2022-7-13 16:00 |

The bear market has left a sour taste for crypto investors, and most are worrying about the current trend in the market. Many firms are also fighting to sustain operations amid issues of insolvency, liquidity shortage, and compulsory workforce downsizing.

But even with all these issues, innovations and developments keep emerging, proving that the industry is not dead. One recent notable development is the plan to create accounts and trading services by M1 Finance.

The online brokerage company plans to expand its operations by including these two services. According to the team, the launch will likely occur in some weeks. M1 Finance has been operating since 2015, and according to them, the firm now has above $5 billion AUM (assets under management).

Related Reading | How Crypto Exchanges Are Handling The Bear Market, Bitrue CMO

M1 Finance is known to provide commission-free trading on exchange-traded funds (ETFs) and stocks. It also offers retirement accounts and plans to add users’ trading services and crypto accounts.

M1 Founder Plans For Crypto SectorThe founder and CEO of M1 Finance have explained the plans through an official blog post. Brian Barnes disclosed that the expansion aims to satisfy their customers vying for more support for digital assets.

According to Barnes, M1 customers are requesting to add crypto to the firm’s services. In addition, he pointed out that many people globally, including 20% of Americans, are already investing, trading, or using digital assets.

Moreover, in the company’s survey of its users, up to half want to use the firm’s platform to invest in cryptocurrency. That’s why M1 Finance plans to add crypto trading and accounts to enable clients to consider the digital assets class in their investment strategies long-term.

Regarding actual roll-out, Barnes disclosed that they would start with the likes of BTC and ETH plus other liquid crypto assets with large capitalization. Then after some time, the firm stated that more offerings would join these big shots. Also, the CEO mentioned that the firm aims to offer commission-free trading, just like Robinhood offers.

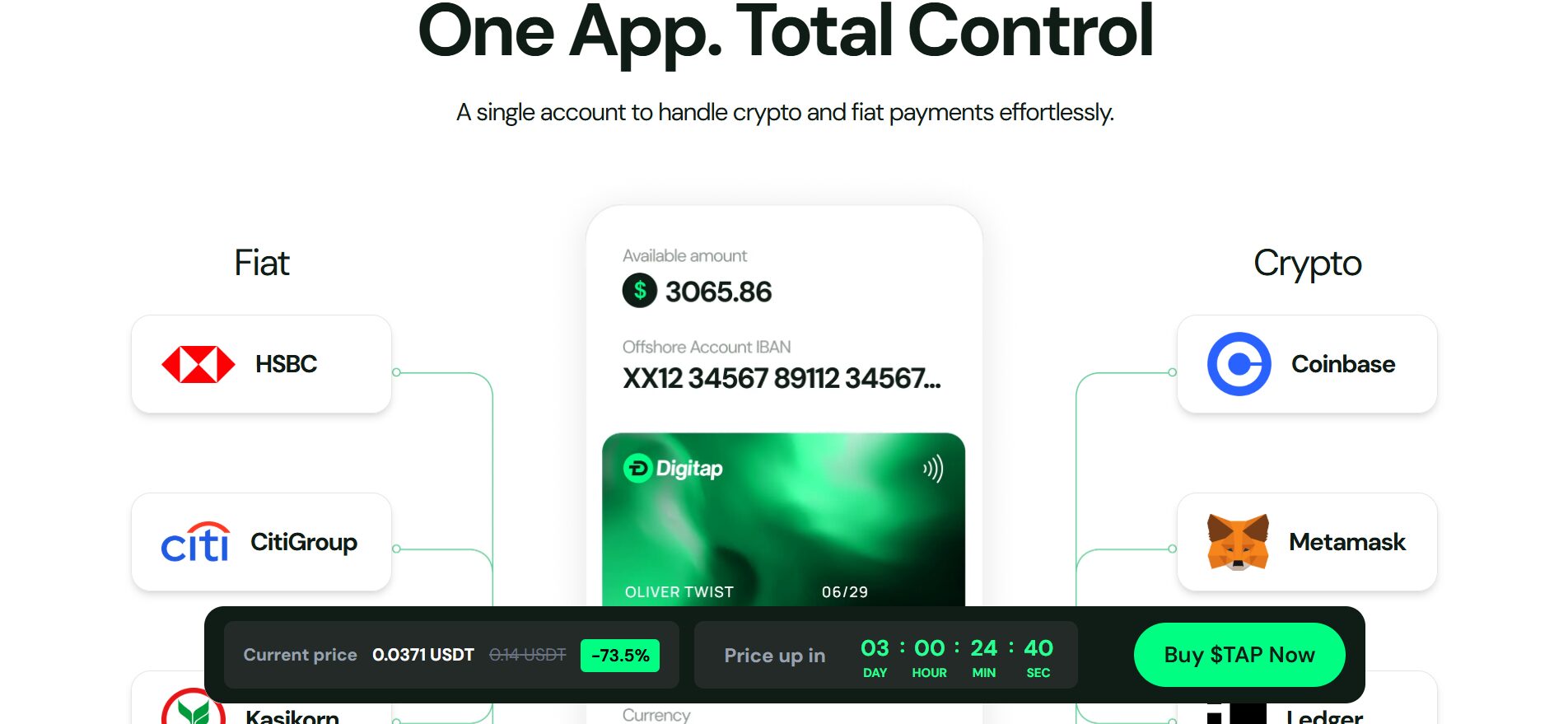

Details On M1 Finance OfferingsM1 offers many services, including the popular pie-based investing services. With this service, users can analyze every asset in their portfolio and the percentage of their exposure via a pie graph presentation. Then, they only need to create the pie-like portfolio and allow the algorithmic software on M1 Finance to balance the portions.

Apart from creating a portfolio of asset Pies, users can also utilize M1 Finance automated Pies showing different kinds of stocks for passive investment. With this latest expansion plan, the firm has disclosed that new cryptocurrency accounts will use Pie-based investing too.

Cryptocurrency market shows strong gains on daily chart | Source: Crypto Total Market Cap on TradingView.comRelated Reading | NFTs Enter A New Era As Solana Closes The Gap With Ethereum

These accounts can create their crypto portfolio matching their risk tolerance and financial goals. Users can decide to build their pies or utilize the pre-built expert Pies based on DeFi, large-cap coins, and Web3. It all depends on the user’s choice.

Featured image from UnSplash, charts from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|