2025-1-10 14:30 |

Cardano’s ADA led losses among crypto majors Thursday as bitcoin weakness showed no signs of stopping, pausing any chances of a rally in altcoins.

Bitcoin (BTC) slipped to nearly $93,000 on Wednesday as fresh economic data sent U.S. treasury yields soaring, leading to a fall in equities. The latest Institute for Supply Management (ISM) report on U.S. service providers was stronger than anticipated, with the prices-paid measure reaching its highest point since early 2023.

This sent other majors spiraling downward. Token prices have been flat over the past week as traders took profits on a short-lived rally earlier in the week, with ADA, Solana’s SOL, BNB Chain (BNB) and ether (ETH) down nearly 10% since Monday.

The broader CoinDesk 20 (CD20), a liquid index tracking the largest tokens, is down 2.87% in the past 24 hours, an additional decline after Wednesday’s 7% plunge.

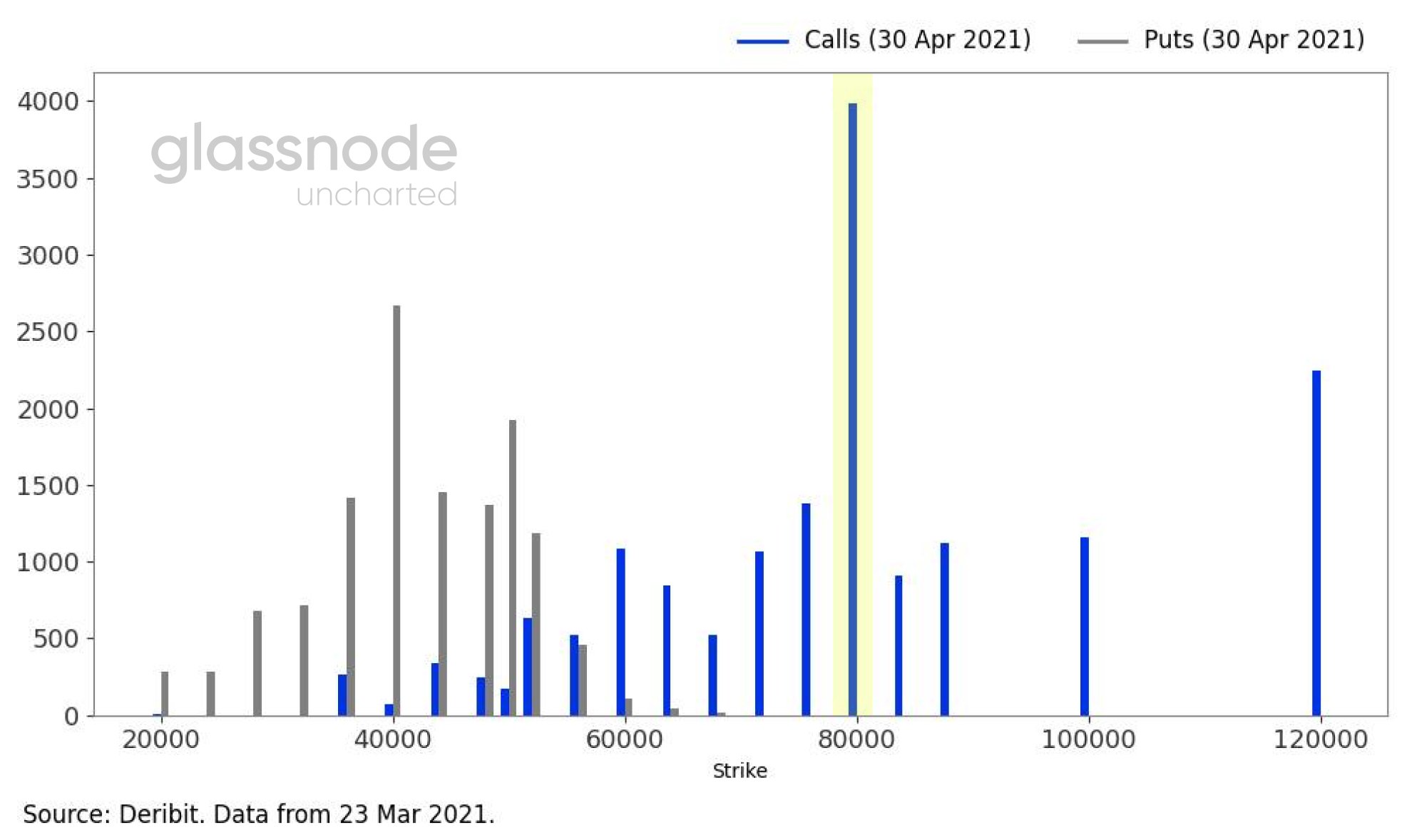

Meanwhile, options on the broad-based S&P 500 now reflect greater downside risk than they did a year ago — which may further dampen chances of an uptick in risk assets, including bitcoin, as traders prefer safer investments such as bonds.

The defensive positioning in stocks perhaps stems from concerns that President-elect Donald Trump's Jan. 20 inauguration could be a "sell-the-news" event, per CoinDesk’s Omkar Godbole. Risk-taking has picked up across financial markets in the past two months in anticipation of pro-corporate and pro-economy reforms under the incoming Donald Trump's presidency, and profit-taking cannot be ruled out.

Trump’s inauguration on Jan.20 is widely expected to shift crypto regulations and even a strategic bitcoin reserve in the coming months, both months that provide legs for the next rally.

It’s a view mirrored by Singapore-based QCP Capital, which says traders should keep an eye for new U.S. economic data on Friday before further positioning.

“All eyes are on this week's FOMC and NFP releases, which are expected to further influence Bitcoin's price trajectory,” QCP said in a Thursday market broadcast on Telegram. “With market anticipation building, we believe Bitcoin's pullback is merely a pause, setting the stage for a bullish rally as Trump's inauguration fuels optimism.”

The NFP is a monthly report that provides insights into job creation or loss in the U.S., excluding farm jobs, reflecting the economy's health. Strong NFP numbers indicate a robust economy, hinting at possible interest rate hikes, which tends to be bad for risk assets such as bitcoin. Poor NFP figures suggest that rates will remain low or decrease, benefiting risk assets.

origin »

Bitcoin price in Telegram @btc_price_every_hour

Cardano (ADA) на Currencies.ru

|

|