2019-2-18 22:14 |

Cryptocurrency Exchanges And Related Businesses Must Create A Self-Regulatory Organization – Says CFTC Commissioner

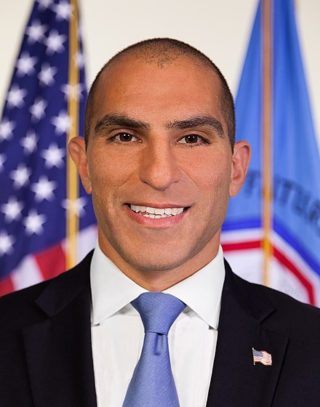

While the United States regulators are still trying to come up with amenable guidelines to govern the crypto industry, the United States Commodity and Futures Trading Commission (CFTC) commissioner, Brian Quintenz has reportedly urged firms and stakeholders in the cryptospace to establish a self-regulatory body that would govern digital assets market participants, according to reports on February 18, 2019.

Cryptocurrency Self-Regulatory Structure necessaryPresent at the Bipartisan Policy Center panel organized on February 12, 2019, CFTC commissioner, Brian Quintenz stated that since the CFTC is yet to implement robust guidelines for the U.S distributed ledger technology (DLT) and virtual currency industry, it has become essential for crypto-focused organizations to come together and form a self-regulatory organization.

According to the official, the primary objective of the self-regulatory organization would be to “discuss, agree to, implement, examine or audit,” the crypto ecosystem.

In other words, Quintenz has pointed out that some of the duties of the self-regulatory body would be to guard against malpractices in the cryptocurrency industry, including insider trading while also carrying out audits concerning conflicts of interest, custody, liquidity and more.

Self-Regulatory Organizations Are ConstitutionalMore importantly, the CFTC commissioner also reportedly made it clear that “a self-regulatory platform is specifically chartered by the U.S. Congress through the law,” although the body will only function as a mutual association by private market participants in the crypto industry.

In the same vein, the U.S. Securities and Exchange Commission (SEC) commissioner, Hester Peirce who was also a member of the panel, reportedly noted that the current regulatory state of the crypto assets space remains quite “confusing.”

At a time when the Bitcoin Exchange Traded Fund (ETF) filing of a significant number of highly reputed firms in the cryptosphere, including VanEck SolidX have been rejected by the regulators citing the seemingly unregulated nature of the industry, Pierce has condemned the decision of the SEC.

In her words:

“There are numerous markets that are not regulated, yet we build derivative products upon them.”

It's worth noting that this is not the first time that Peirce is showing strong support for bitcoin and other blockchain-based digital assets.

As reported by Bitcoin Exchange Guide in August 2018, the Commissioner urged the U.S regulators to soften their stance as regards cryptocurrency regulation.

“Apparently, bitcoin is not ripe enough, respectable enough, or regulated enough to be worthy of our markets. I dissent,” tweeted Peirce earlier in July 2018.

In related news, on February 13, 2019, Bitcoin Exchange Guide informed that Peirce had made it clear that the outdated rules of the SEC could make the launch a Bitcoin ETF impossible this year.

Bitcoin (BTC), Ethereum (ETH), XRP (Ripple), and BCH Price Analysis Watch (Feb 18th)

origin »Bitcoin price in Telegram @btc_price_every_hour

United Bitcoin (UBTC) на Currencies.ru

|

|