2019-6-30 02:24 |

Chainlink Literally Moons in Bizarre Upswing

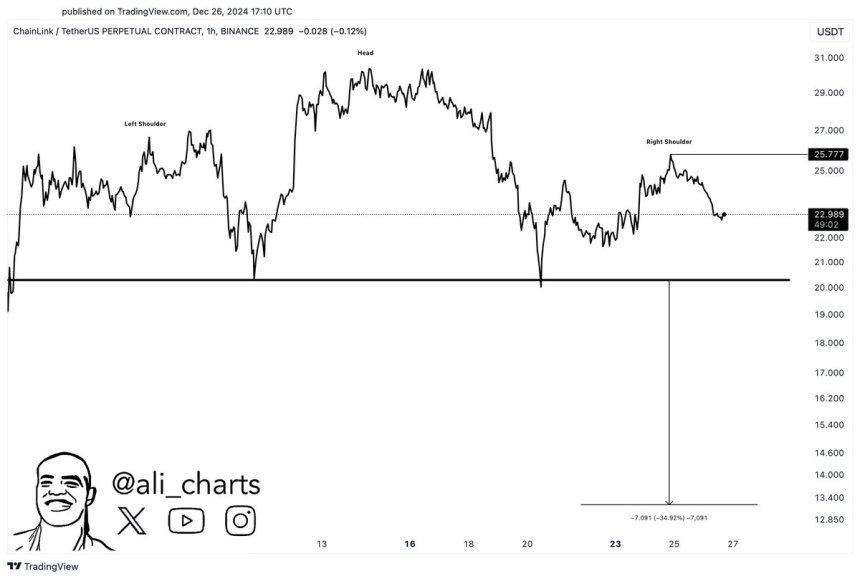

Bitcoin (BTC) may have stuttered this week, but Chainlink (LINK) sure isn’t. While the leading cryptocurrency rallied by 20% to only fall by $3,000 the next day, LINK, a top Ethereum-based token, has rallied by 137% in the past seven days according to Messari’s OnChainFX. With this move, the cryptocurrency has entered the top 16, which is a far cry from where it was during the last market boom. The chart below sums up the asset’s performance rather well.

While LINK may be looking much like any random “pump and dump” coin, there has been an array of positive news for the cryptocurrency as of late. This may be the one time in this cycle that news has directly led to price action in a large-cap cryptocurrency.

As of the time of writing this article, LINK is up 50% in the past 24 hours, finding itself at $4.20. During the same time period, Bitcoin lost 2%, accentuating the craziness of the Ethereum token’s crazy swing to the upside.

Here are a few tidbits of news regarding the asset class.

Reasons for LINK’s Jaw-Dropping SurgeFirstly, Google, yes the Google, announced last week that it would be integrating the asset and technology into its Cloud services. In a blog post titled “Building hybrid blockchain/cloud applications with Ethereum and Google Cloud”, the Silicon Valley giant revealed that it would allow for

Chainlink, and thus Ethereum smart contracts, to interact with BigQuery, Google’s data analyzer and portal. What this does is allows for developers to build decentralized applications that can harness Google, theoretically improving the efficiency and viability of smart contracts. As a Cloud developer concludes:

“We’ve demonstrated how to use Chainlink services to provide data from the BigQuery crypto public datasets on-chain. This technique can be used to reduce inefficiencies (submarine sends use case) and in some cases add entirely new capabilities (hedging use case) to Ethereum smart contracts, enabling new on-chain business models to emerge.”

For those unaware, Chainlink’s claim to fame is its so-called “oracle” system, which is a recently-launched product meant to improve processes on something like Ethereum. For instance, if someone is betting on a real-world financial scenario with the Ethereum-centric Augur, an oracle can be used to make the outcome verification process much easier. Google later name dropped Chainlink in a Youtube video. This mainstream support is important, especially in an industry where startups announce countless fraudulent, misguided partnerships.

Secondly, technology giant Oracle, the third biggest software company, has revealed that it will be using Chainlink technologies. It isn’t clear how exactly the company will be using the startup’s technology, but it surely won’t hurt its budding ecosystem.

Thirdly, Coinbase recently unveiled support for Chainlink for both Coinbase Pro and Coinbase.com, which gives U.S. investors a regulated onramp into LINK, which will likely be integral once Binance leaves the U.S. This is important than more reasons than just a listing. You see, earlier this year, Coinbase announced intentions to support staking for cryptocurrencies. With the Chainlink Network involving staking-enabled nodes, institutional investors that use Coinbase’s custody platform may begin to take further interest in LINK, which can create passive income in an investor’s portfolio.

Photo by Tim Mossholder on UnsplashThe post Chainlink (LINK) Surges 137% on the Week as Coinbase, Google, Oracle News Activates FOMO appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|