2020-9-17 10:19 |

The hype around Cardano’s staking rewards continues to fade, as multiple technical and on-chain metrics struggle to hold up inflated ADA prices.

Bumpy Road Ahead of CardanoCardano suffered a significant correction following Shelley’s mainnet launch in late July.

Since then, ADA’s price dropped over 45% to reach a low of $0.085 recently. Despite the significant losses incurred, different technical and on-chain metrics suggest that the smart contracts’ token has more room to fall.

For instance, when looking at its 4-hour chart, ADA appears to have broken out of a symmetrical triangle in a downward direction. The distance between the initial high and low of this technical pattern forecasts that the so-called “Ethereum killer” could plummet another 10%.

Under such circumstances, a further increase in the selling pressure behind ADA might see prices make a lower low of $0.080.

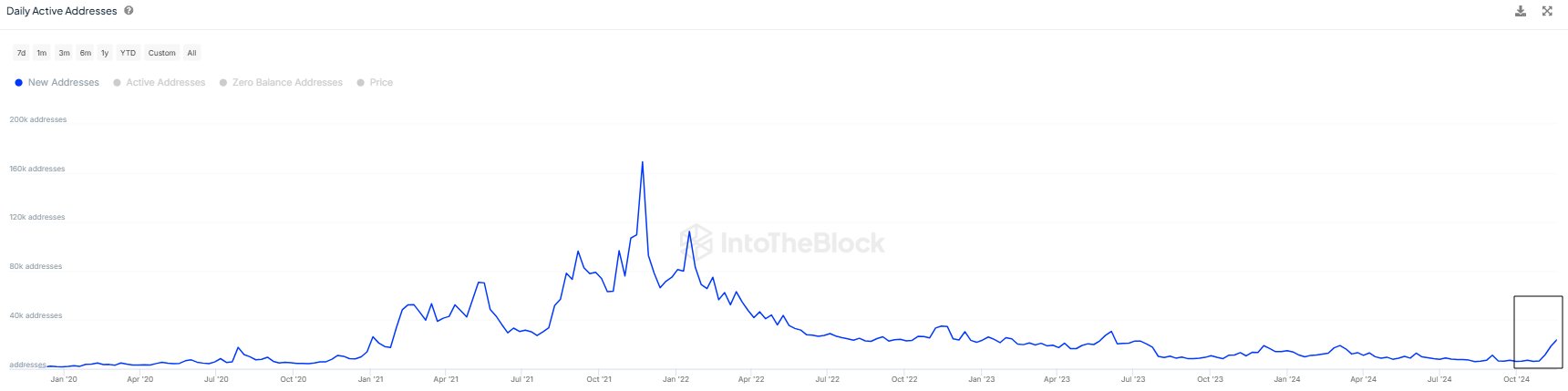

ADA/USD on TradingViewThe downward trend in network growth adds credence to the bearish outlook. Since Sept. 3, the number of new daily ADA addresses has steadily declined. Roughly 11,000 addresses were joining the network daily around that time.

This number has dropped to 4,600 a day, representing more than a 58% drop.

The downward trend in network growth is a red flag for price growth in the near future. Usually, a sustained decline in network growth is a leading indicator of deteriorating prices. The lack of newly-created addresses tends to affect the regular inflow and outflow of tokens in the network, and hence liquidity.

Cardano’s New Daily Addresses by IntoTheBlockIn the event of a steeper decline, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model estimates that there are not any significant supply barriers underneath Cardano. Given the lack of support walls, ADA could be on its way down to reach the target presented by the symmetrical triangle previously mentioned.

In/Out of the Money Around Price by IntoTheBlockThat said, the bullish outlook cannot be taken out of the question due to the cryptocurrency market’s unpredictability.

The IOMAP cohorts show that if buy orders begin to pile up, Cardano bulls may have difficulty pushing prices above $0.096. Here, approximately 22,000 addresses had previously purchased over 2.4 billion ADA.

These holders are likely more inclined to exit their currently underwater positions as prices rise, keeping an advance at bay. Therefore, it will take an enormous amount of buying pressure to send prices higher.

Given these numbers, the odds currently favor a pessimistic short-term outlook on ADA.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cardano (ADA) на Currencies.ru

|

|