moving forward, in our view,” analysts added.

Armstrong announces efficiency measuresRecently, Coinbase had laid off 18% of its staff, while acknowledging that future staff cuts might be a possibility.

And amid the extreme crypto volatility and the faltering performance of Coinbase, CEO Brian Armstrong took to Twitter to underline that there is “still a lot of growth left to absorb” after the upward trajectory of 2021.

“As companies scale, they usually slow down and become less efficient,” Armstrong said.

“While this trajectory is natural, it is not inevitable. Every great company, from Amazon to Meta to Tesla, found ways to retain their founding energy in conjunction with appropriate controls, even as they scaled to be much larger than Coinbase is today,” he added.

The exchange chief emphasized on driving efficiency at Coinbase by slowing the growth of the platform.

Coinbase grew a ton in 2021 and we're still adjusting to that growth. One of the crazy parts about our industry is that in any given year we might be growing 300-500% or -50%. It makes it incredibly challenging to plan and culturally to absorb so many people during up periods.

— Brian Armstrong – barmstrong.eth (@brian_armstrong) July 12, 2022According to Mizuho analyst Dan Dolev, however, Coinbase is struggling “because their business model is seeing structural issues: suffering from a perfect storm of more competition in a declining market while take rates are perceived to be too high and unsustainable.”

Last month, Goldman Sachs downgraded Coinbase to “sell” on the back of falling revenue and trading levels.

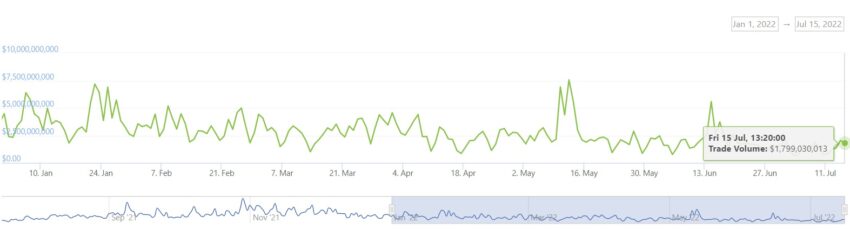

A former Coinbase employee told Inc42: “This is serious. And this is not just due to the crypto winter. Look at Coinbase’s business operations in the past two quarters. The total trading volume is down from $547B in Q4 2021 to $309B in Q1 2022, a staggering decline of 44%. Retail trading is also down by more than 50%. Compared to this slump, FTX and Binance have performed better.”

Source: Coinranking.comTherefore, the Coinbase slowdown could provide a competitive advantage to platforms like FTX and Binance.

The post Coinbase Falling Trade Volume Hits Ranking; CEO Blames Fast Growth appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Volume Network (VOL) на Currencies.ru

|

|