2024-10-26 16:49 |

Dante Disparte, Circle’s global head of policy, expressed confidence that formal laws for stablecoins—a type of cryptocurrency pegged to traditional currencies like the US dollar or the British pound—are imminent.

“I think we’re within months, not years,” Disparte shared during an interview in London. His optimism reflects policymakers’ growing sense of urgency to establish a regulatory framework for digital assets. Disparte believes the UK’s cautious approach to crypto regulation has been beneficial, especially given recent industry upheavals.

The UK’s deliberate pace in introducing crypto laws may have been prudent. Disparte suggested that many in the UK feel vindicated for not rushing regulations, particularly after events like the collapse of FTX, a crypto exchange once valued at $32 billion. “Many in the UK and other countries would argue that they’re vindicated in not having jumped in too quickly,” he noted.

The Need for Regulatory ClarityBy not enacting stablecoin-specific regulations, the UK could fall behind regions like the European Union, which is already enforcing regulations under its Markets in Crypto Assets (MiCA) framework. Singapore has also established formal laws for the stablecoin industry.

“In the spirit of protecting the U.K. economy from excess risk and crypto, there’s also a point in time in which you end up protecting the economy from job creation and the industries of the future,” Disparte said

The Stablecoin launch will help the banking sector. Real-time payments and the digitization of the British pound have the potential to revolutionize financial transactions. The Bank of England is exploring the possibility of a digital pound, often referred to as “Britcoin.” Disparte mentioned meeting with Bank officials and felt reassured by their thoughtful approach to central bank digital currencies (CBDCs).

Circle is actively engaging with UK authorities to advocate for clear and effective stablecoin regulations. The company’s involvement underscores the importance of collaboration between the private sector and regulators in shaping the future of digital finance.

Previous administrations expressed ambitions for the UK to become a global crypto hub. Under former Prime Minister Rishi Sunak, plans were announced to make the UK a “world leader” in the crypto space, aiming to introduce legislation for stablecoins and consult on regulating crypto asset trading. In April, the government outlined intentions to bring stablecoins into the regulatory fold, reflecting a proactive stance towards digital currencies.

Current Government’s StanceThe new Labour government has been less vocal on crypto regulation compared to its predecessors. In January, the party released a financial services plan that included a proposal to position the UK as a hub for securities tokenization. Securities tokens represent ownership of real-world financial assets, such as shares or bonds, in digital form. This move indicates a shift towards embracing blockchain technology within traditional financial markets.

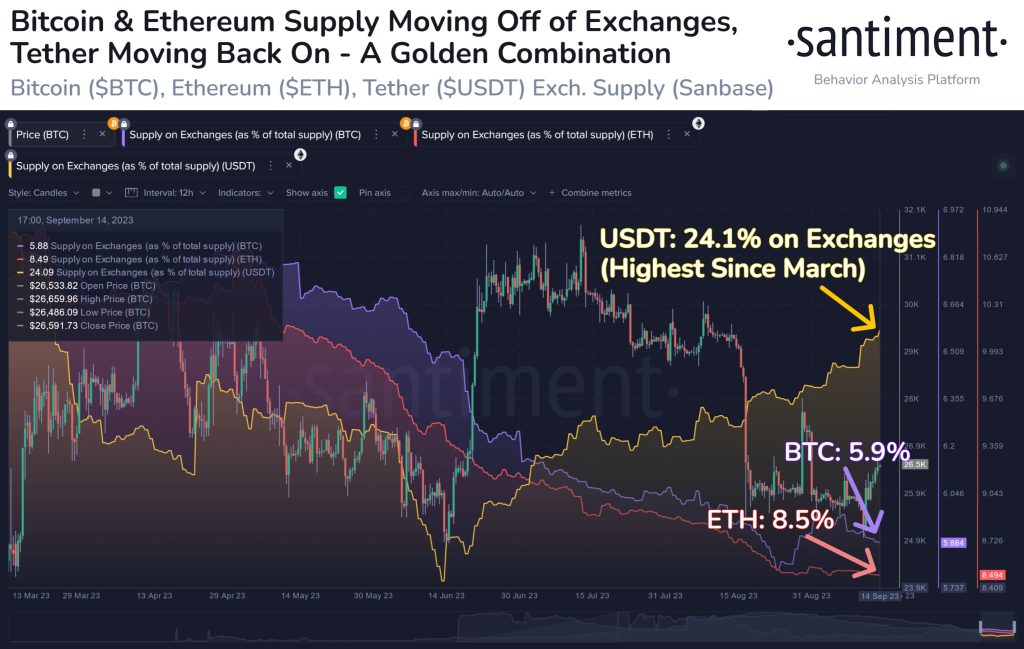

Stablecoins represent a significant segment of the cryptocurrency market, with a total value exceeding $170 billion. Tether’s USDT is the largest stablecoin, boasting a market capitalization of over $120 billion. Circle’s USDC is the second-largest, with coins in circulation worth more than $34 billion.

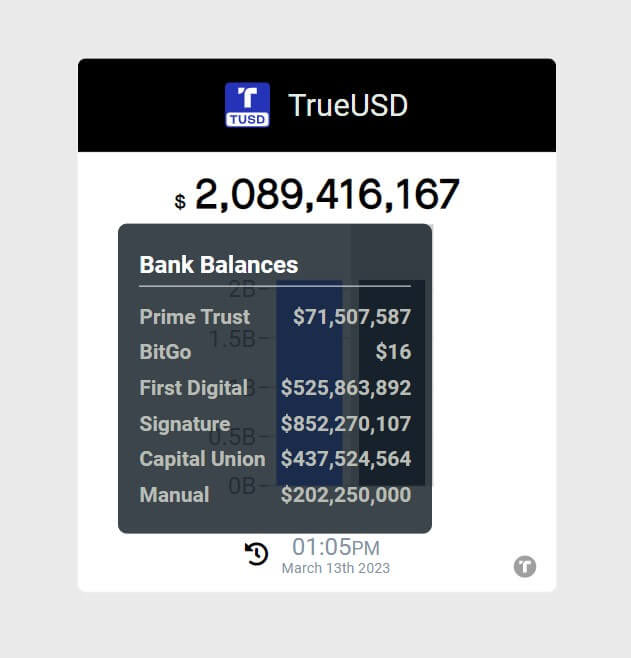

Despite their prominence, stablecoins have faced controversies. In 2022, Tether’s USDT briefly lost its $1 peg following the collapse of a rival stablecoin, terraUSD. This event raised concerns about the stability and backing of these digital assets. It’s crucial to ensure that stablecoins are fully backed by reserves for them to gain widespread acceptance. Tether asserts that dollars and dollar-equivalent assets, including government bonds, always back its coin.

Implementing robust regulations can enhance transparency and trust in the stablecoin market, protecting consumers and investors. As the UK contemplates its next steps, industry leaders like Circle hope regulations will be enacted soon. Introducing stablecoin laws could position the UK as a leader in digital finance, fostering innovation and attracting investment.

“You can’t have the economy of the future unless you have the money of the future,” Disparte concluded, emphasizing the importance of embracing digital currencies.

origin »

Bitcoin price in Telegram @btc_price_every_hour

USDx stablecoin (USDX) на Currencies.ru

|

|