2020-9-19 12:15 |

Several major exchanges have listed Uniswap’s UNI governance token after the project launched the coin yesterday, marking one of the fastest mass token listings in crypto history.

Which Exchanges List UNI?Coinbase was the first major exchange to list UNI on Coinbase Pro, adding support just hours after the listing. Binance and its American counterpart, Binance.US, have listed the coin as well. So have Gate.io, KuCoin, OKEx, Bithumb, and Huobi.

Some exchanges, including Huobi and Gate.io, have even launched UNI-based derivative products and perpetual swap contracts alongside their standard UNI listings, aimed at high-risk investors.

Over 25 exchanges list the UNI token at the moment.

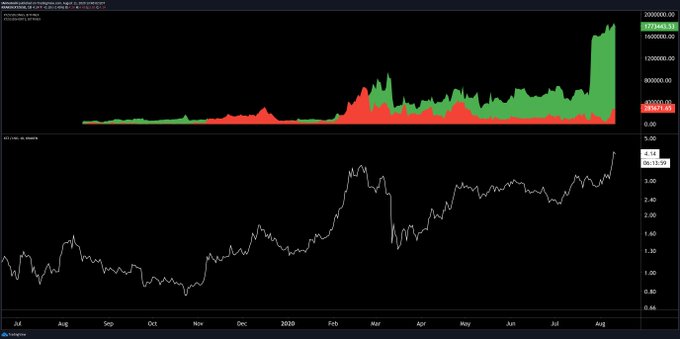

Why Do Exchanges Support Uniswap?No exchange has fully explained its enthusiasm for Uniswap’s new token. The most likely explanation is fee revenue: UNI has already generated over $1.8 billion in trading volume, making it the eighth most-traded cryptocurrency by volume.

Exchanges have, presumably, collected thousands of dollars in trading fees.

Some exchanges also have a specific relationship with Uniswap. Coinbase says that it has invested in Uniswap’s development company, Universal Navigation Inc. OKex, meanwhile, says that it “collaborate[s] with participants in [DeFi],” though it does not acknowledge an explicit partnership with Uniswap.

That fact that Uniswap has quickly attracted listings is a sign that centralized exchanges and DeFi exchanges can provide benefits to one another. That is, centralized exchanges may attract new crypto investors to DeFi platforms like Uniswap, while DeFi tokens can provide centralized exchanges with a revenue source.

Coinbase may be the exchange most interested in decentralized finance: it announced plans to list several other DeFi tokens in June and July, and has announced guidelines for projects that want to see their tokens listed on the exchange.

origin »Miner One token (MIO) на Currencies.ru

|

|