2020-1-22 17:23 |

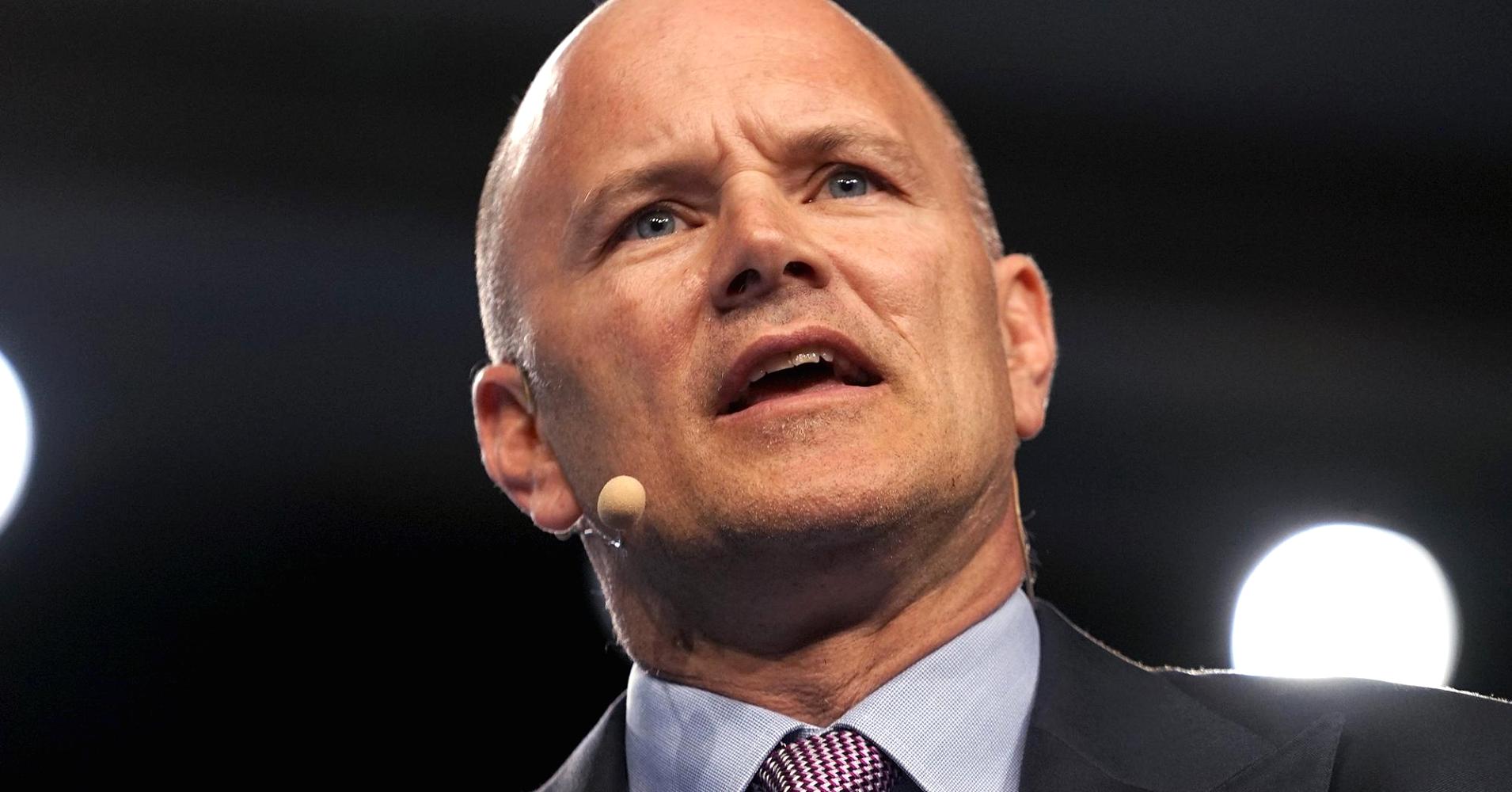

Last week, Canada’s security regulators released new guidance which is a positive step towards regulating cryptocurrencies. According to the crypto trading platform CoinSquare, CEO Cole Diamond, Canada right now is at a “pivotal point” where the authority has an

“unbelievable opportunity to lead globally by putting the right regulations in place for digital assets.”

The implications of the guidance aren’t “entirely clear yet” although the notice makes it very clear for certain aspects of the industry like a Bitcoin ATM company which now has clear guidelines that they should be responding to the FINTRAC rules that will come into effect in June of this year, explained Cole in an interview with Bloomberg.

Clearer guidance but not everyone will surviveThe guidance also impacts CoinSquare’s business which has been preparing for it for over two years. Registered as a broker-dealer, the company will continue to track with 80s registration and its IIROC registration which would mean oversight from the OSC and IIROC.

Although it is “really positive that we now have a somewhat clearer guidance,” the guidance also means not everyone will survive this process.

Cole points out how there were three main digital asset trading platforms in Canada in 2017. Quadriga lost millions of its customers’ funds while British Columbia Securities Commission seized Einstein exchange after users complained they can't access their funds.

CoinSquare meanwhile is still here which Cole says has been following FINTRAC guidance for over a year now and the markets he says have “gone through a very very significant cleanup.”

This “very complicated space” needs a new frameworkRegulators around the world have been struggling to determine the best way to regulate digital currencies. The US authorities have already declared that Bitcoin isn’t a security.

But it remains “a very complicated space,” and CSA and the OSCE aren’t saying that it is security but that if it acts a certain way then the guidance, not law, says you're operating potentially under securities regulation.

The issue is it is a nascent industry which needs a new framework, said Cole, because digital asset trading doesn’t work the same as security trading though the trade is performed much the same way for which “there's a bunch of stuff that already exists within the securities trading market that you could follow.”

Much wider opportunity than just bitcoin tradingCurrently, the market is very much speculative and highly volatile. As Cole says,

“most people are buying it because they think that it'll increase in value or most people are buying it just as a hedge against fiat currencies or other assets within their portfolios.”

But it is expected to change because there is a much wider opportunity than trading crypto assets, like putting stock onto the blockchain.

But moving forward, both technology to lead and regulators to set up guidelines have to happen in tandem. For Canada to have a unique opportunity to lead, Cole says they need to start putting a dedicated force in place to make it happen.

origin »Bitcoin price in Telegram @btc_price_every_hour

Canada eCoin (CDN) íà Currencies.ru

|

|