2023-11-29 05:06 |

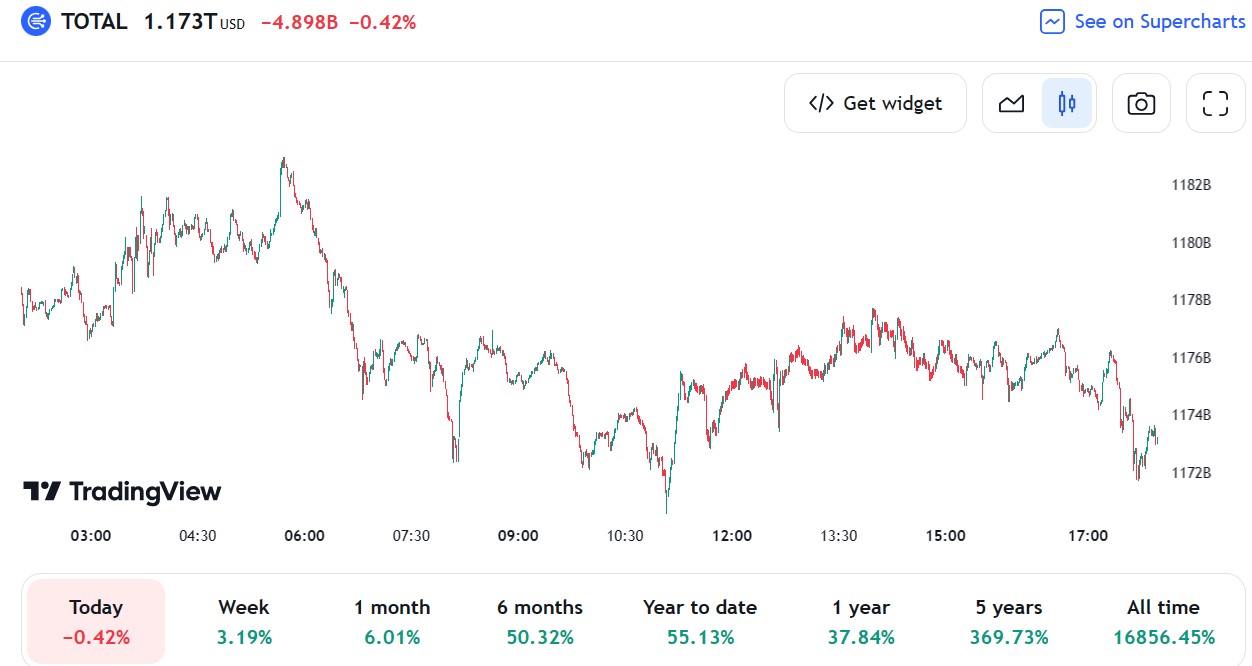

Cryptocurrency prices have been the best-performing financial assets in 2023. They have outperformed stocks, bonds, and commodities like gold and crude oil. The total market cap of all cryptocurrencies has jumped from less than $1 trillion to almost $1.5 trillion.

Bill Ackman on rate cutsOne of the top reasons why cryptocurrency prices have jumped is that inflation has dropped modestly in the past few months. It has dropped from the 2022 high of 9.1% to 3.2% and there is a likelihood that it will continue falling.

Therefore, there is increased hope that the Federal Reserve will start to cut rates in 2024. In a statement on Tuesday, Christopher Waller, one of the most hawkish Fed official said that rate cuts were on the table if inflation starts falling.

Most economists have now priced in a rate cut in June next year followed by two more. In most cases, risky assets like crypto and stocks do well when the Fed has embraced a dovish tone. Bitcoin reached its record high level when rates were at near zero.

Notably, Bitcoin has done better than expected after the Fed hiked rates to a two-decade high of 5.50%. Its price crashed to $15,000 but has recovered to over $38,000. In addition to high rate hikes, Bitcoin has had to contend with the collapse of FTX, Terra, Three Arrows Capital, and Celsius.

Also, it has contended with more regulatory scrutiny from the SEC. Just last week, the agency sued Kraken and forced Binance to pay $4.3 billion in fines. Changpeng Zhao, the company’s CEO and founder was also forced out.

Now, Bill Ackman, the billionaire founder of Pershing Square Capital, has made another call that the Fed will cut rates in the first quarter of the year. His views are followed closely by Wall Street because of his success.

For example, he recently made $100 million when he ended his short of US short-term treasuries. His exit was well-timed since the 10-year Treasury yield has fallen sharply in the past few weeks.

Watch here: https://www.youtube.com/embed/CKhSE7iaqMo?feature=oembed Risk assets to do wellBitcoin vs Cardano vs Tron vs Ethereum

If Bill Ackman is correct about rate cuts, it means that risky assets are bound to continue rising. This means that Bitcoin could continue rising in the coming months. In a note, an analyst at Standard Chartered has reiterated his view that BTC price will surge to $100k in 2024.

Other popular altcoins will also thrive if this happens. Chainlink (LINK) price will do well because of DeFi inflows and the growing tokenisation craze. Chainlink has a big market share in key industries and is one of the most solid platforms. LINK has jumped by over 200% from the lowest point in July.

Ethereum price is also set to do well because of its strong market share in the smart contract industry. It is a widely popular chain that runs some of the biggest dApps in the industry like Compound, AAVE, and Uniswap. Cardano and Tron are also widely popular coins that are set to do well if Bitcoin price jumps in the coming months. Tron, in particular, has surged by over 126% from its lowest point in 2022. It has done well as its ecosystem, especially JustLend has seen record inflows.

The post Buy Chainlink, Ethereum, Tron, Cardano if Bill Ackman is right about this appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

LikeCoin (LIKE) на Currencies.ru

|

|