2020-1-16 18:10 |

\n

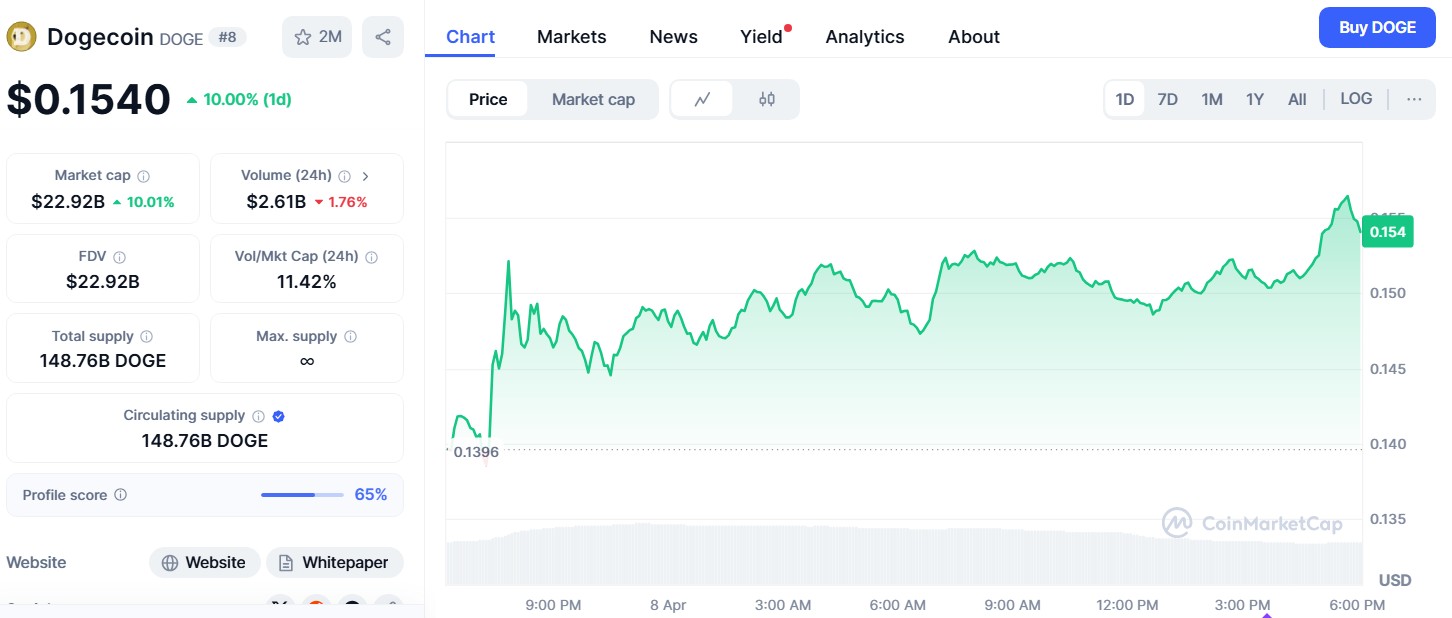

The Dogecoin (DOGE) price has not experienced significant volatility since December 2019. As long as the current descending resistance line is intact, we can assume that the price is still trending downward.

The price has made several attempts at breaking out above this line of resistance, all of which have been unsuccessful. Furthermore, the current resistance is strengthened by the presence of the 200-day moving average (MA).

Cryptocurrency trader and streamer @imbagsy outlined the DOGE price chart and stated that he is back in the trade, anticipating an upward move. In addition, he outlined a growing bullish divergence in the daily chart, most likely the reason why he is long on the coin.

$DOGE

I'm back in. pic.twitter.com/xMO8B8XzKj

— Bagsy (@imBagsy) January 15, 2020

Dogecoin Long-Term Bottom

Throughout the price history of DOGE, there have been two areas that have been instrumental at initiating upward movements, found at 23 and 15 satoshis, respectively.

The price reached the 23 satoshi support area on Sept 6, 2019, and began an upward move. However, it has retraced almost completely and is now trading at 28 satoshis.

Descending Resistance LineA look at the daily time-frame reveals that the DOGE price has been following a descending resistance line since May 16, 2019. The price has made several unsuccessful attempts at breaking out above this line.

In addition, the price is facing close resistance from the 200-day moving average. The price moved above this MA twice prior but quickly returned below it. Therefore, we can assume that the price is still down-trending, as long as it is below both the MA and the descending resistance line.

Even though the bullish divergence outlined in the tweet is still present, it would not be optimal to trade this coin by entering at the current level, mostly due to the close resistance right above the price created by the descending resistance line and the 200-day MA.

A better way to enter is given by either of the following two options outlined in the image below:

If the price again falls to the 23 satoshi support area, it would mark a very suitable level for the placement of a stop-loss, since the support would be less than 10% below the price.

Conversely, a breakout followed by a retest of the descending resistance line would make for a price not much higher than what it is now. However, this option runs the risk of the price continuing to move upward without retracing to validate the resistance line.

To conclude, while the DOGE price has shown some signs of a reversal, there is still strong resistance ahead and the price has not made any attempts at breaking out yet. This one might be best to wait until a breakout is validated or it revisits the 23 satoshi support area.

The post Can Dogecoin Break Out Above Moving Average Resistance? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Dogecoin (DOGE) на Currencies.ru

|

|