2024-9-14 01:00 |

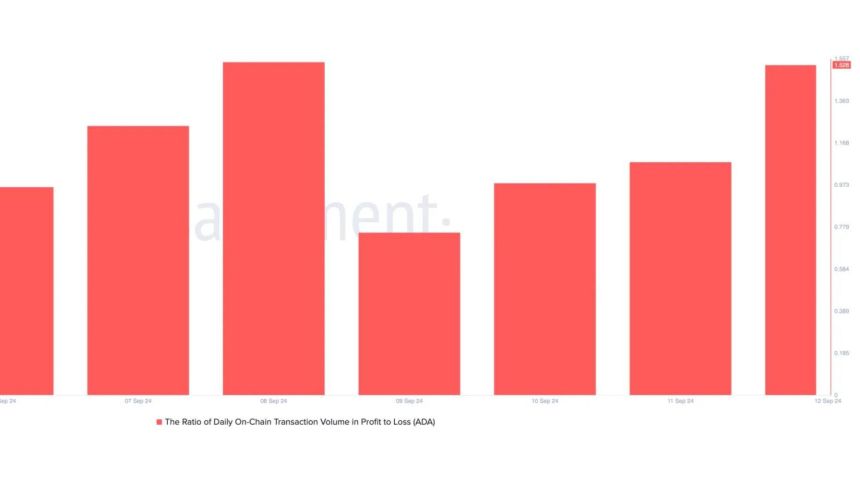

Cardano has surged over 10%, breaking a key resistance level, and is now testing higher prices. Despite the bullish momentum, on-chain data reveals that long-term holders are beginning to take profits. The ratio of daily on-chain transactions in profit to loss has turned positive, suggesting that many investors are capitalizing on recent gains.

As the market continues to evolve, ADA strives to maintain its uptrend, buoyed by positive sentiment and growing optimism for further price recovery. However, this profit-taking activity indicates that some investors are cautiously locking in gains, potentially leading to short-term price volatility.

With high expectations for a continued rally in the coming weeks, investors are closely watching ADA’s performance to see if it can sustain its momentum. The next few days will be critical for confirming whether Cardano can hold above these levels and push toward new highs.

Cardano Long-Term Holders SellingCardano is testing local supply levels after a significant surge, with investors becoming cautious in their short-term strategies.

Yesterday, the ratio of daily on-chain transactions in profit to loss reached 1.53, meaning that for every ADA transaction resulting in a loss, 1.53 transactions have generated profits. This metric highlights that many investors are taking advantage of the recent price gains, leading to some long-term holders selling their coins for profit.

Data from Santiment supports this view, showing a slight decline in Cardano’s Mean Coin Age and Mean Dollar Invested Age on September 11. These metrics track long-term holders’ behavior, reflecting the average age of ADA coins and the amount invested over time. A drop in these metrics suggests that holders who purchased ADA at lower prices are now taking profits, decreasing the average age of the coins in their possession.

Despite this selling pressure, ADA still has the potential to maintain its bullish momentum if market conditions continue to push. Cardano could target higher prices, but the cautious behavior from seasoned investors signals that the rally might face resistance soon.

Related Reading: Is Chainlink (LINK) $12 Breakout Imminent? Data Reveals A Rising Open Interest

The coming days will be crucial for ADA, as it needs to hold above its current levels to confirm a continued uptrend. If buyers regain control and demand increases, Cardano could break through key resistance levels and aim for new highs.

ADA Price Action DetailsADA trades at $0.3565 after testing a key resistance at $0.36. The price has closed above the 4-hour 200 exponential moving average (EMA) at $0.3490.

This is a significant indicator of short-term strength that ADA had respected as resistance since early August. This successful reclaim of the 4H 200 EMA is crucial for maintaining the uptrend.

If ADA manages to retest this EMA and hold it as support, it would confirm a short-term bullish trend. Breaking and holding above this level suggests that ADA could continue to push upward. Investors and analysts see the next target as being in the $0.38 to $0.40 range.

However, if ADA loses this support level, the price could drop to lower demand zones, possibly retreating to around $0.33. This would signal a weakening current momentum and potentially spark further selling pressure.

Featured image from Dall-E, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Cardano (ADA) на Currencies.ru

|

|