2024-12-8 10:13 |

Crypto-tracked futures recorded over <a href="https://www.coinglass.com/LiquidationData" target="_blank">$1 billion in liquidations</a> in the past 24 hours as bitcoin briefly nosedived from a Thursday record high above $103,000 to nearly $92,000 early Friday on profit-taking.

BTC futures recorded nearly $500 million in net liquidations, with $420 million of those stemming from longs, or bets on higher prices. ETH futures recorded a smaller $85 million in liquidations.

Liquidations occur when an exchange forcefully closes a trader's leveraged position due to a partial or total loss of the trader's initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position, that is, they don't have enough funds to keep the trade open.

Over 156,000 individual traders were liquidated, and the largest single liquidation order was on crypto exchange OKX – a BTC/USD trade worth $18 million. The data shows that some 89% of all traders affected were long traders, or those that bet on higher prices.

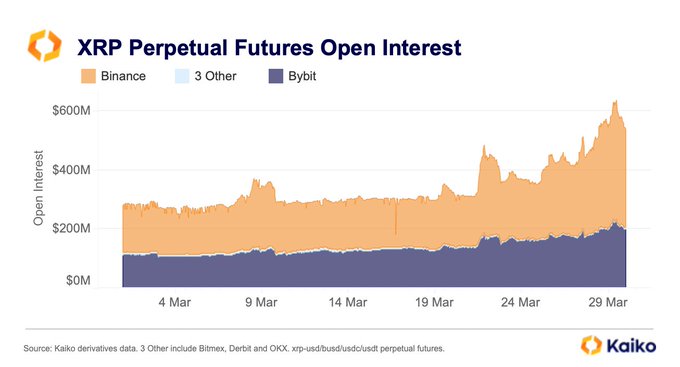

Outside of BTC and ETH, futures tracking Dogecoin (DOGE) and XRP logged a cumulative $50 million in losses — as prices reversed from a multiweek rally in both tokens that sent open interest on their futures to record highs last month.

Open interest (OI) refers to the number of active or open futures contracts at a given time. An uptick in open interest is said to represent an inflow of money

The drop caused the popular crypto fear and greed sentiment index to fall to “greed” from “extreme greed,” its lowest level in over 30 days. The index tracks volatility, prices, and social media data to indicate whether participants are fearful—usually a sign of local bottoms—or greedy, which marks market tops.

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|