2023-8-18 09:14 |

Friday is Bitcoin options expiry day, and market volatility has surged again with the recent big move. Can this week’s tranche of contract expiries reverse the downward momentum for BTC and ETH markets?

On Aug. 18, around 22,000 Bitcoin options contracts will expire with a notional value of $580 million. The open interest, or the number of contracts that have yet to expire, is very similar to last week’s options expiry event.

Bitcoin Options ExpiryThe contracts have a max pain point of $29,500. This is exactly the same as last week’s but a long way off the BTC spot price, which has dumped to $26,500.

Max pain is the price point with the most open contracts. It is also the level at which most losses will be made when those contracts expire.

Moreover, the options contracts have a put/call ratio of 0.55, meaning almost twice as many calls (longs) are expiring than puts (shorts).

Greeks Live commented on today’s selloff, adding that “the market has been characterized by tight liquidity several times this week.” Traders lost confidence once $29,000 was broken.

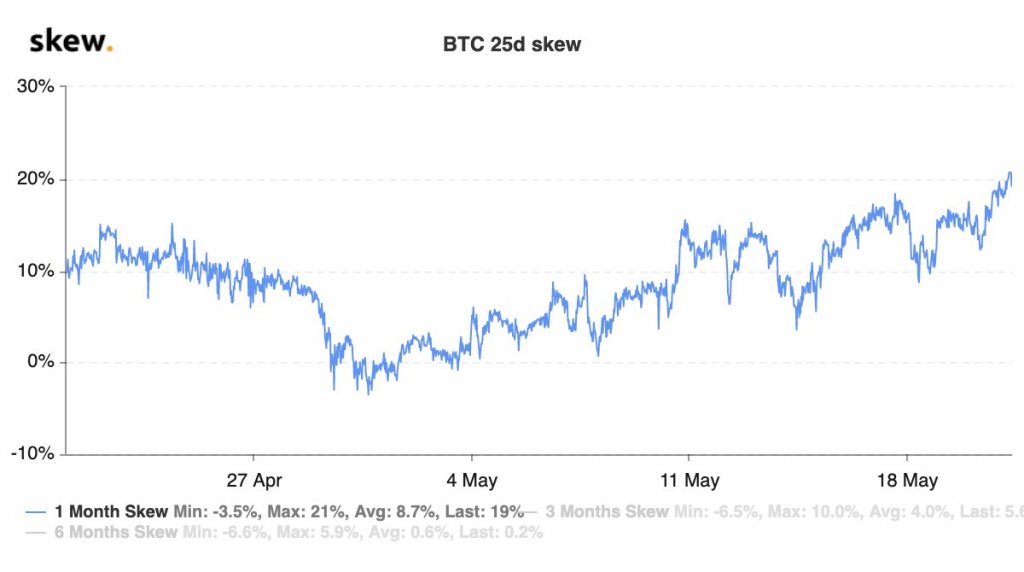

Bitcoin Open Interest. Source: X/GreeksLiveIt added that BTC and ETH major term implied volatility rose sharply, back above 40% of the higher levels of the second half of the year. However, once markets stabilize, IV will rapidly fall back again.

“IV is still not too high in the options market, and short-term buying is very cost-effective, whether you continue to short or long the BTC.”

Implied volatility is a measure of expected future volatility derived from the expiring derivatives contracts.

If you’re interested in trading Bitcoin derivatives, check out BeInCrypto’s guide here.

Coinglass commented, “For the first time since March 12 this year, the Bitcoin OI-weighted funding rate is below -0.01%.” The options funding rate refers to the cost of holding an open options position over time and is based on the difference between the spot price and option strike price.

Ethereum Contracts ExpiryIn addition, there are also 144,000 Ethereum options contracts expiring today. These have a notional value of $240 million and a max pain point of $1,800, well above the current spot price.

The Ethereum contracts have a put/call ratio of 0.51 which is very similar to the BTC contracts.

BTC is currently trading down 7.6% on the day at $26,449, while Ethereum had dropped 6.5% in a fall to $1,680.

Markets are currently seeking a new support zone where they have been for the past six hours or so. It is unlikely that today’s options expiry will have much impact since the mass liquidation has already occurred.

The post Can $580M in Expiring Bitcoin Options Reverse Market Momentum? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|