2022-3-1 15:21 |

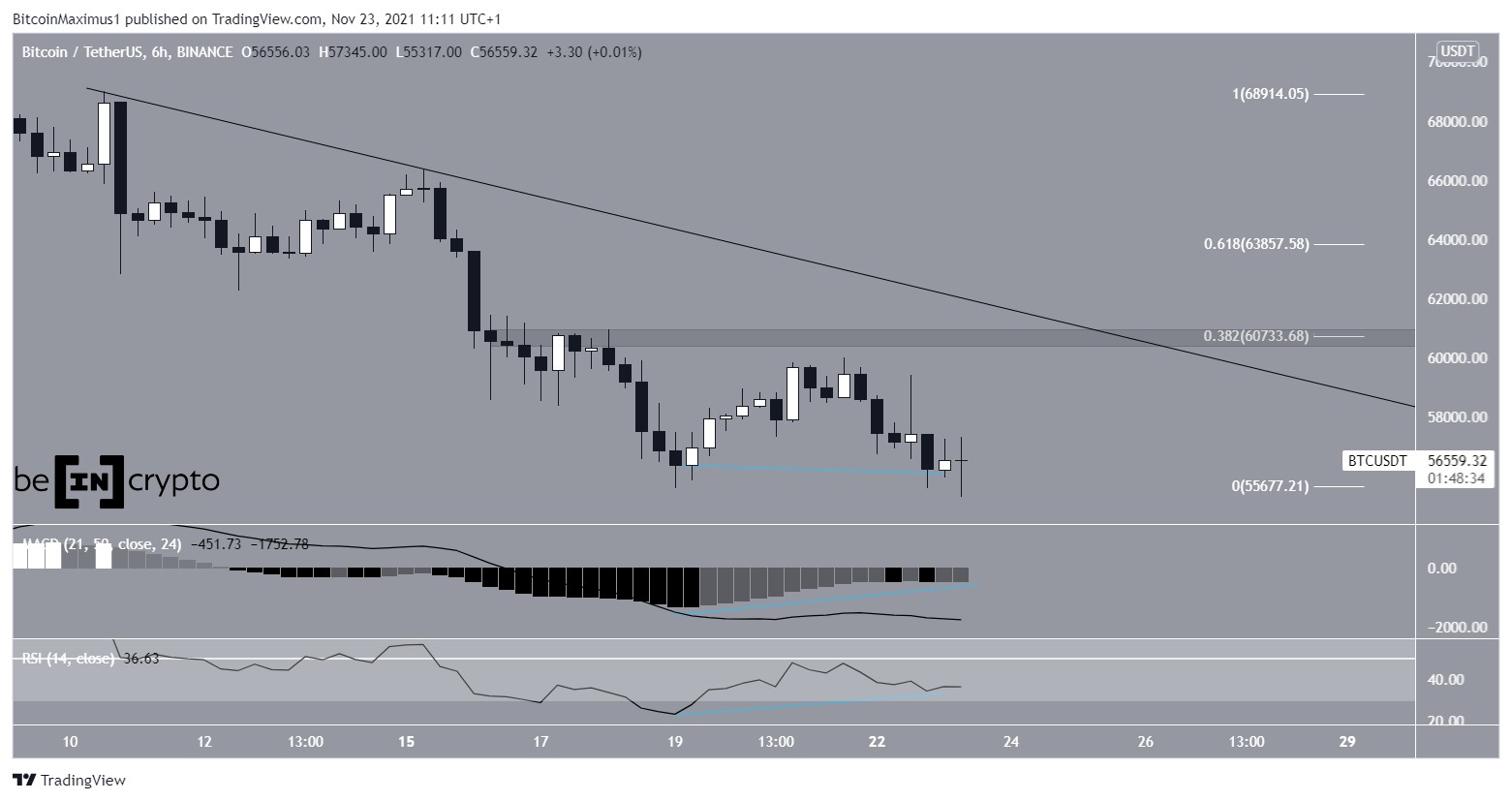

Ruble-denominated Bitcoin volumes reached a 9-month high as investors fled to safe-haven assets. Most of the trading is on cryptocurrency exchange Binance, according to details cited by CoinDesk.

More and more people have looked to buy Bitcoin and other cryptocurrencies across Russia and Ukraine amid the impact of war on local currencies, data shows.

According to data from crypto tracking site Kaiko, ruble and Ukrainian hryvnia-to-crypto volumes have shot up in the past week to multi-month highs.

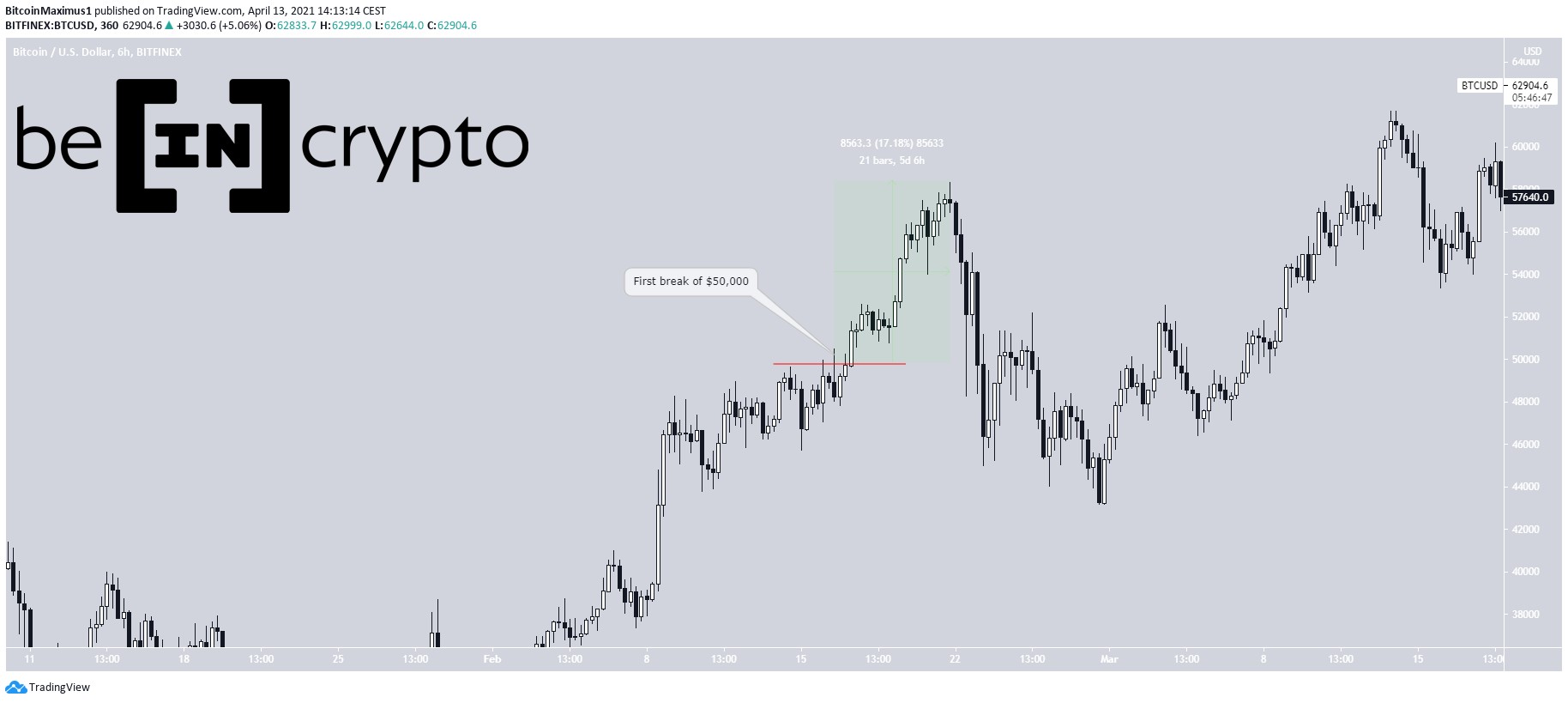

Per the data, trading volumes denominated in the ruble-bitcoin (BTC-RUB) pair increased sharply to hit levels last seen in April-May 2021.

Ruble-denominated BTC volume soared by 1.5 billion RUB on 24 February, according to Kaiko, just ahead of the weekend’s stiffer sanctions that saw Russian banks cut off from the SWIFT system.

Ruble-denominated BTC volume. Source: Kaiko

Ukraine’s hryvnia-BTC volume also surgeWhile the ruble saw the most trading volume amid the rush to hedge against the impact of sanctions, investors in Ukraine were equally nervous. Kaiko’s Medalie said that even though still low, the bitcoin-Ukrainian hryvnia (BTC-UAH) pair spiked over the week.

Tether-ruble (RUB-USDT) and tether-hryvnia (UAH-USDT) trading volumes have also increased in respect of the invasion, the data showed.

Most of the rising volumes have been on Binance- and LocalBitcoins- which allows for peer-to-peer Bitcoin exchange.

Falling rubleThe rising volumes are majorly driven by a rush to safe-haven assets by investors spooked by the sanctions and the potential ramifications for the ruble.

Gold, US Treasuries, USD, and the Swiss franc are among the assets to see an uptick in buy-side pressure over the past few days. Bitcoin also soared to highs near $40k over the weekend but continues to face pressure alongside stocks.

Already, sanctions have seen Russia’s ruble fall to new lows of 119 against the dollar, with the Central bank of Russia moving to adopt measures meant to defend the fiat currency from further depreciation and inflation hits.

Among these measures is Monday’s move to raise key interest rates from 9.5% to 20%, and an order to local brokers prohibiting them from providing services to foreigners seeking to sell securities.

The post BTC/RUB volume hits a 9 month high as Russians look for Ruble alternatives appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

High Voltage (HVCO) на Currencies.ru

|

|