2022-12-5 06:27 |

Centralized crypto exchange Bybit has become the latest to axe staff as crypto winter deepens. The move adds to layoffs by the company earlier this year in June.

Singapore-headquartered Bybit has announced plans to reduce its workforce. Furthermore, the move is part of an ongoing reorganization of the business. It has become the latest crypto company to refocus efforts during the deepening bear market.

The announcement was made on Dec. 4 by Bybit co-founder and CEO Ben Zhou, who added that the planned downsizing would be across the board.

He apologized to those that will be affected and said that the move was necessary to survive the crypto winter.

“It’s important to ensure Bybit has the right structure and resources in place to navigate the market slowdown and is nimble enough to seize the many opportunities ahead.”

1) Difficult decision made today, but tough times demand tough decisions. I have just announced plans to reduce our workforce as part of an ongoing re-organisation of the business as we move to refocus our efforts for the deepening bear market.

— Ben Zhou (@benbybit) December 4, 2022 Bybit Joins Long List of Crypto LayoffsChinese industry analyst Colin Wu reported that the layoff ratio is 30%. He added that axed employees would get three months’ salary as compensation. Wu also reported that Bybit laid off 30% of its workforce in June. Furthermore, its workforce had grown from a couple of hundred to around 2,000 at the height of the bull market.

Bybit is a spot and derivatives exchange. According to CoinGecko, it has a daily trade volume of $239 million and offers 265 coins and 345 pairs. It also reportedly has a reserve of $1.88 billion.

In November, a spokesperson told BeInCrypto that blue chip assets accounted for over 85% of Bybit reserves.

Bybit is not the only crypto company to announce workforce reductions recently. According to tech industry layoffs tracker, Layoffs.fyi, 17 crypto-related companies let staff go in November.

On Nov. 30, Kraken announced that it was firing 30% of its 1,100-strong workforce. Additionally, it stated that the reduction takes the team size back to where it was only 12 months ago.

On Nov. 29, Bitso, Coinjar, and Bitfront all announced layoffs with the latter completely shutting down, according to Reuters.

Other crypto firms axing staff recently include BlockFi, Coinbase, Dapper Labs, BitMEX, Crypto.com, Mythical Games, WazirX, and NYDIG.

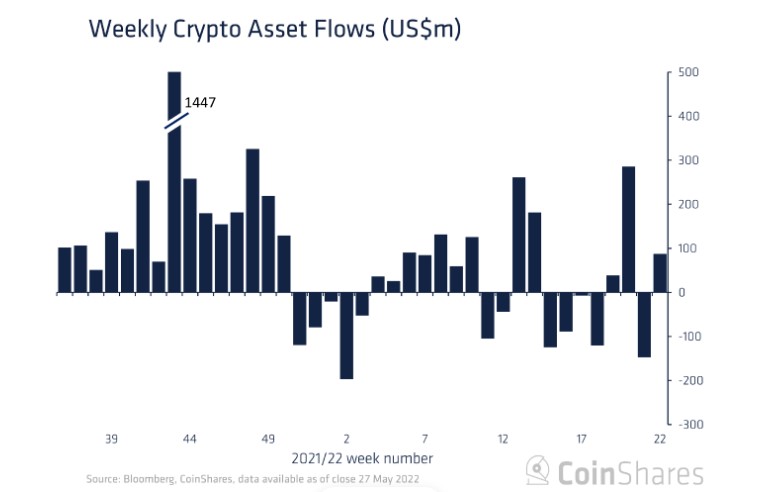

Bear Market DeepensCrypto markets have gained a marginal 1.5% over the past 24 hours. However, the overall outlook is still extremely bearish.

Total market capitalization has just topped $900 billion again, having gained $80 billion since the cycle bottom on Nov. 22.

Nevertheless, markets remain battered and are 71% down from their peak levels of over $3 trillion in November 2021.

The post Bybit to Cut 30% of Workforce as Crypto Bear Market Deepens appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|