2018-9-20 18:39 |

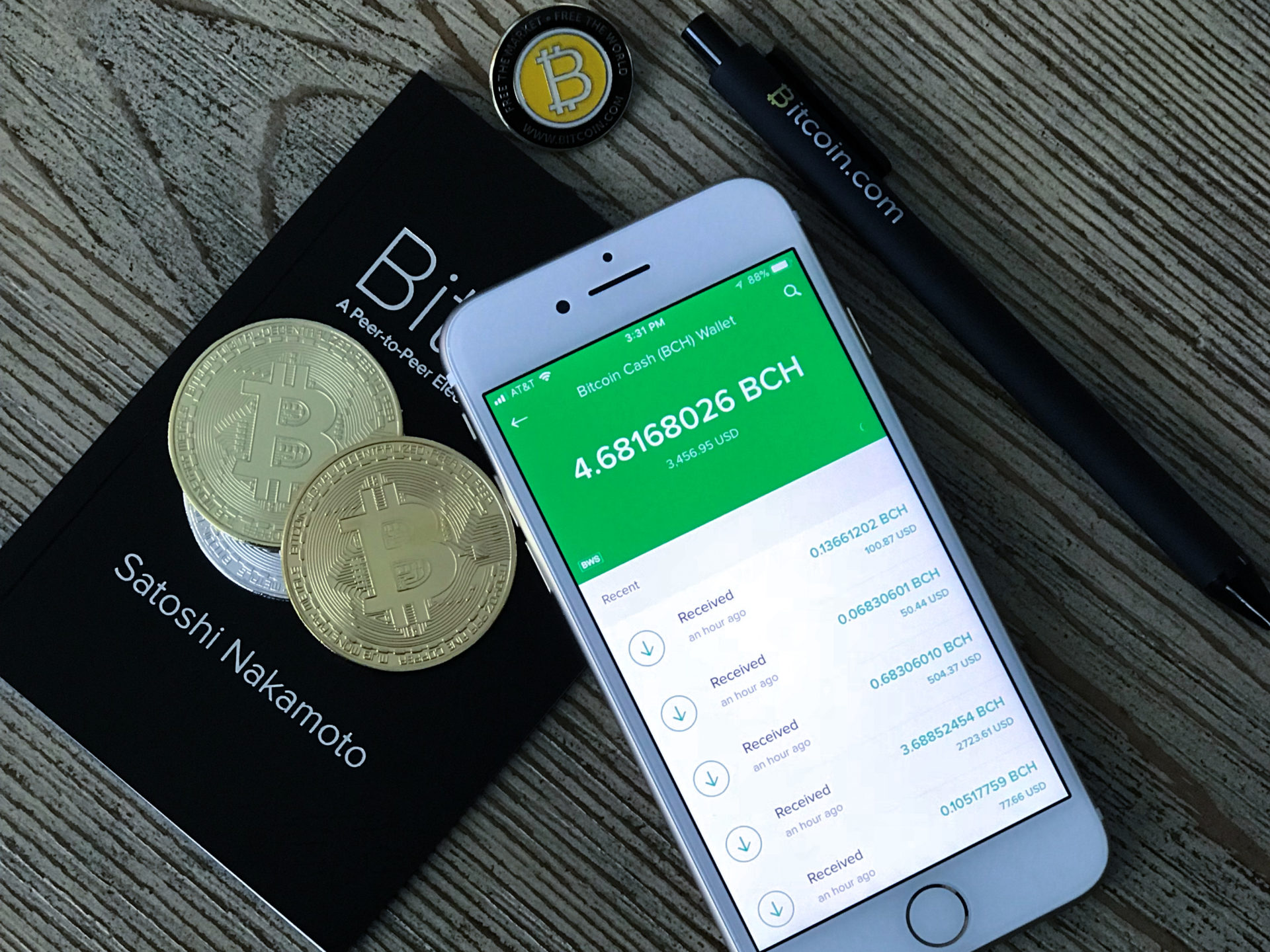

We have the majority of the Bitcoin community who regularly trade with the cryptocurrency, and then we have a certain clique of muscled hodlers who won’t lift a finger to either move or cash out on their digital investments.

In fact, as indicated in a report compiled by Dair, about a quarter of the Bitcoin supply is still sitting in wallets held by BTC whales who amassed the assets prior to the price build-up of 2017.

As is already evident, these whales don’t give a thought to the bears and bulls of the crypto market – at least not at the moment. By all indications, these investors seem pretty poised for the long haul of the BTC evolution. They like it long-term – or so to speak.

According to Dair, more than 87% of the BTC supply is held in just about 0.7% of all available BTC address, with each containing upwards of 10 BTC. Of even more interest is the fact that 62% of all Bitcoins in the market are held in 0.1% of addresses, with each address holding 100 coins or more.

That fact alone, coupled by the realization that most of those addresses haven’t seen action for quite a while, suggests that the whales have their eyes on the future of Bitcoin.

Besides the unknown whales, there are 5 exchanges believed to own 5 wallets that hold about 3.8% of all Bitcoin supply. According to Chainalysis, a firm dealing in blockchain analytics, about 1,600 people are in possession of about a third of BTC supply in the market. That’s besides the huge Bitcoin tranche that many believe is owned by Bitcoin’s creator, Satoshi Nakamoto.

Perhaps one of the reasons the whales aren’t in a hurry to move or cash out is the uptick in the Bitcoin’s network hashrate since the price dip of 2018. An increase in hashrate means that the network is safer, and therefore people who still have lots of BTC don’t feel the urgency to do anything yet since their stash is now safer than ever. In that sense, the BTC whales with no immediate need to cash out seem to have decided in favor of long term investment.

In fact, even during the 2017 price peak, 40% of Bitcoin addresses holding more than 200 BTC registered no outward transfers. Interestingly, 27% of then have actually registered inward transfers since then.

The post BTC Whales Who Made Their Stash Before The 2017 Peak Are Still Not In The Mood To Cash Out appeared first on ZyCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cashcoin (CASH) на Currencies.ru

|

|