2020-7-11 18:33 |

Demand for Chainlink skyrocketed following the weekly candlestick open. As buy orders began to pile up, the decentralized oracles token saw its price rise by 38.5%. LINK surged from $4.75 to reach a new all-time high of $6.60.

Despite the substantial upswing, investors seem to have taken advantage of the price action to take profits. Data from IntoTheBlock reveals that around the peak, nearly 3,800 addresses had transferred out all of the tokens they held.

The increasing selling pressure pushed Chainlink down by 12.30% to a low of $5.70.

Investors Sell Their LINK Tokens As Its Price Reaches All-Time Highs. (Source: IntoTheBlock)While investors seem to “fear” a further price slump, multiple indexes suggest that Chainlink is poised to rebound.

Chainlink Prepares to Resume the UptrendBased on LINK’s 4-hour chart, the Tom Demark (TD) Sequential indicator will likely present a buy signal in the form of a red nine candlestick. Although this cryptocurrency may still have some room to go down and test the setup trendline at $5.60, the odds for an upswing are increasing.

A spike demand for Chainlink might help validate the bullish outlook. If this were to happen, the TD setup forecasts that LINK could surge for one to four candlesticks or begin a new upward countdown.

The TD Setup May Present a Buy Signal For Chainlink. (Source: TradingView)IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that in the event of an upswing, this altcoin could rise to $6 since there isn’t any major supply barrier in-between. But the 34 addresses holding 1 million LINK around this price level may prevent it from higher highs.

These holders would likely try to break even in their long-positions, and the selling pressure generated by them could be significant enough to send Chainlink back down.

The Most Critical Resistance Ahead of Chainlink Sits at $6. (Source: IntoTheBlock)On the flip side, the IOMAP cohorts show that one of the most significant support levels underneath this cryptocurrency sits around $5.60, which is also where the setup trendline sits. Here, roughly 1,800 addresses had previously purchased 1.10 million LINK. Such a massive supply wall could hold and prevent a further decline.

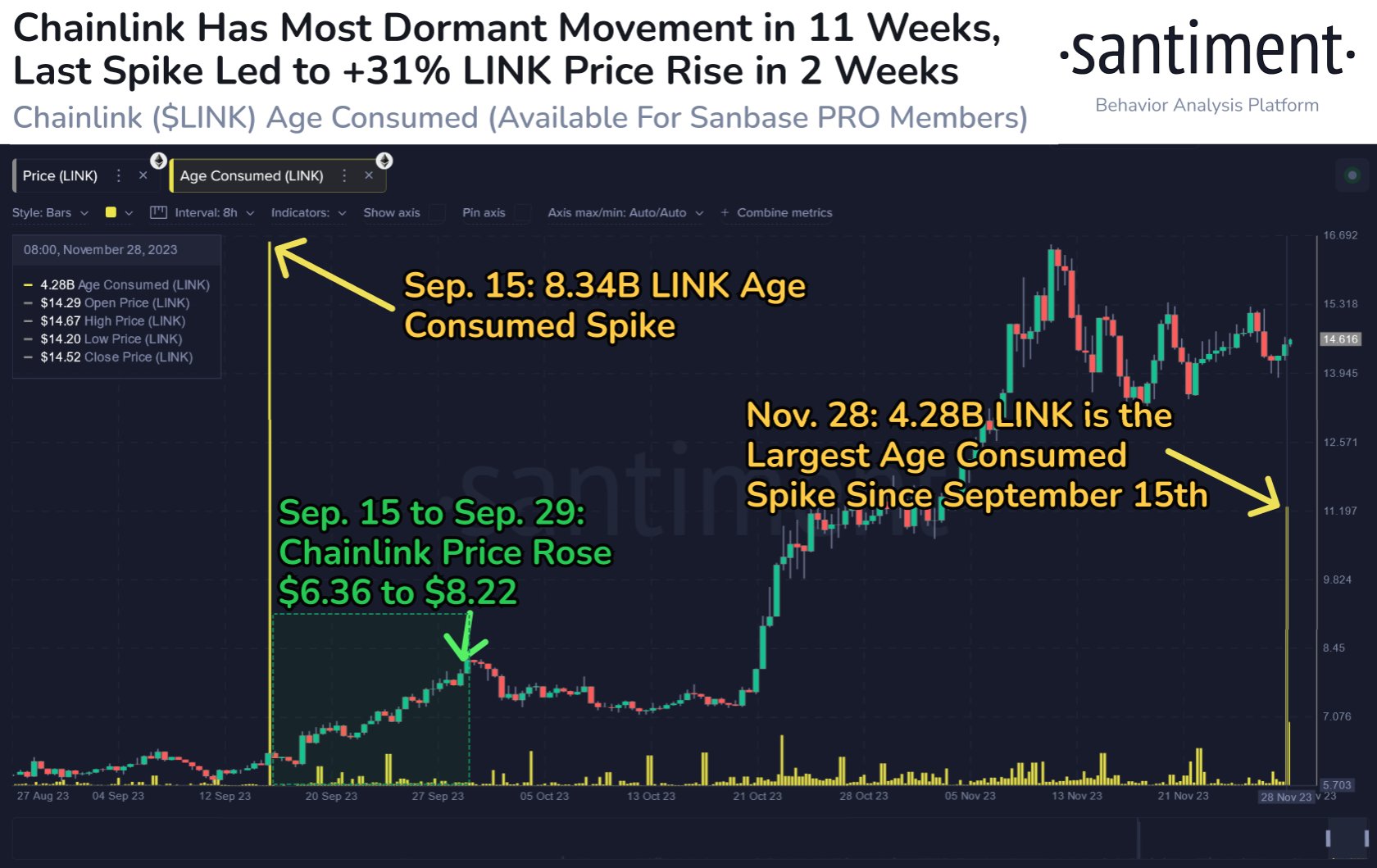

On-Chain Metrics Remain BullishThe behavior analytics platform, Santiment, has repeatedly stated that on-chain volume, along with daily active addresses and social volume, is a “great triple thread to track.” These fundamental gauges can help determine whether a given cryptocurrency is poised to continue its upside momentum.

A look at Chainlink’s on-chain and social volume, as well as the number of daily active addresses, reveal that these metrics have been trending up for over the past month. If the positive movements continue, sooner rather than later it would be reflected LINK’s price once the retracement is over.

Chainlink's Daily Active Addresses and On-Chain/Social Volume. (Source: Santiment)Sidelined investors might take advantage of the current price levels to re-enter the market. Nonetheless, a break of the $5.60 support level would likely translate into more losses for the decentralized oracles token.

Featured Image by Shutterstock Price tags: linkusd, linkbtc Chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

High Voltage (HVCO) на Currencies.ru

|

|