2023-10-25 20:10 |

Quick Take

The interest in Bitcoin is on an upward trajectory, a trend palpable in the recent data analysis. One aspect that has drawn media attention, including CryptoSlate, is the potential approval of a Bitcoin spot Exchange Traded Fund (ETF). This development could act as a springboard, propelling Bitcoin into the mainstream financial ecosystem by providing a regulated and simplified method of investment.

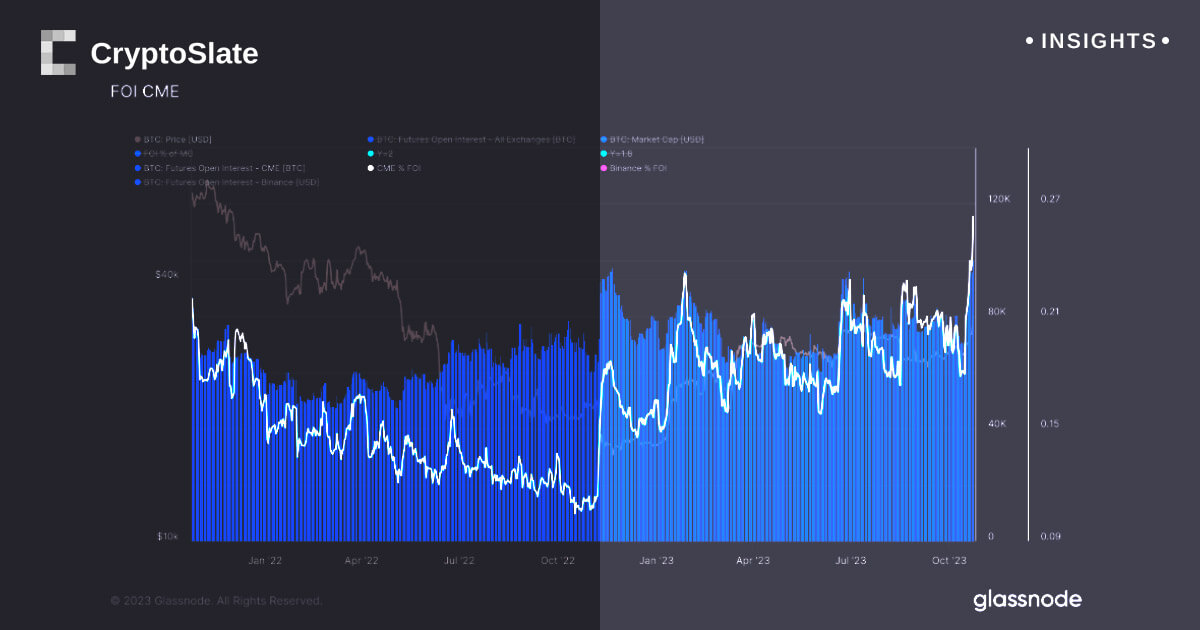

The Chicago Mercantile Exchange (CME), a favorite platform among institutions, has seen its open interest exceed 100,000 Bitcoin, which is approximately equivalent to $3.1 billion. Approximately 27% of the total open interest now resides with CME, marking the highest level ever recorded.

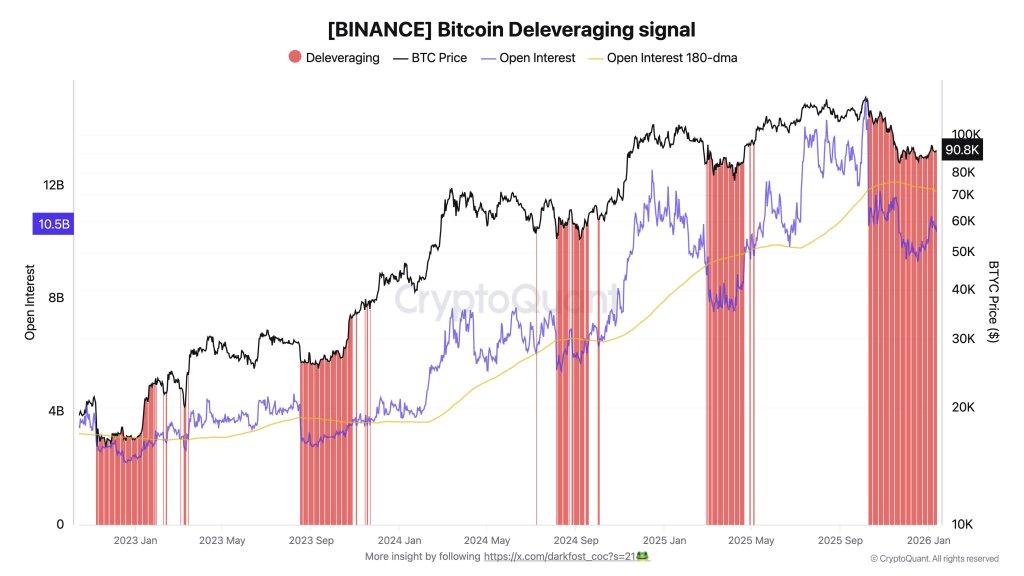

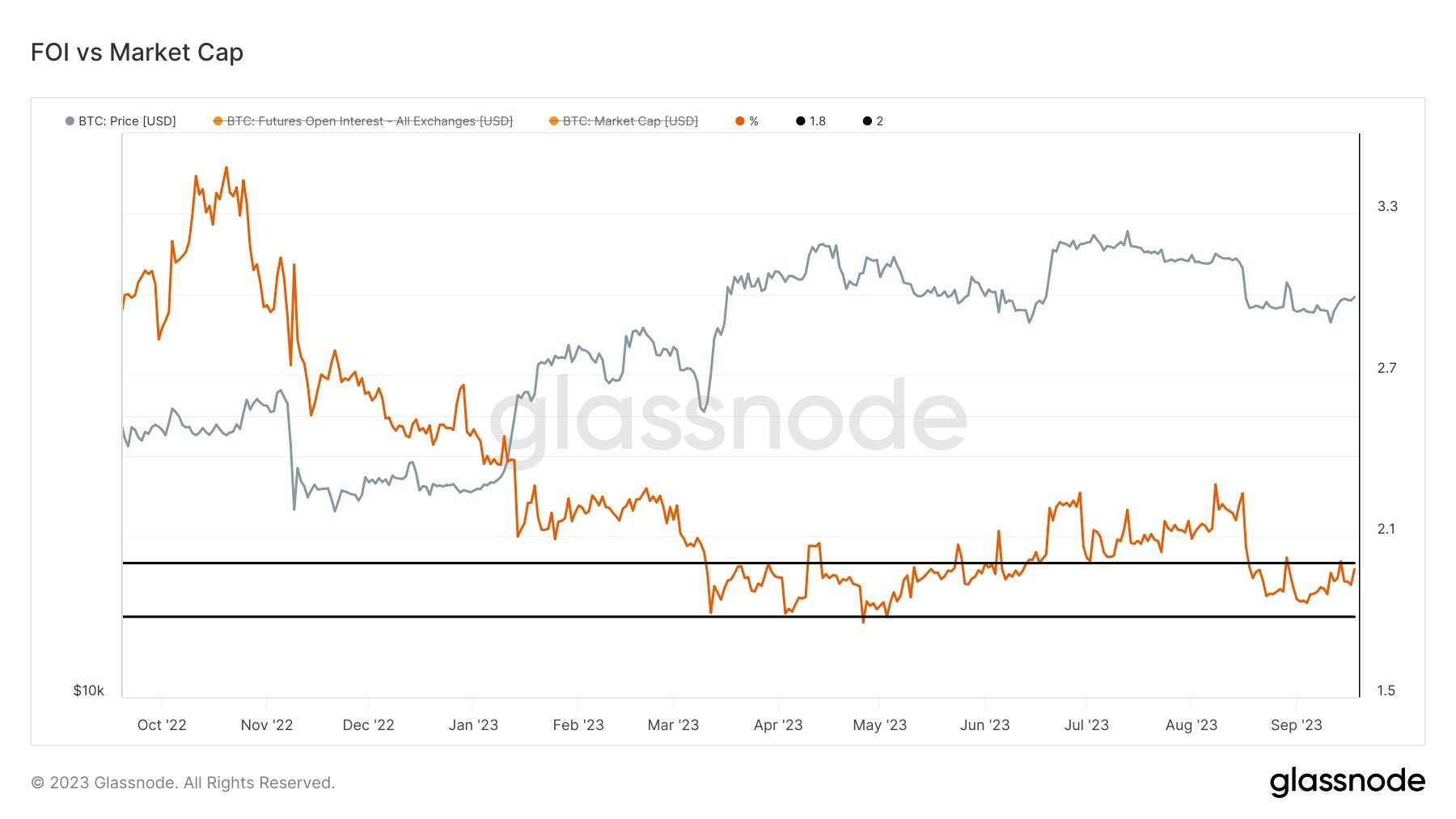

Futures Open Interest, CME: (Source: Glassnode)On the other hand, Binance holds an open interest of about 112,000 Bitcoin, accounting for just under 30% of the market, a figure nearing its lowest point for the year to date. An exciting disparity is beginning to emerge between Binance and CME.

Futures Open Interest, Binance: (Source: Glassnode)The post CME sees over 100k BTC in open interest amidst rising institutional interest appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Interest (BCI) на Currencies.ru

|

|