2018-7-27 11:25 |

Chicago Mercantile Exchange (CME) CEO Terry Duffy revealed in an interview with Bloomberg that they will not introduce futures on cryptocurrencies other than Bitcoin in the foreseeable future.

Duffy emphasized that the company should first evaluate and develop an approach for Bitcoin, stressing that Bitcoin futures might have been the most controversial launch of a product. The CEO reiterated the company’s previous position on launching altcoin futures, having said earlier this year that listing other cryptos would be “a little irresponsible right now.”

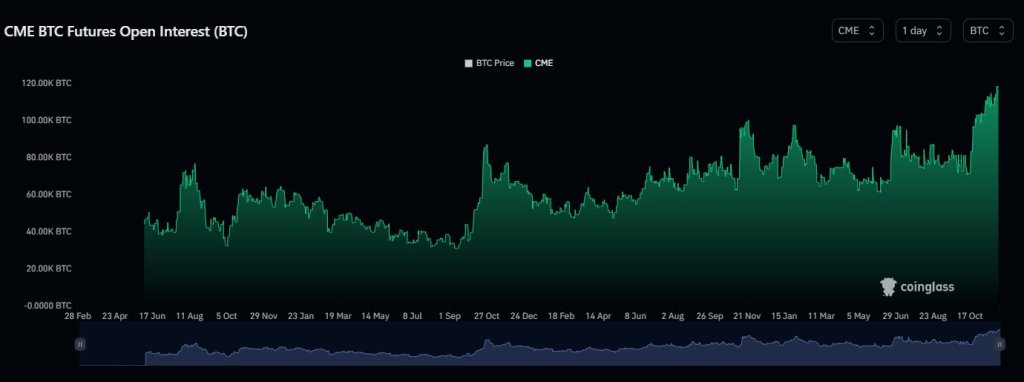

CME, the world’s largest exchange operator, started offering Bitcoin futures in December, shortly after rival Chicago exchange Cboe Global Markets Inc. CME’s contract is five times as large as Cboe’s and trading in both contracts have been relatively modest since their introduction.

Cboe has traded 5,881 contracts a day so far in 2018, beating CME’s daily average of 3,063, according to data compiled by Bloomberg. But looked at another way, CME is winning. CME’s daily average works out to 15,317 Bitcoin daily, more than double the amount at Cboe. Bitcoin futures is a sliver of CME’s business. In the second quarter, CME’s total average daily volume was 18.4 million contracts.

Just yesterday, CME reported revenue of $1.06 billion and operating income of $667 million for the second quarter of 2018. Net income was $566 million and diluted earnings per share were $1.66. On an adjusted basis, net income was $591 million and diluted earnings per share were $1.74.

Duffy said:

“With double-digit growth in five of our six asset classes, Q2 2018 was our second best quarter ever in average daily volume, following record performance in the first quarter of 2018.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|