2026-1-24 19:57 |

Circle’s USYC has overtaken BlackRock’s BUIDL as the world’s largest tokenized money market fund, a type of investment product that holds U.S. Treasury securities and trades on blockchain networks.

USYC reached $1.69 billion in assets while BUIDL fell to $1.68 billion. USYC grew 11% in 30 days while BUIDL declined 2.85%, according to RWA.xyz data.

The roughly $6 million margin between the two comes with a significant caveat as Arkham Intelligence data shows Binance holds $1.43 billion of USYC, representing 94% of the total supply.

Previous on-chain records showed Usual Protocol held a similar share before diversifying its reserves in late 2024. Nearly all of USYC’s growth came from a single institutional relationship with Binance.

Arkham Intelligence data showing Circle USYC top holders by entity. Binance controls 94.19% of the total supply at $1.43 billion, followed by Usual Treasury at 3.22%. | Source: Arkham Intelligence

Binance Partnership Drives USYC GrowthCircle announced its partnership with Binance in July 2025, allowing institutional clients to use USYC as backing for trades on the exchange.

The fund was issued on Binance’s blockchain network, with approximately $1.4 billion now deployed there.

Kash Razzaghi, Circle’s Chief Business Officer, said at the time that the integration unlocks new possibilities for institutional capital efficiency.

Catherine Chen, Head of Binance VIP & Institutional, said the integration represents a major step forward in support for the future of capital markets.

The partnership followed Circle’s acquisition of Hashnote, the original USYC issuer, in January 2025.

Holder Distribution ComparisonBlackRock’s BUIDL fund maintains a more diversified holder base with 103 distinct holders. BUIDL’s distribution is more granular, though its top 10 holders still account for over 95% of total value.

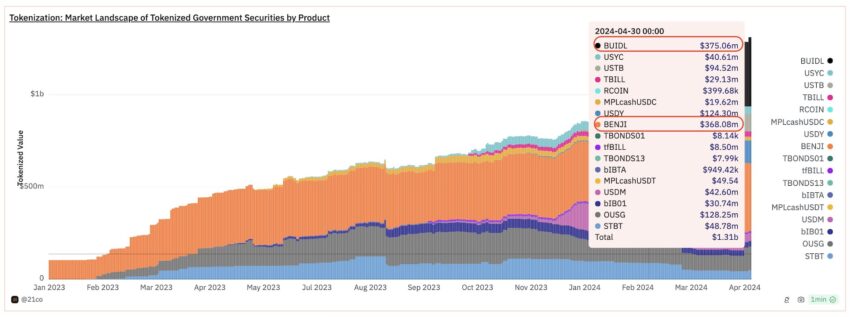

The overall tokenized treasury market reached $10.07 billion, with USYC and BUIDL combined representing approximately one-third of that value.

Both funds invest in short-duration U.S. Treasury securities and serve institutional investors seeking interest-earning digital assets.

The thin margin between the two funds means rankings could shift with normal fund activity. Stablecoin transaction volumes increased to reach $33 trillion in 2025, which may continue driving institutional interest in related products.

nextThe post Circle’s USYC Overtakes BlackRock’s BUIDL as Largest Tokenized Treasury Fund appeared first on Coinspeaker.

origin »Bitcoin price in Telegram @btc_price_every_hour

DFOhub (BUIDL) на Currencies.ru

|

|