2021-7-10 01:08 |

Cardano, the fifth-largest cryptocurrency by market cap, after not doing so badly in Q1 and Q2 of 2021, seems to be positioning itself to be the best performing asset of Q3, 2021.

The open-source project founded in 2015 by the co-founder of Ethereum, Charles Hoskinson, has also received a significant boost with its inclusion to Grayscale Digital Large Cap Fund (GDLC) – one of Grayscale Investments’ cryptocurrency investment funds.

A recent report notes that the fund rebalanced its books, by selling off some of its other holdings, and has reinvested the returns to add Cardano’s ADA to the investment portfolio. As of July 1, each share of the fund comprised 4.26% of ADA; Bitcoin (67.47%) and Ether (25.39%) still comprise the lion share of the investment portfolio, ADA is third-placed.

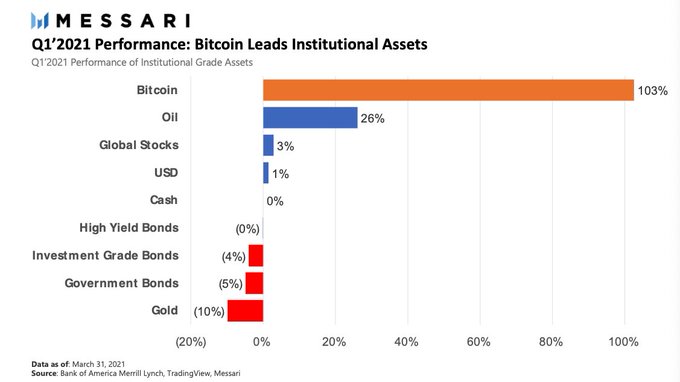

ADAUSD Chart By TradingviewNotably, the year-to-date performance of Cardano in the crypto market shows that the asset is up 570% with the price hovering around $1.40 currently, it has outperformed both Bitcoin and Ethereum which are up 98%, and 144%, respectively year to date.

Similarly, Grayscale investment funds have seen large success this year. They have been one of the de-facto investment instruments of investors looking to dip their hands in crypto investments without the risk of actually purchasing and holding cryptocurrencies.

Its GDLC fund currently boasts of having over $348.9 million of assets under management and has grown 310.24% in the last 12 months. Grayscale also has other products it offers to investors including Grayscale Bitcoin Trust Fund (GBTC) which recently announced it would begin the unlocking of its shares that is backed by about 41,000 Bitcoins.

Additionally, another reason that the proof-of-stake network Cardano may be positioning for a stellar performance in quarter three of 2021 is the recent announcement of the launch of the long-awaited smart contracts platform called Alonzo in testnets. With the upgrade set to reach mainnet later this year, a record-breaking $30 billion worth of ADA has already been staked. This figure makes ADA the most capitalized cryptocurrency by staked value, beating Ethereum’s $13 billion.

The development indicates that investors remain bullish on the cryptocurrency. ADA is currently trading at $1.350, up 2.5% in the last 24 hours.

The new development involving the GDLC fund addition of Cardano as the third-largest asset has been met by multiple reactions in the crypto market. Observers have noted that the move is a strategic one for both Grayscale Investments and Cardano network. With the Alonzo smart contracts platform set to reach the mainnet of the network in about ninety days, investors are bound to earn massive returns from both staking their ADA and investing in cryptocurrencies via the GDLC fund.

origin »pxUSD Synthetic USD Expiring 1 April 2021 (PXUSD_MAR2021) на Currencies.ru

|

|