2020-1-2 13:00 |

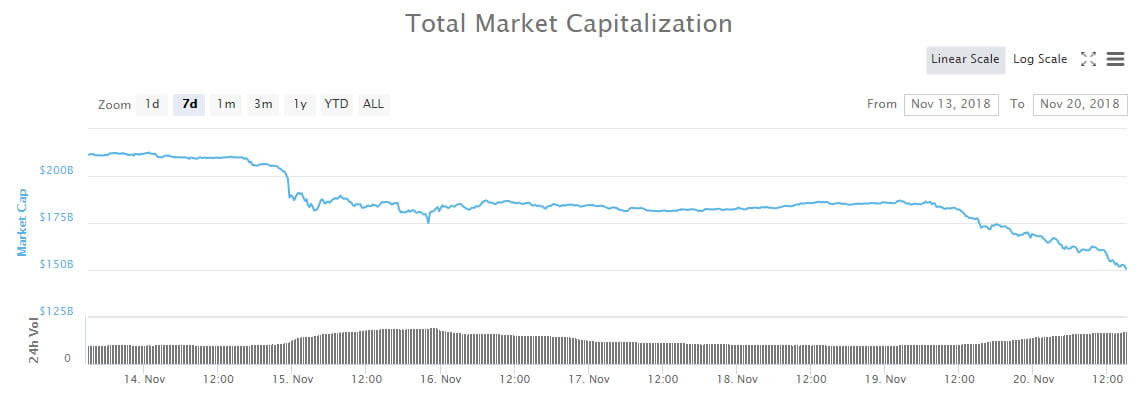

If you were trading Bitcoin or other crypto assets in late-2018, you likely remember the word “capitulation” mentioned time and time again. Why? well, after trading at $6,000 for months on end, BTC traders finally capitulated in November, resulting in the price of the leading cryptocurrency collapsing from $6,000 to $3,150 in four weeks’ time. This was the 2018 bear market’s capitulation moment. Related Reading: Why a Fund Manager Thinks Bitcoin Will Rally 25% to $9,000 In One Month With crypto as a whole entering back into a bearish state since Bitcoin’s year-to-date peak of $14,000 was established in June, analysts have been wondering if 2019’s bear market has had its own capitulation moment. According to on-chain analytics, this event hasn’t happened yet, implying that prices of digital assets may have further to fall before a recovery. Sorry bulls… Crypto Investors Still Need to Capitulate Cryptocurrency analyst CryptoHamster recently drew attention to the below chart, which shows the SOPR (Spent Output Profit Ratio) indicator — an indication of the average Bitcoin holder’s profitability — over the past few years. In it, he shows that the SOPR is a way in which analysts can accurately determine the four phases of Bitcoin’s market cycles: bull market, transition period, a bear market, and a capitulation event that starts the cycle again. CryptoHamster noted that per historical trends, Bitcoin has not yet seen a capitulation event for the current cycle, implying that the crypto market could see one strong dip before a return to a bullish phase. SOPR, 7-days-smoothed data. Markets phases are pretty clear (see the reaction of the indicator with the level "1"). Currently we are in a bear market and there was no capitulation yet. $BTC $BTCUSD #bitcoin@renato_shira pic.twitter.com/VyEQ0R0olo — CryptoHamster (@CryptoHamsterIO) January 1, 2020 It is important to note that CryptoHamster is making this analysis from the perspective that Bitcoin’s price action over recent months was part of a bona fide bear cycle, not just an extended bull market correction as Willy Woo, partner at Adaptive Capital, has suggested. Related Reading: Federal Reserve’s Record $235 Billion Repo Intervention Validates Bitcoin Regardless, Bitcoin’s Trajectory Still Positive No matter whether or not Bitcoin will see another capitulation event, analysts are convinced that the directionality of this industry is decisively positive. Asia’s Global Coin Research released ts “Community Predictions for 2020” report, in which it cited countless industry executives. Changpeng “CZ” Zhao, the prominent chief executive behind crypto’s top firm, Binance, was quoted as saying that he thinks that the long-term trajectory for the Bitcoin and crypto market remains decidedly positive. He elucidated: “Bitcoin is still a small market cap instrument so there will be high volatility in the short term. However, if you look at the fundamental technology, the longer-term view, about a 5-year or 10-year horizon, we’re very confident that bitcoin and cryptocurrencies are here to stay.” Andy Bromberg, co-founder of CoinList, echoed this assertion in an interview with Bloomberg, remarking that from his perspective, there hasn’t been this much “building” in the crypto market since 2017. Related Reading: Bitcoin Poised to Collapse Under $5,000? Market Cycle Fractal Suggests So Featured Image from Shutterstock The post appeared first on NewsBTC. origin »

Bitcoin price in Telegram @btc_price_every_hour

Chronobank (TIME) íà Currencies.ru

|

|