2023-6-7 21:42 |

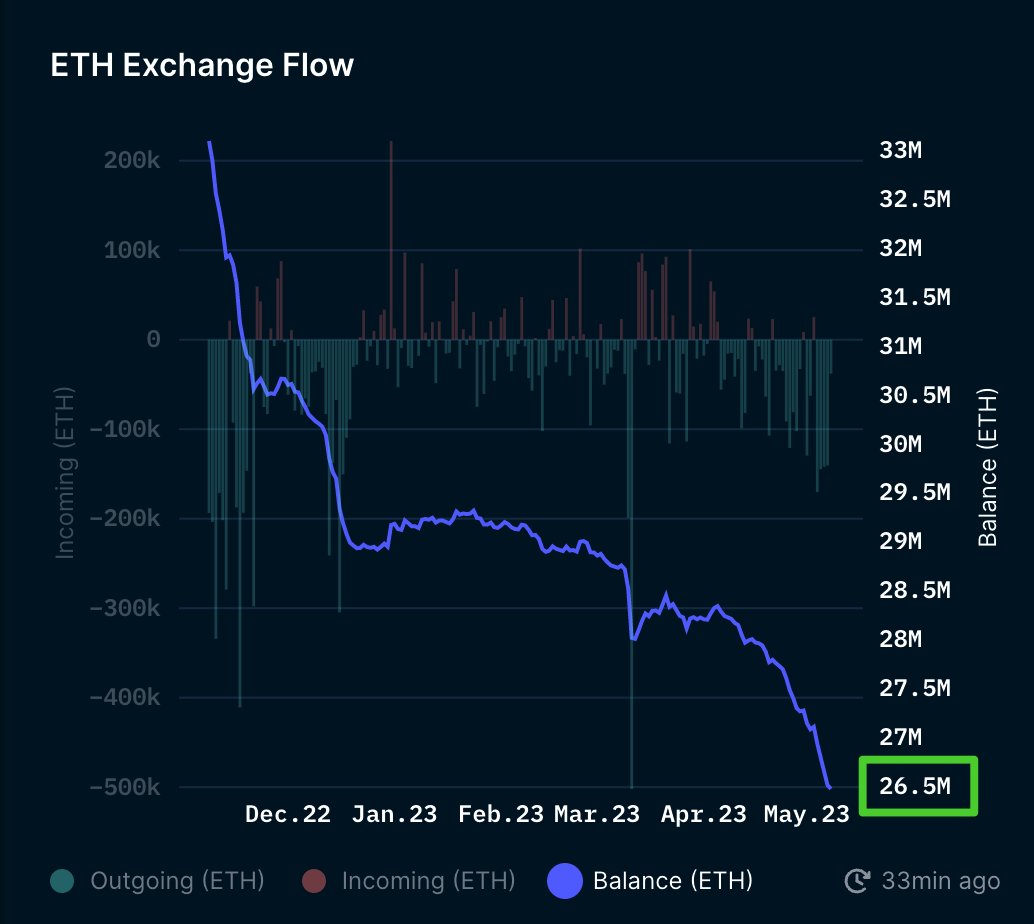

According to blockchain data, centralized exchange volumes have fallen to an all-time low, with DEXs rising in popularity in the cryptocurrency market. The numbers show trading activity on centralized exchanges is declining and has reached its lowest point since October 2020.

The general sluggish market circumstances, the exit of well-known companies like Jane Street and Jump owing to regulatory worries, and the rise of decentralized exchanges with meme coin trading are some of the causes of this decline.

Decentralized exchanges are taking advantage of the rising need for better privacy and quicker asset listing. As centralized exchanges see a decrease, decentralized exchanges (DEXs) have seen substantial growth.

By enabling direct peer-to-peer trading, these blockchain-based platforms provide improved security, anonymity, and control over funds. According to recent statistics from Dune, an on-chain analytics company, May has seen a noticeable surge in user activity on various decentralized finance (DeFi) platforms in May 2023. This increase in user numbers highlights the growing acceptance and popularity of DEXs in the crypto industry and is similar to the peak levels seen during the bullish market era in 2021.

Meanwhile, major cryptocurrency exchange Kraken has been having problems with its crypto gateway and delays in the deposit and withdrawal processes. Frustrated users have reported having trouble accessing their money. Delays and gateway issues are viewed as potential roadblocks for investors and traders using the Kraken platform, raising questions about its dependability and effectiveness.

Further on the legal front, a global emergency order to freeze Binance.US assets has been requested by the U.S. Securities and Exchange Commission (SEC). The SEC’s action is part of a case now being litigated against the crypto exchange.

The development underscores the possible impact on Binance.US’s activities and assets and the increased regulatory scrutiny it is currently subject to. The development shows the importance of this regulatory action and the SEC’s efforts to impose control over Binance.US and its operations outside of the United States.

The agency claimed that the emergency restraining order was required to “prevent the dissipation of available assets for any judgment, given the Defendants’ years of violative conduct, disregard of the laws of the United States.”

Changpeng Zhao, the founder of Binance, is also required under the ruling to “show cause why a preliminary injunction” against him and two holding companies “should not be entered.”

The action follows the SEC’s lawsuit against Binance and Zhao earlier this week, claiming that CZ and the exchange conspired to inappropriately combine money, deceive investors, and act as an unregistered broker, dealer, and clearing house.

origin »Bitcoin price in Telegram @btc_price_every_hour

Safe Exchange Coin (SAFEX) на Currencies.ru

|

|