2020-11-16 23:00 |

Bitcoin has exploded higher over the past few weeks. The coin is up around 50% in the past five weeks alone. Capital is flooding into the Bitcoin market almost at a record pace, according to Willy Woo. Woo specifically pointed to the Realized Price metric, which tracks the estimated cost basis of the average Bitcoin investor. Bitcoin Is Seeing Record Inflows… Almost: Willy Woo

Bitcoin has exploded higher over the past few weeks. In the past five weeks alone, the leading cryptocurrency has gained 50% against the U.S. dollar, basically outperforming all other assets.

Bitcoin currently trades for $15,900, far above the $9,800 lows of September though slightly below the $16,500 local highs.

Capital is flooding into the Bitcoin market almost at a record pace, according to Willy Woo.

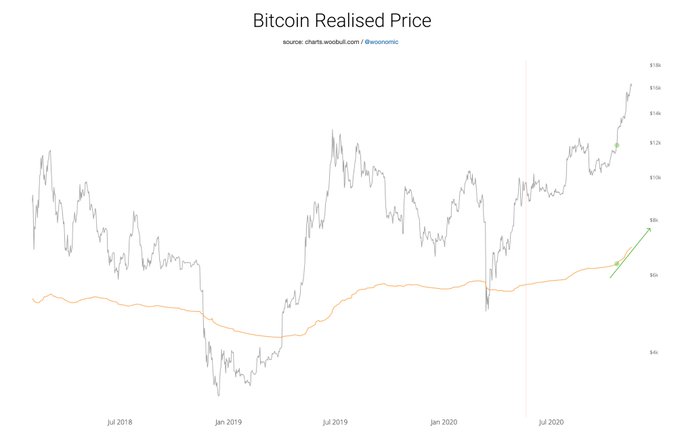

The prominent on-chain analyst recently noted that per his data, it is clear that there is an influx of capital entering the Bitcoin market, which is driving up prices. He pointed to the Realized Price metric, which tracks the estimated average cost basis that Bitcoin investors have paid. Referencing the chart seen below, he recently stated:

“Realised Price estimates the average price the market paid for their BTC. Now at its steepest slope for this cycle, meaning capital influx into #Bitcoin is at its highest rate since the last bull market. (Higher than last year’s $4k-$14k move; the current move is more organic.). For the sake of this comment I’ll define “organic”. Organic price action happens when BTC price tracks closely with investor capital entering and leaving. When it’s inorganic BTC price is dominated by short term derivative traders.”

Chart of BTC's price action over the past few years with a realized price analysis by crypto analyst Willy Woo (@woonomic on Twitter). Far From the Only Good SignThe growing strength in the Realized Price of Bitcoin isn’t the only good sign that the analyst has recently seen. He recently stated that the ongoing rally seems to have been catalyzed by large investors, suggesting that there is institutional money influencing this rally:

“Who has been buying this rally? It’s smart money… High Net Worth Individuals. You can see the average transaction value between investors taking a big jump upwards. OTC desks are seeing this too. Bitcoin is still in it’s stealth phase of its bull run.”

Of note, Woo recently stated that Bitcoin’s recent price action could be seen as bearish from a technical perspective, pointing to a bearish RSI divergence and other unfortunate signs.

Woo did caveat that point by highlighting that what really matters, the on-chain fundmentals, remain bullish for the cryptocurrency.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Capital Is Flowing Into Bitcoin Almost At a Record Pace: On-Chain Data origin »Bitcoin (BTC) на Currencies.ru

|

|