2020-8-17 12:21 |

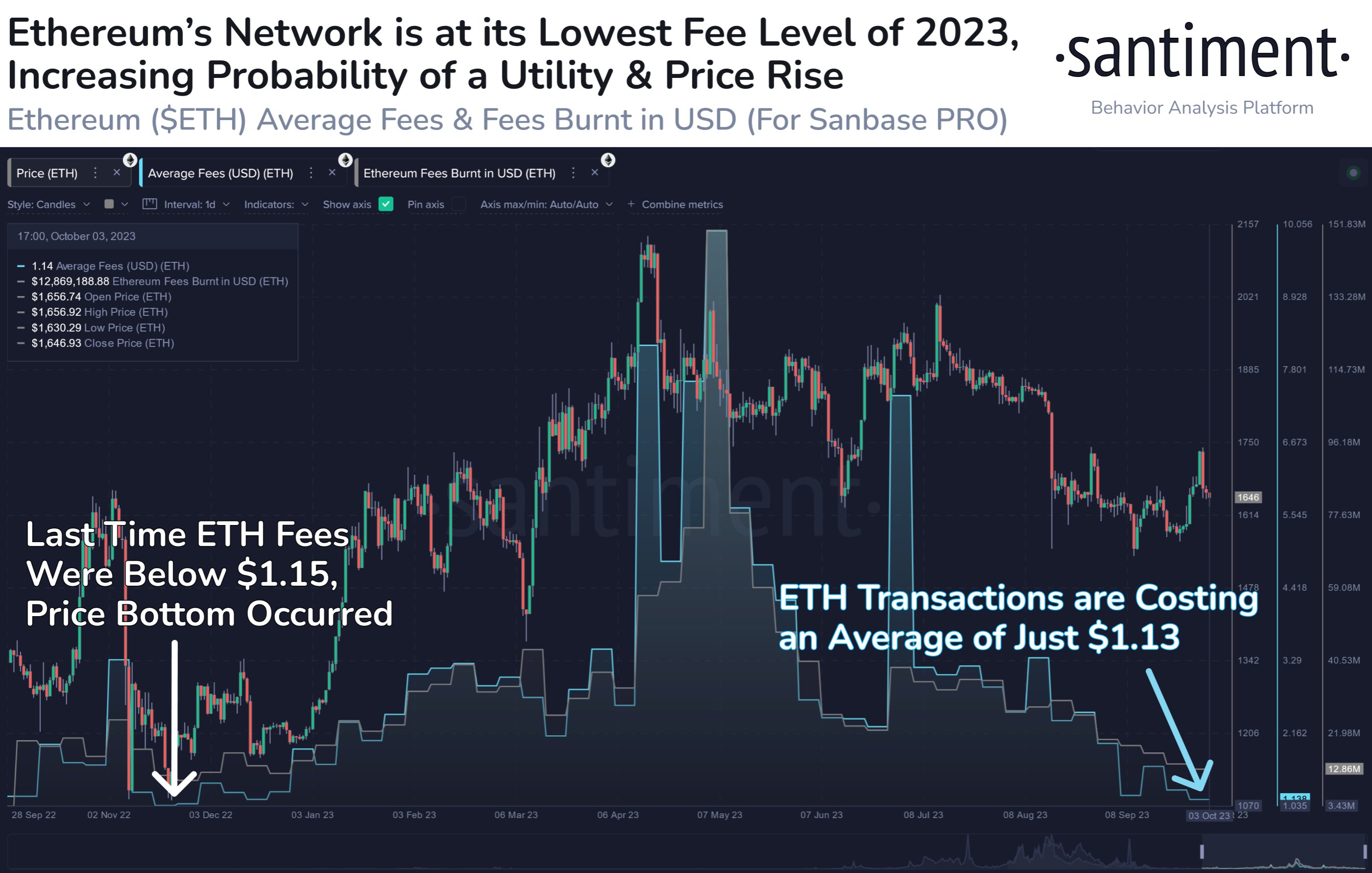

Ethereum’s network fees are increasingly becoming a major concern and more people are wary of paying ridiculous fees to transact on the network. The amount of gas being spent on Ethereum has reached an all-time high with a daily average of $6.8 million going to fees, according to data by glassnode.

Etherscan currently recommends a gas price of 350 gwei for a 20-second transaction waiting time, meaning that people are paying as much as $50 dollars to process transactions on Ethereum.

A certain and evidently tired blockchain and crypto enthusiast is now calling on Cardano’s Charles Hoskinson to launch smart contracts and native assets faster so that all the DeFi business on Ethereum can be ported to Cardano.

“$ETH fees are RIDICULOUS. The sooner we can start porting DeFi apps across from Ethereum over to #Cardano the better. Now is our opportunity to strike @IOHK_Charles. Imagine $ADA adoption if consumers have an alternative to paying up to$50 per transaction using ETH.”

Hoskinson who’s also Ethereum’s cofounder agrees with this sentiment, implying that such high fees are not feasible and Cardano will take care of it.

“I can’t imagine it, which is why I built Cardano.”

ETH Fees Will Keep Surging With Increasing Network ActivityThe gas price on Ethereum is measured in ether subunits known as gwei. While each transaction needs to pay a gas fee to be processed, miners often have a lot of say on what the gas should be.

In times of high network activity, miners can “motivate” people into paying a higher transaction fee to have their transactions processed faster.

Increased wallet addresses and DeFi activity have been triggering higher gas on the Ethereum network and although the Ethereum community is happy with surging ETH prices, transacting on the network is also increasingly becoming unsustainable.

Data from Blockchair has charted all-time high eth gas prices for the past three months which has also raised tonnes of complaints from people wishing they didn’t have to spend as much as they did while transacting on Ethereum.

“tbh spent more on $ETH tx fees in the past 3 months that I’ve spent on bank service charge over my entire lifetime.”

Transaction fees are only going to get worse with increasing DeFi activity and while ETH 2.0 will try and address this issue, some feel that it may be time to dethrone Ethereum with better and already available solutions.

“I’ve changed my mind after using a dozen of DeFi platforms. So long as ETH 2.0 is not fully rolled out, there’s an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|