2020-4-14 19:45 |

Since its sell-off in March, the price of bitcoin has been making a recovery. This positive movement has the miners’ profitability turning positive after being negative following the price crash.

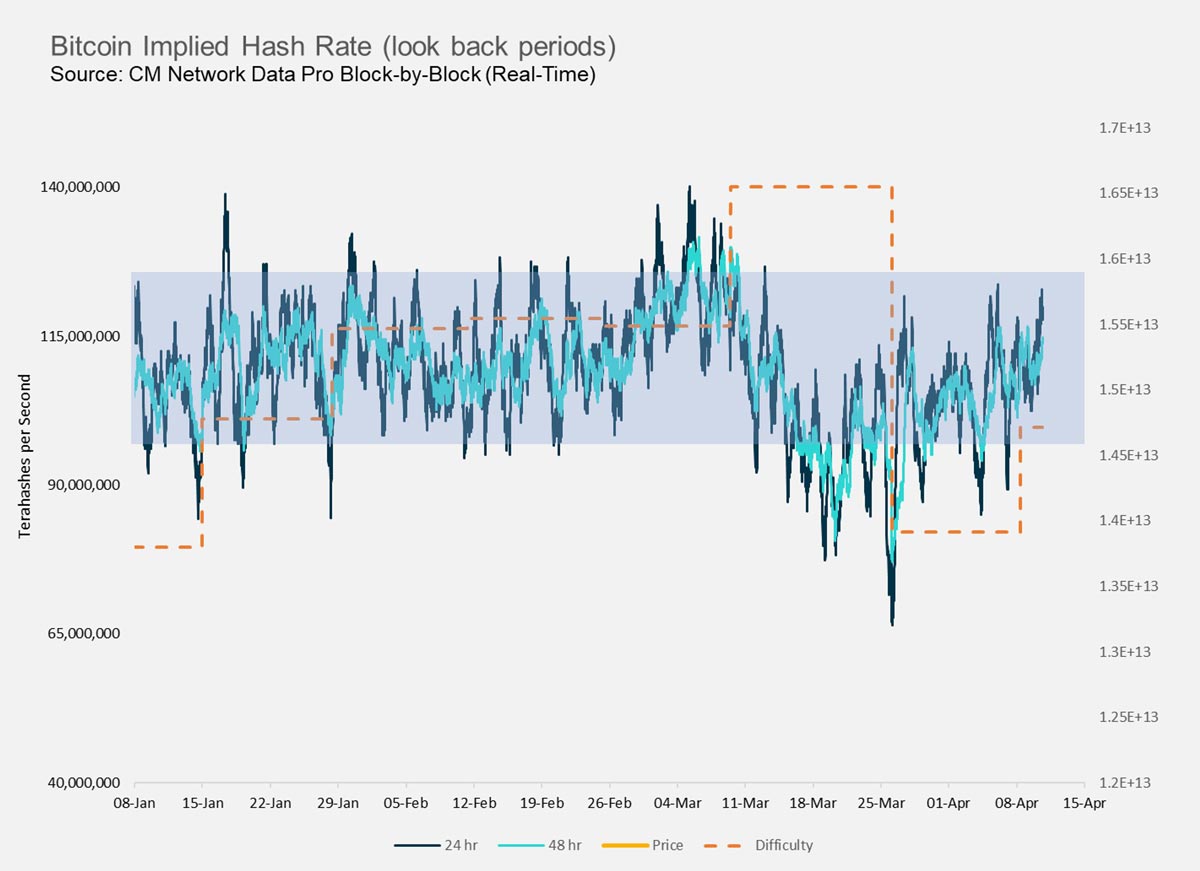

As such, the hash rate of the network has increased by 18% since hitting bottom in late March. As miners have started powering on their machines yet again, it resulted in a positive difficulty adjustment after more than 15% of negative adjustment following the drop in hash power. Crypto data tracker Coin Metrics noted,

Source: CoinmetricsThe network started seeing positive growth only for the BTC price to fall back below $6,800. Today, we went down as low as $6,542.

Increasing hash rate and rising mining difficulty combined with falling prices and upcoming halving, however, is not good for miners. Their profitability can yet again take a hit which could push them to sell their BTC. Coin Metrics founder, Nic carter said,

“Now the difficulty can consistently increase and the rewards halve, a pretty expense operation this mining business, how much do we need to sell these coins for now whilst remaining competitive.”

The halving is now less than a month away that would cut down the block rewards in half. And “RSI … never been this oversold before the halving.”

#bitcoin RSI … never been this weak before the halving pic.twitter.com/dBAoKo0agV

— PlanB (@100trillionUSD) April 12, 2020

A momentum indicator, the relative strength index (RSI) measures the magnitude of recent price changes to evaluate the overbought or overvalued conditions in the price of an asset. The oscillator with a reading from 0 to 100.

If the RSI has a value at or above 70, the asset is overbought or overvalued while a reading of 30 or below indicates the oversold or undervalued conditions.

Bitcoin’s RSI is currently less than 50 just before the halving and it has never been this undervalued before the event.

Also, unlike the losses we are seeing right now, such a pullback pre-halving wasn’t seen on previous events. After the 2016 halving, there was a “little blip” because of the DAO hack on Ethereum and Bitfinex exchange hack but after the 2012 halving, BTC went “straight up.”

However, we are currently undergoing a coronavirus crisis that didn’t happen in the past decade. This is also BTC’s first time experiencing government slashing interest rates to zero and printing money like crazy.

origin »Bitcoin price in Telegram @btc_price_every_hour

Miners' Reward Token (MRT) на Currencies.ru

|

|