2026-2-1 23:48 |

Chainlink (LINK) is showing resilience amid a broadly stagnant crypto market.

The token has posted a modest gain of 1% in the past 24 hours, outperforming the broader market movements and signalling underlying strength.

Whale accumulationWhales and strategic reserve accumulation are playing a key role in LINK’s price dynamics.

Since December 25, top wallets have withdrawn more than $8.5 million worth of LINK from exchanges, according to CryptoQuant data.

This pattern of accumulation points to confidence among large holders, suggesting a belief that the token may be undervalued.

Chainlink’s LINK reserve boostAt the same time, Chainlink’s official reserve continues to grow.

On January 29, Chainlink announced that the reserve had added 99,103 LINK, marking the largest single purchase since Q4 2025.

This brings the total reserve holdings to approximately 1.77 million LINK, representing a 377% increase year-over-year.

The accumulation is funded by revenue from on-chain service usage and institutional off-chain payments, underlining real network adoption rather than speculative activity.

Generally, the reserve growth has a dual effect on LINK’s outlook.

It reduces circulating supply, creating a potential scarcity effect.

It also signals a long-term commitment to the network, which could amplify price moves if demand picks up.

Ethereum network fees hit an all-time high of $6.8 million, showing robust usage despite a -36% year-to-date price decline.

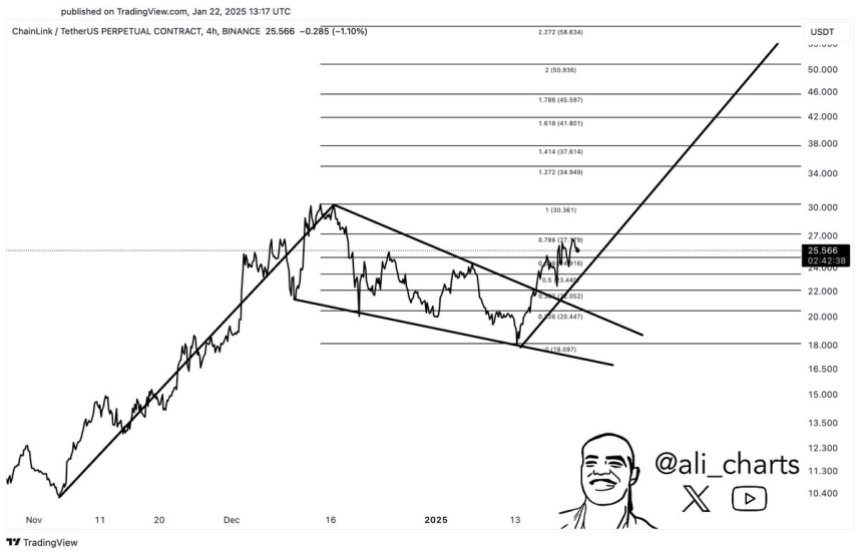

LINK price analysisFrom a technical perspective, LINK is attempting a short-term rebound.

The token has bounced from a low of $10.51 on January 30, with the Relative Strength Index (RSI) currently below 30, signalling oversold conditions.

Chainlink price chart | Source: TradingViewWhile the MACD histogram is currently bearish, the main and signal lines suggest a possible bullish crossover, though the token remains below key resistance at $12.06, which corresponds to the 38.2% Fibonacci retracement level.

Liquidity remains moderate, with a turnover rate of 7.6%, sufficient to support short-term moves but highlighting caution for larger spikes.

Chainlink price forecastTraders should closely monitor the $10.80 support level.

Holding above this level may allow LINK to target the first resistance at $12.25.

Breaking through $12.25 could open the way to $13.22, followed by a third resistance at $14.28.

If the $10.80 support fails, analysts warn that the next level to watch is $9.51, which could act as a strong floor for potential downside.

Short-term recovery hinges on a close above $12.60, corresponding to the 50% Fibonacci retracement, while holding $11.59 will be crucial to avoid further losses.

Sustained reserve growth, whale accumulation, and fee revenue trends will continue to be the key fundamentals shaping LINK’s price trajectory even as institutional adoption remains a mixed factor.

LINK’s inclusion in CME futures and Grayscale/Bitwise ETPs has expanded access for investors.

However, ETF inflows remain modest, totalling only $1.4 million on January 29, indicating continued caution among traditional financial players.

Traders should watch for the launch of CME ADA futures on February 9 for potential spillover effects that could influence LINK’s momentum.

The post Chainlink price analysis: reserve growth and whale accumulation shape LINK outlook appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|