2023-2-14 07:03 |

Cardano, the 8th largest crypto by market cap, has been surrounded by polarized opinions in the crypto community. ADA has faced its fair share of ups and downs as a large-cap cryptocurrency in recent years, with its price dropping by 82% in 2022 and then jumping by 45% in 2023.

As the crypto market continues to evolve, it’s important to look closely at what blockchain analytics firm Santiment had to say about Cardano’s on-chain activity to understand its current standing and potential for growth.

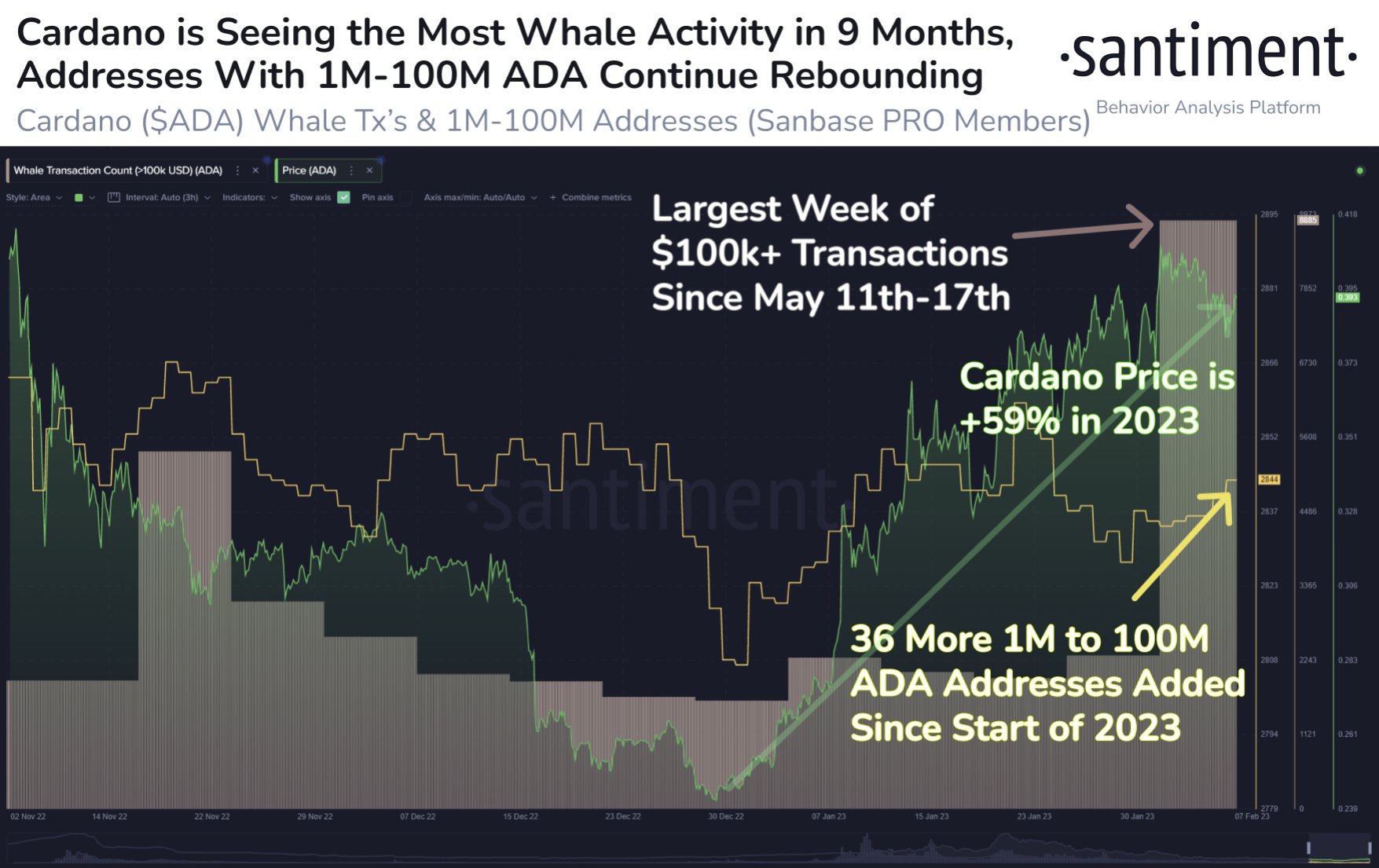

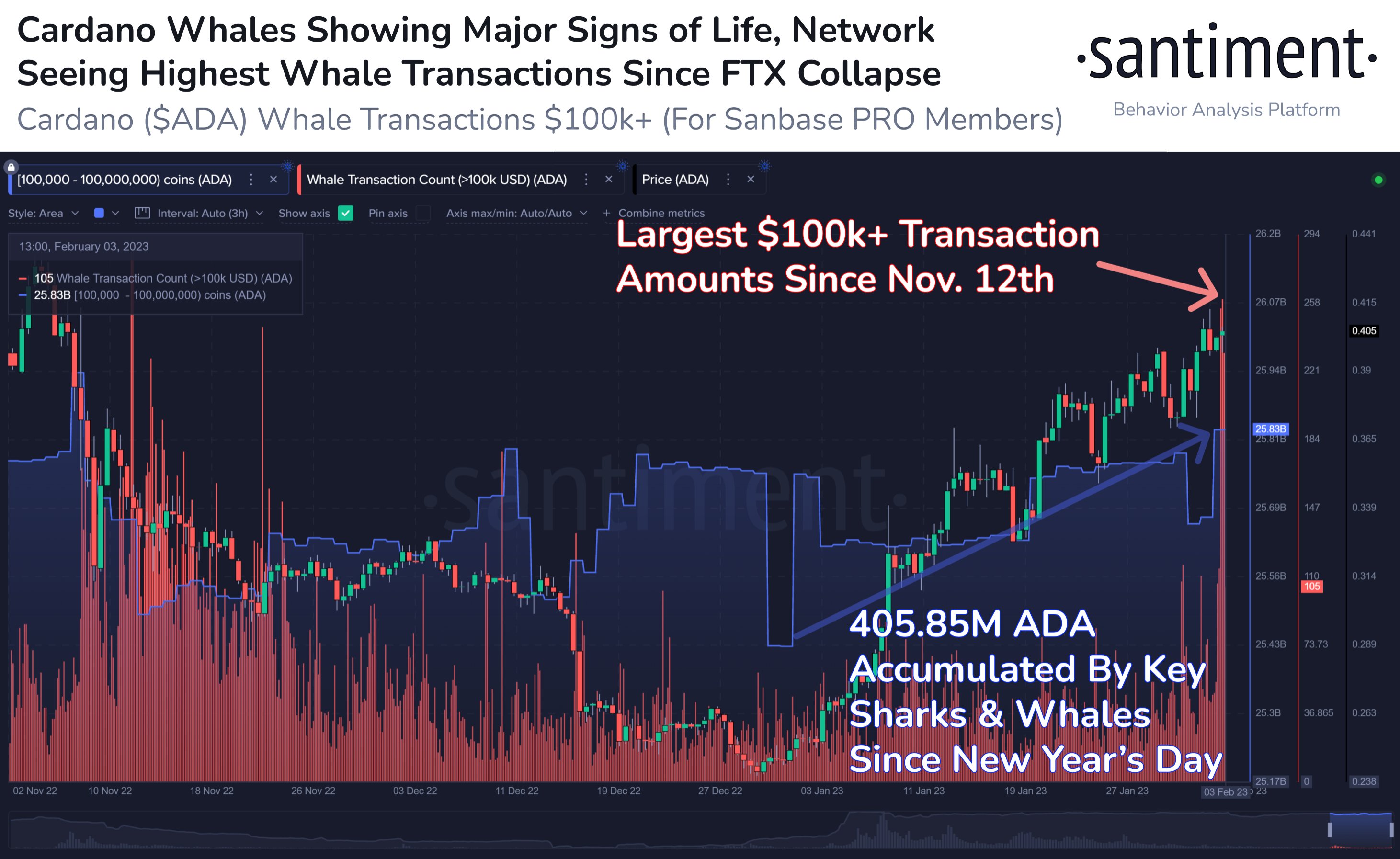

Whale Transactions on the RiseIn February 2023, the number of whale transactions on Cardano (ADA) significantly increased. With an average of 1,700 transactions per day valued at $100,000 or more, this contrasts sharply with the 300 daily transactions recorded in January 2023. This uptick in whale activity is a positive sign for the crypto asset.

Source: Santiment Key Stakeholders Accumulating ADASince the FTX collapse on November 9, 2022, whale and shark addresses holding 10,000 to 10 million ADA have accumulated 659.53 million ADA, worth $235.5 million. This accumulation of Cardano by key stakeholders is a promising sign for the digital asset.

Source: Santiment Lower Risk for InvestorsTraditionally, investors are advised to enter positions when there is “blood in the street,” meaning when prices are low, and there is a lot of negativity around an asset. In the case of Cardano, the two-week price correction and the ongoing recovery from the 82% drop in 2022 present a lower risk for investors to buy into the asset compared to other points in its history.

Source: Santiment Dormant Coins Remain an IssueSantiment’s Mean Dollar Invested Age metric indicates that large investments in Cardano coins remain dormant, with the average time that coins sit in an address increasing from 267 days to 407 days over the past six months. This lack of circulation is a concern for the crypto asset.

Source: Santiment Daily Active Addresses DecreasingDespite an initial surge in the number of unique daily addresses interacting on the Cardano network, the number has since decreased from 85,000 addresses moving Cardano daily in November 2022 to about 62,000 addresses per day. This drop in daily active addresses is a negative sign for the asset.

Source: Santiment Final ThoughtsOverall, there are more positive than negative indicators for Cardano. The good ones include the surge in whale transactions, accumulation by key stakeholders, and lower risk for investors due to the recent price correction. The current negative sentiment among traders toward ADA is also a positive sign that a price surge could surprise the crypto market. Still, the issues with dormant coins and declining daily active addresses cannot be ignored and will need to be closely monitored.

It remains to be seen how Cardano will perform in the future, but continued monitoring of whale activity and the stability of Bitcoin will be key factors in determining the ADA’s success.

The post Cardano (ADA) Price Performance: In-Depth On-Chain Analysis appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cardano (ADA) на Currencies.ru

|

|