2023-6-22 10:45 |

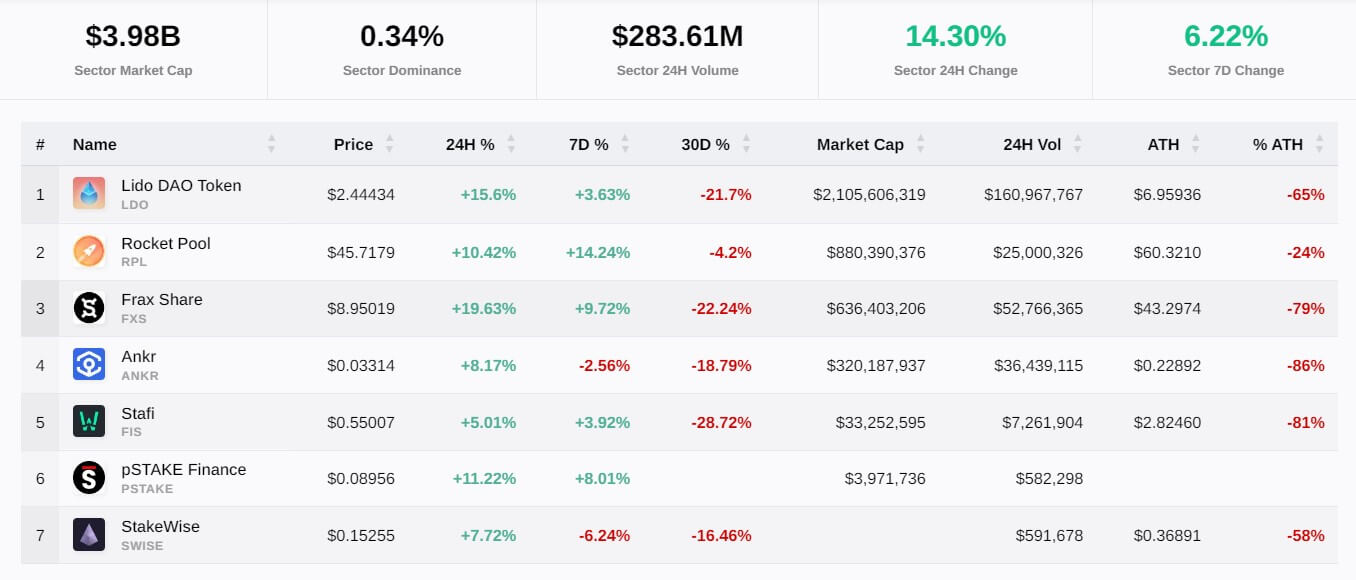

With the growing concern around the limitations of staking crypto assets, investors are looking into assets that provide good liquid staking options. Liquid staking transforms locked-up capital into liquid assets, granting immediate fund access and generating collateral for extra rewards.

Ethereum and Avalanche are great options to consider for liquid staking, but a new cryptocurrency with a unique passive income scheme has emerged in Caged Beasts.

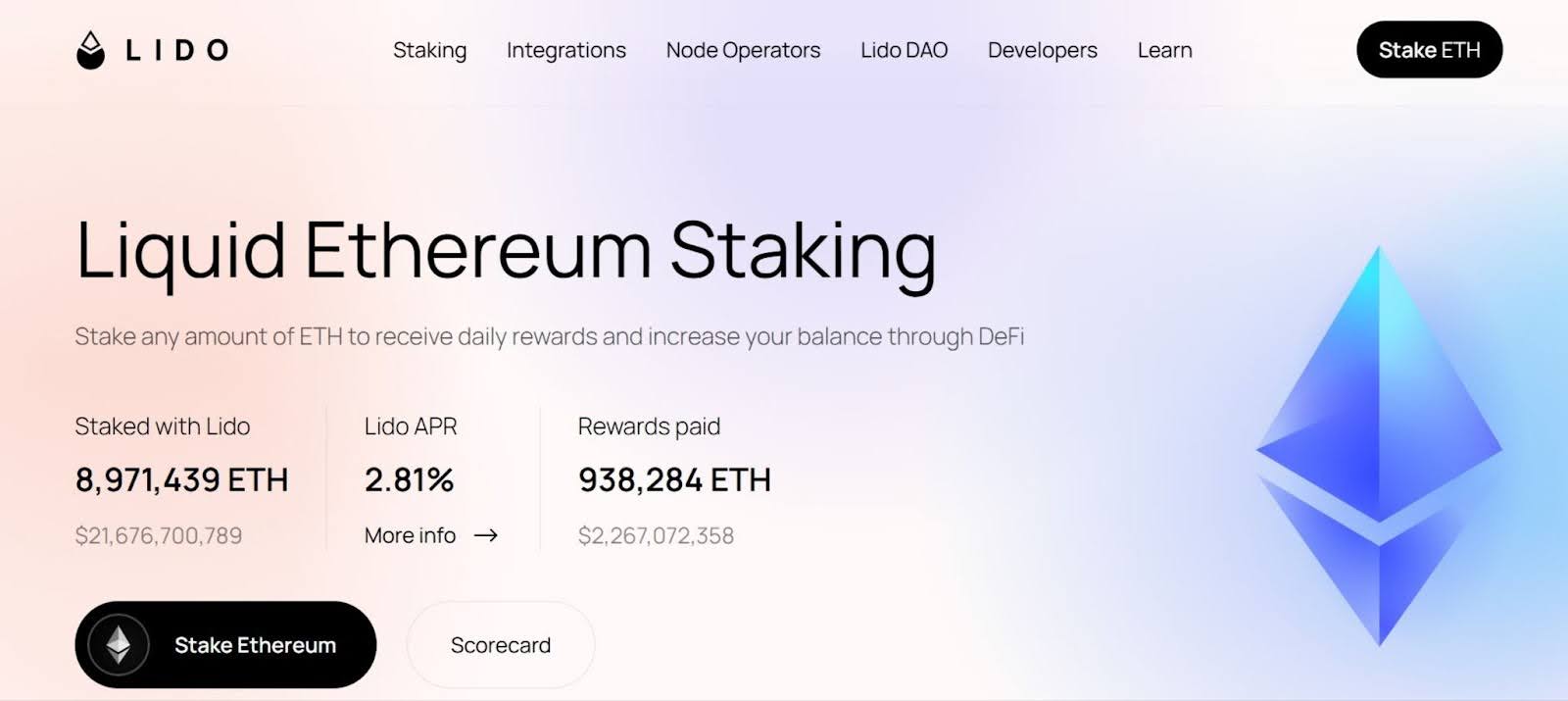

Ethereum: where utility is uppermostLiquid staking Ether (ETH) provides an innovative solution for addressing illiquidity, complexity, and centralization risks associated with self-staking and exchange staking. It allows users to stake any amount of Ethereum and easily use a derivative of their staked ETH.

Tokenized versions of staked funds act as derivatives, enabling transfer, storage, spending, and trading like regular tokens.

Users deposit their ETH into a third-party app, which acts as a validator. The app deposits the user’s ETH into the Ethereum deposit contract and mints a derivative of the ETH token. This token ensures ETH liquidity, enabling asset transfers while earning staking rewards.

AVAX: the answer to Ethereum’s issuesThere is much to like about Avalanche (AVAX), including low costs and fast transaction speed, making it a worthy opponent to its rival, Ethereum. In fact, these attributes have propelled it amongst the top 15 cryptos by market cap.

Staking AVAX tokens allows investors to earn returns. Unlike Ethereum, the Avalanche network is immune to slashing risk.

However, staking AVAX carries other risks, like opportunity cost and the inability to unstake during the lock-up period. Liquid staking provides an alternative, allowing users to earn rewards while maintaining the option to unstake.

Though AVAX lacks liquid staking options, specialized services can assist. Unstaking may not be immediate, and liquid staking might offer lower yields.

Caged Beasts revolutionizing crypto passive income sceneCaged Beasts (BEAST) is an up-and-coming token that prioritizes its community and aims to provide an engaging experience with diverse activities, offering various avenues for community members to generate profits. This underscores the importance of active participation and contribution within the community.

Caged Beasts has implemented a distinct two-way referral program, enabling users to create their referral codes. Both the code creators and users who make purchases using the codes receive a commission: a rare opportunity that promises gains for everyone involved.

With a strategic focus on growth and advancement, Caged Beasts establishes itself as a formidable player in the cryptocurrency space. The name Caged Beasts is a play on the concept of Caged Liquidity, where transparency is at the core. They maintain a visible ledger of their locked funds to ensure the project’s financial accountability, instilling confidence in community members.

Recognizing the value of early investments, Caged Beasts ensures that the token’s worth increases at each presale stage. The token’s storyline progresses alongside the presale, expanding the ecosystem to incorporate NFTs and creating a unique and immersive experience for investors.

The takeawayLiquid staking is positioned to thrive alongside the expanding DeFi movement, driven by its commitment to decentralization, accessibility, and the opportunity to earn staking rewards. Suffice to say that it embodies the essence of DeFi. Hence, it is advisable to consider potentially rewarding liquid staking options.

However, the value of returns now lies in direct proportion to the price of the token, which is susceptible to market volatility. The up-and-coming Caged Beasts eliminate space for failure with a roadmap, which is a great proponent for investors. Its native token, the BEAST is set to shake up the market.

The post Caged Beasts takes on Ethereum and Avalanche in liquid staking appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Liquid (LQD) на Currencies.ru

|

|