2023-11-4 07:05 |

Bitcoin (BTC) price has been one of the best-performing financial assets this year. The coin surged to a high of $35,978 on Thursday, a 132% increase from the lowest point in December last year. It has outperformed other financial assets like gold, bonds, equities, and commodities.

Bitcoin’s surge has attracted mixed reactions from some of the best commentators in the industry. While some analysts believe that Bitcoin has more room to run, others suspect that the price will retreat in the coming months.

Michael Saylor, the Chairman of MicroStrategy (MSTR), made the case that Bitcoin price could continue surging in the long term. And he is putting his money where his mouth is as MicroStrategy continues buying BTC. The company bought 6,067 Bitcoins in the third quarter in a $167 million deal. It now holds 158,400 bitcoins worth over $4.69 billion.

Watch here: https://www.youtube.com/embed/l-N1Mb3xTi8?feature=oembedIn an interview with CNBC, Saylor explained why he believes in Bitcoin. First, he cited the ongoing shift to BTC from institutional investors. Big companies like Blackrock, Invesco, Franklin Templeton, and Ark Invest have all applied for a spot Bitcoin ETF.

Second, he believes that demand for Bitcoin will continue rising in the coming months as institutional investors come in. The implication is that these companies will buy more coins, which are getting quite rare. As a result, this trend will lead to higher prices.

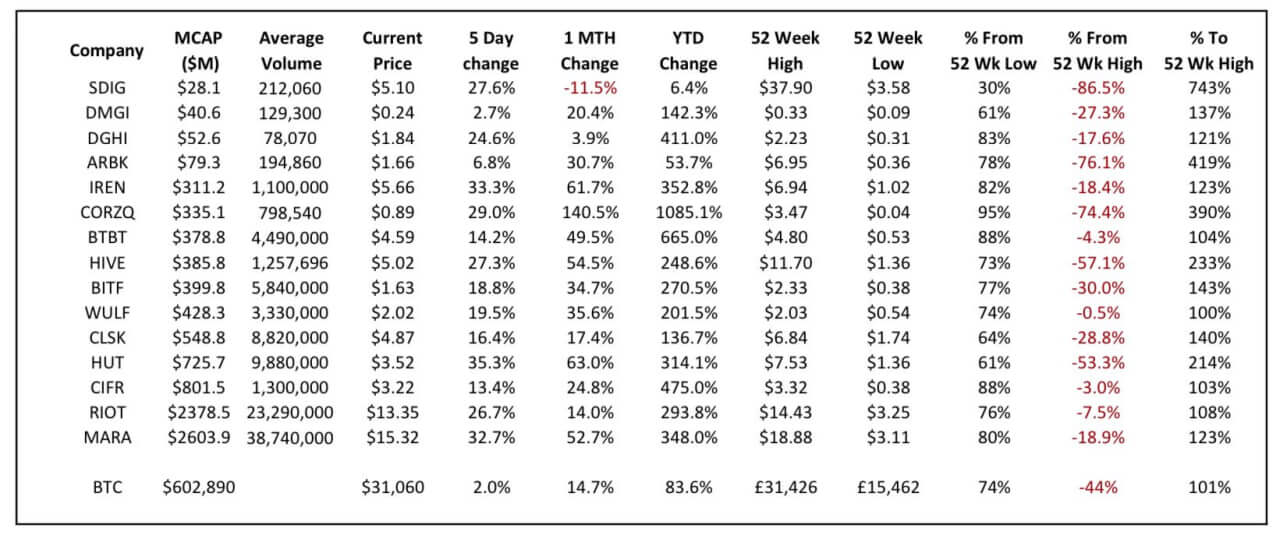

The most recent data shows that the amount of Bitcoin sitting in exchanges has plunged. Therefore, these companies will need to buy their coins from miners like Riot Platforms, Marathon Digital, and Hut 8 Mining. Third, the upcoming Bitcoin halving will slow Bitcoin production drastically.

Meanwhile, Cathie Wood, the head of Ark Invest, argued that Bitcoin is the digital equivalent to gold. She believes that Bitcoin price could surge to $1 million in the next decade. She said:

“Bitcoin, hands down. Bitcoin is a hedge against both inflation and deflation because there’s no counterparty risk, and institutions are barely involved. It’s “digital gold.”

Not all analysts are convinced. Peter Schiff, who is a well-known gold bull, believes that Bitcoin’s future is quite bleak. He has recently criticised Bitcoin and the Grayscale Bitcoin Trust (GBTC).

All of you #Bitcoin HODLers making fun of my posts should be selling your Bitcoin instead. You can always buy it back much cheaper if you really want to. This sucker's rally is a gift. Take advantage of the opportunity while you can. If you don't you'll be kicking yourself later.

— Peter Schiff (@PeterSchiff) October 24, 2023Peter Schiff’s Bitcoin criticism should be taken with a grain of salt since he runs Schiff Gold, a company that deals with gold.

Still, I believe that Bitcoin has more room to run in the long term. For one, the coin has survived some of the biggest disasters of the last decade. It thrived after the collapse of Mt. Gox, FTX, Terra, Voyager Digital, and Celsius.

Most importantly, Bitcoin has thrived in the ongoing phase of interest rate hikes. The Fed has hiked rates from zero in 2022 to between 5.25% and 5.50%. In the past, the argument among Bitcoin bears was that Bitcoin would crash as interest rates jumped.

The post Cathie Wood, Michael Saylor, Peter Schiff debate the future of Bitcoin appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

New Year Bull (NYB) на Currencies.ru

|

|